The Algorithmic Classroom

South Korea’s ambitious experiment with AI in classrooms holds lessons for the world

$15.00

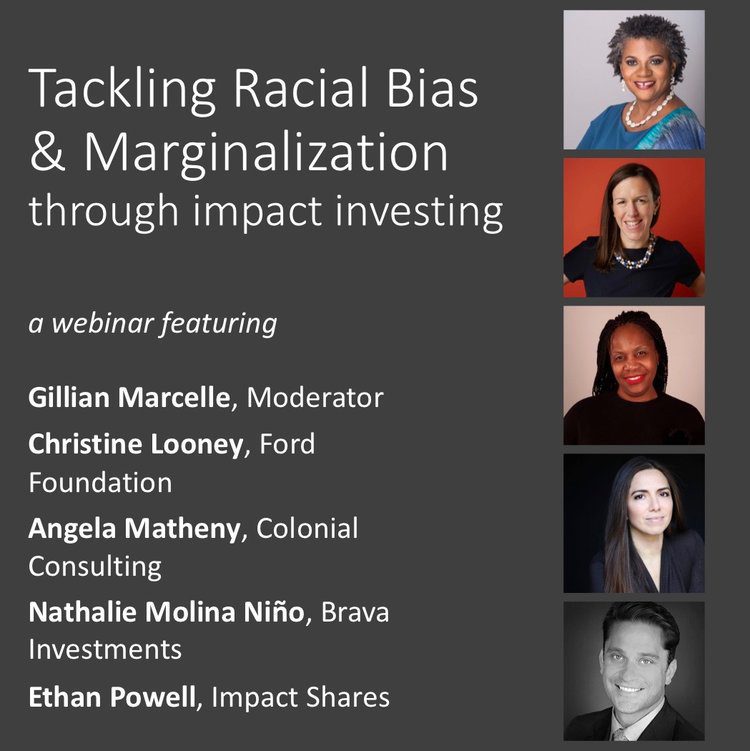

Content: Video Webinar Presentation with Q&A

Length: 1:12:20

Premium Members get free access to the entire catalog of past webinars as well as invitations to upcoming, live programs.

$15.00Add to cart

In the USA, there have been a number of focused and specialist efforts to direct impact funds at marginalized communities where there are concentrations of people of color. These efforts are important and potentially significant because they come after decades of urban blight, discrimination and regeneration that led to displacement. In this webinar, we will discuss and learn about:

Product development to directly channel finance to social justice and anti-racism not for profits and projects that focus on empowerment of people of color

Specialist funds launched by large institutional investors to reinvigorate marginalized communities

Social Venture funds deploying capital to founders who would otherwise have limited access to funds

Efforts to improve racial diversity in the impact investment community by promoting and strengthening LPs, fund managers and other decision makers

This webinar is the second in a series of three programs focused on diversity, inclusion and accountability in impact investment designed in collaboration with Gillian Marcelle of Resilience Capital Ventures LLC. For more information on the series, visit this link.

Gillian Marcelle, PhD is a senior leader in economic development and international business with a proven track record in attracting investment to emerging markets. She is currently the managing member of Resilience Capital Ventures LLC, an advisory firm in the blended finance space and serves as a non-Executive Director of Tafari Capital, an innovative fintech start-up in Joburg, South Africa. Her finance background includes development finance with the International Finance Corporation, as well as, equities and capital markets with JP Morgan Chase. She has also advised the United Nations on impact investment and innovation for the benefit of the global South. In July 2018, she completed a contract as the Executive Director of the UVI RTPark, a specialist economic development agency for the US Virgin Islands. In this role, she successfully transformed the organization; doubling the number of technology and knowledge based investors in three years and placing focus on deriving social investment contributions from the firms benefitting from generous tax incentives. A global citizen with wide networks and various communities of practice drawn from her personal and professional connections in Washington DC., London, Johannesburg and Trinidad & Tobago. Her educational background includes earning degrees in Economics from the University of the West Indies, St Augustine, and the Kiel Institute of World Economics, an MBA with a specialization in high technology management from the George Washington University and a doctorate in innovation policy from the Science and Technology Policy Research Unit, SPRU, University of Sussex. For her scholarly work, she is an affiliated researcher at the Tata Center for Technology and Design, MIT, Cambridge MA.

Christine Looney serves as the Ford Foundation’s deputy director of Mission Investments. In this role, she supports investments under the Foundation’s two mission investment funds – the $280 million program related investment fund and the newly created $1 billion mission related investment fund. She supported Ford’s strategic planning efforts to develop a new line of work on impact investing which integrates grant and investment capital as well as the approval of the Foundation’s new mission related investment fund. Before joining the Foundation, Christine worked in nonprofit consulting and was an associate in Chase Manhattan’s Structured Finance Group. Christine has a MBA in finance and management from New York University’s Stern School of Business and a bachelor’s degree in economics from College of the Holy Cross. She is on the board of Mission Investors Exchange and serves on a number of credit committees and limited partnership advisory committees.

Angela Matheny is the Head of Diverse Manager Equity of Colonial Consulting. She works with consultants and the research department to drive the firm’s diversity initiative in an effort to attract and source diverse asset managers while monitoring protocol and the internal vetting process of (“MWBE”) minority-owned and women enterprises. She facilitates the constant communication between Colonial and fund managers as the firm continues to build a robust pipeline of what it believes is a largely under-followed segment of the manager community marketplace.

Angela spent a stint of her career at a financial services law firm, Schulte Roth & Zabel, assisting attorneys in preparing documents for filing with the SEC. Working along with human resources, she later moved into training and development where she worked toward the firm’s technical training, cultural awareness in the workplace, and diversity and inclusion initiatives. Angela received a Master’s of Public Administration at Metropolitan College of New York while volunteering in the evening at a non-profit organization in an underserved area of Brooklyn, NY where she implemented a character development and a college ready program. She also earned a Certificate in Human Resources Management from VillaNova University, which included studies in diversity and inclusion. Angela’s Bachelor’s degree is in Psychology from Bernard Baruch College of New York. She also serves on York College’s (CUNY) foundation board.

Nathalie Molina Nino is an investor and tech globalization veteran focused on high-growth businesses that benefit women and the planet. She is the author of LEAPFROG, The New Revolution for Women Entrepreneurs and a serial entrepreneur. Molina Niño launched her first tech startup at the age of twenty and is the co-founder of Entrepreneurs@Athena at the Athena Center for Leadership Studies of Barnard College at Columbia University, where she continues to lecture and advise.

Before her career in academia and impact investing, she spent 15 years advising organizations like Disney, Microsoft, MTV, Mattel, and the Bill & Melinda Gates Foundation. During that time she co-led the launch and growth of a multinational business with Lionbridge into a $100M operation in 30+ countries. Molina Niño serves as a Venture Partner at Connectivity Capital Partners and advises the WOCstar Fund. She also serves on the advisory board of WENYC and Vote, Run, Lead, and persistently connects entrepreneurship and the mission of getting more women into elected office.

Ethan Powell has spent over two decades in financial services, primarily in Hedge Fund and Private Equity. Most recently Ethan founded Impact Shares. Impact Shares is a collaboration of leading financial service and non-profit organizations providing single social issue ESG solutions. Impact Shares has issued exchanged traded funds in collaboration with The NAACP Minority Empowerment ETF, the YWCA Women’s Empowerment and the United Nations Sustainable Development Goals. Additionally, Ethan serves as the Chairman of the board for a $4 billion mutual fund complex and is a finalist for 2016 mutual fund director of the year. Previously, Mr. Powell was the Chief of Product and Strategy at Highland Capital Management Fund Advisors, L.P. In this role he was responsible for evaluating and optimizing the registered product lineup offered by Highland Mr. Powell also served as the portfolio manager of the Highland ETFs and worked with other portfolio managers and wholesalers on the appropriate positioning of strategies in the market place. Prior to joining Highland in April 2007, Mr. Powell spent most of his career with Ernst and Young providing audit and merger and acquisition services. Mr. Powell received an MS in Management Information Systems and a BS in Accounting from Texas A&M University. Mr. Powell has earned the right to use the Chartered Financial Analyst designation and is a licensed Certified Public Accountant.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.