Helping Smallholder Farmers Modernize through Technology

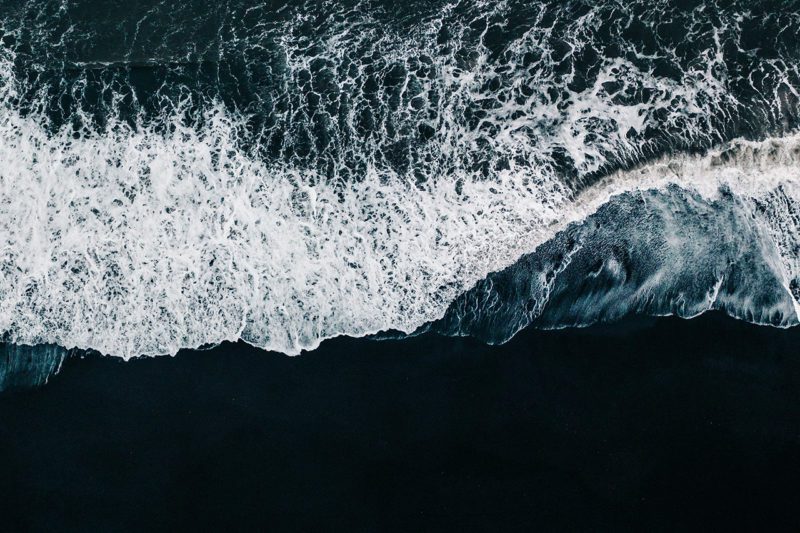

The debate is over and has been for a while: anthropogenic greenhouse gas emissions are the root cause of climate change. However, only recently has it become clear that restoring and maintaining ocean health, as outlined in Sustainable Development Goals (SDGs) 13 and 14, is a key tool for fighting climate change.

The oceans absorb an estimated twenty-five percent of carbon dioxide emissions through their rich, biodiverse ecosystems. Phytoplankton, coral, kelp, algae, marine bivalves, and ocean sediments turn our seas into a natural carbon sink. In fact, marine ecosystems sequester ten times more carbon than terrestrial ecosystems. However, the ocean’s role in combatting climate change (SDG 13) has only recently gained mainstream traction after decades of scientific research. The emergence of the term ‘Blue Carbon’ — carbon captured and stored by coastal and ocean ecosystems — indicates a shift in understanding about the ocean’s important, planet-saving role in the fight to curb climate change. Consequently, ‘Blue Carbon’ has slowly begun to infiltrate business models and investment decisions in a burgeoning blue technology sector.

‘Blue Carbon’ has slowly begun to infiltrate business models and investment decisions in a burgeoning blue technology sector.

As corporations begin to reduce greenhouse gas emissions and investors become aware of their potential impact on ocean health, many are turning to market-based approaches — in particular, carbon credits. Once part of an undeveloped and overly complicated system, carbon credits are now more navigable. As frequent droughts, freak storms, and rising global temperatures have elevated the climate crisis in our collective consciousness, verification tools have improved and matured. In 2019, atmospheric CO2 concentrations were higher than at any point in at least two million years. These realizations have encouraged the CEOs at investment institutions, like BlackRock’s Larry Fink, to think critically about investments and more favorably about market-based mechanisms to curb climate change. Governments have also pressured large companies to hit net-zero targets, taking ownership of their past and current roles in climate change. As a result, the projected demand for carbon credits is projected to increase by a factor of 15 by 2030, raising the carbon market’s value to $50 billion, according to a 2021 McKinsey Report on voluntary carbon markets.

A carbon credit is a transferable instrument certified by a third party — usually government or independent companies. Each credit represents the reduction of one metric ton of greenhouse gas. Regulatory bodies then authorize the methodology development and project design and monitor the results to approve a mitigation project.

Companies can buy credits to “offset” their emissions and use the credits to provide evidence to customers of progress toward their net zero goals. After buying credits, companies receive a certificate stating that they are responsible for X number of GHG reductions. Those credits are retired; they no longer exist in the market. As more companies commit to net zero goals, but are unable to reduce “in-house” GHGs, they turn to carbon credit emissions projects as their answer. Restoring a degraded coastal ecosystem with mangrove reforestation is an example of a Blue Carbon offset project. Mangrove reforestation, which removes carbon from the atmosphere, also creates new carbon credits that enter the Blue Carbon market.

Restoring a degraded coastal ecosystem with mangrove reforestation is an example of a Blue Carbon offset project.

According to Bloomberg NEF, since 2014, venture capitalists have spent $150 million on early-stage companies that monitor carbon capture and sequestration in oceans, lands, and forests. Land-based companies that work with certified carbon registries, like NCX (formerly SilviaTerra), have traditionally received the most investment. However, angel investment groups, such as SeaAhead’s Blue Angels — which focus on the intersection of the ocean, sustainability, and innovation — are on the rise, with investors that consider the triple bottom line (people, planet, and profit) when evaluating a startup’s potential.

According to Bloomberg NEF, since 2014, venture capitalists have spent $150 million on early-stage companies that monitor carbon capture and sequestration in oceans, lands, and forests. Land-based companies that work with certified carbon registries, like NCX (formerly SilviaTerra), have traditionally received the most investment. However, angel investment groups, such as SeaAhead’s Blue Angels — which focus on the intersection of the ocean, sustainability, and innovation — are on the rise, with investors that consider the triple bottom line (people, planet, and profit) when evaluating a startup’s potential.

Startups like Cascadia Seaweed and Smart Oysters understand the value of incorporating blue carbon removal and sequestration into their business models. Based in Vancouver, Cascadia Seaweed is part of the Oceans 2050 Seaweed Project to quantify how much carbon is sequestered through seaweed farming. One of their research and development products is green gravel — a gravel inoculated with giant kelp seedlings, which creates a favorable growing environment for kelp and marine habitat restoration. Founded in 2017 by Ewan McAsh and Philip Browning, Smart Oysters is a personalized oyster farm management tool with built in carbon quantification capabilities. Smart Oysters provides farmers with knowledge about how much carbon they are sequestering through their oyster crops, along with the corresponding data.

Although the first global scheme for a carbon market originated in the 1997 Kyoto Protocol, certain barriers continue to prevent carbon markets from gaining traction. For example, more research is needed to quantify and document the rates of carbon sequestration.

Today, there are only four major GHG standards crediting programs that can issue carbon credits after completing a rigorous verification process through an ISO accredited third-party verifier — Verified Carbon Standard (VCS), Gold Standard (GS), American Carbon Registry (ACR), and Climate Action Reserve (CAR). The credits are tracked on all registries so they are not double-counted, and credits can be traded within their specific registry.

Market failures within the carbon market often exist due to lack of access to information and pricing transparency. Carbon market enthusiasts insist that increased competition will help the market find its natural equilibrium in price. However, due to the market’s voluntary nature and breadth of unique projects, it is doubtful that the market failure can be corrected without policy intervention on a global scale.

Notably, at COP26, negotiators from over 200 countries agreed on the final rules of Article 6 in the Glasgow Climate Pact that created a UN-certified and standardized carbon credit, which can be traded globally. The UN-certified carbon credits may solve certain pain points in the current model, which are largely caused by siloed efforts to establish carbon markets without a standardized framework. While Article 6 is a step in the right direction toward a global regulatory framework that is necessary for widespread adoption, it does not provide any enforcement mechanisms, and relies on the good faith of the participants.

Notably, at COP26, negotiators from over 200 countries agreed on the final rules of Article 6 in the Glasgow Climate Pact that created a UN-certified and standardized carbon credit, which can be traded globally. The UN-certified carbon credits may solve certain pain points in the current model, which are largely caused by siloed efforts to establish carbon markets without a standardized framework. While Article 6 is a step in the right direction toward a global regulatory framework that is necessary for widespread adoption, it does not provide any enforcement mechanisms, and relies on the good faith of the participants.

The ocean is a vital part of the global economy, contributing $2.5 trillion to the annual global GDP and playing an essential role in reducing greenhouse gases and combatting climate change (SDG 13). While Blue Carbon credits are poised to provide a market-driven solution for climate change, they are not a panacea to the real challenge – reducing emissions. In fact, cap-and-trade policies allow companies to continue to emit harmful CO2 if they buy carbon credits, which can be a less expensive option than reducing emissions.

On the other hand, a Blue Carbon credit market stimulates interest from private companies and philanthropic organizations, generating awareness about the ocean’s value in the fight against climate change. Furthermore, monetizing ecosystem services can incentivize companies to transition to climate-friendly practices and can inspire bluetech innovations and technologies and increased ocean investments that create progress toward SDGs 13 and 14.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments