Hadithi Crafts: Turning Stories of Hope into Lasting Change

Impact investors supporting entrepreneurs in indigenous communities

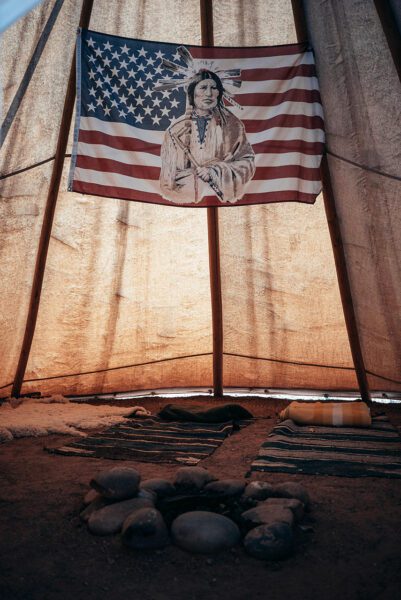

Image courtesy of Oweesta Corporation

Despite centuries of resilience and ingenuity, Indigenous entrepreneurs remain among the most underfunded groups in philanthropic and investment spheres. The numbers are stark: they receive less than 0.5 percent of all philanthropic funding, and an even smaller fraction filters into impact investing. At the venture capital level, Indigenous founders in the United States garner a mere 0.01 percent of total funding — an almost imperceptible slice of an industry that exceeds $300 billion annually.

These disparities reflect systemic factors — including minimal generational wealth, limited institutional trust, and a scarcity of culturally aligned capital screening methods — that have long constrained Indigenous-led ventures. Yet they also represent a vast, untapped opportunity for socially conscious investors. By closing capital gaps, impact investors can help cultivate high-potential Native-owned startups that simultaneously generate financial returns and promote social justice, economic empowerment, and cultural revitalization.

This article delves into the roots of the funding shortfall, spotlighting the individuals and organizations working to bridge it. From grantmaking foundations to specialized Native Community Development Financial Institutions (CDFIs) to venture funds, a growing ecosystem of impact investors, philanthropic groups, and intermediaries is committed to rethinking how capital can equitably reach Indigenous founders. Although Indigenous communities are frequently marginalized in mainstream finance, one pivotal turning point — the 1988 Indian Gaming Regulatory Act — demonstrated the profound economic potential of Native-owned ventures. By channeling gaming revenues into local reinvestment and community empowerment, it served as a model for what can happen when Indigenous principles and assets are harnessed for sustainable development.

Against this backdrop, the following sections examine innovative solutions and fresh policy directions that give Indigenous and other displaced communities renewed access to capital — fostering economic growth, job creation, and the preservation of cultural values.

The lingering effects of colonization — including the centuries-old “Doctrine of Discovery,” used to expropriate Indigenous lands — manifest today in systemic socio-economic marginalization and cultural alienation. Intergenerational trauma has produced deep mistrust toward banks and investors, while the absence of inherited generational wealth amplifies the reluctance of mainstream lenders to fund undercapitalized Indigenous projects.

The lingering effects of colonization — including the centuries-old “Doctrine of Discovery,” used to expropriate Indigenous lands — manifest today in systemic socio-economic marginalization and cultural alienation.

Exacerbating this problem is the high percentage of unbanked Native Americans — over 16 percent, nearly eight times the rate for other Americans — many of whom lack sufficient credit histories. Geographical isolation is another factor: on average, Natives must travel 12 times farther to reach a bank. Many are also “credit invisible,” and significant distances often mean fewer local opportunities for financial literacy programs. Delayed entry into credit markets leads to lower average credit scores and higher delinquency rates. In addition, roughly 20 percent of Natives living on tribal land lack internet access, limiting online banking options. Those with only a P.O. box address often struggle to receive debit cards from traditional banks unwilling to mail them to non-street addresses.

In an effort to close these banking and capital gaps, Amber Buker (Choctaw) founded Totem Neobank, which ceased in 2024. It was the nation’s only digital bank designed specifically for Indigenous people. Totem focused on “decolonizing banking” by eliminating common barriers to access. FDIC-insured and Native-led, Totem required no monthly fees or minimum balances — addressing the top reason most individuals remain unbanked — and provided both physical and virtual cards, surcharge-free ATMs, and P.O. box mailing for cards. As a fintech startup with no physical branches, Totem partnered with a sponsoring bank, ensuring deposits are FDIC-insured. The company generated revenue through merchant fees and card network partnerships, then shared a portion of these revenues with tribal partners — keeping resources circulating within Native communities.

A growing network of Indigenous-led organizations acts as intermediaries to eliminate funding asymmetries between impact investors and Native American communities. Two standouts are South Dakota–based NDN Collective and Colorado-based Oweesta Corporation.

NDN Collective builds Indigenous power through grantmaking, philanthropy, and capacity-building rooted in Indigenous values. Its NDN Fund finances large-scale Indigenous development projects, prioritizing Indigenous regenerative economic principles. According to NDN’s Director of Philanthropic Networks, Thalia Carroll-Cachimuel, NDN Fund has already deployed nearly $10 million in loan capital for food systems, renewable energy, and LANDBACK projects, and plans to distribute over $100 million more in unique and flexible structures to finance community development, housing, social enterprise, regenerative agriculture, and more — always guided by the “principles of regenerative and just economies.”

(From left) Leroy Silva; Executive Director at Laguna Community Foundation; Cece Meadows, CEO + Founder of Prados Beauty; Bernina Gray, CEO + Founder of nDigitize; Zachariah Ben, Owner of Bidii Baby Foods; Nicole Johnny of Raven Capital Investment, and Cecilia Pacheco-Becenti, Program Manager of Tribal Entrepreneurship at UNM Rainforest Innovations

Oweesta Corporation, the oldest Native Community Development Financial Institution (CDFI) intermediary, offers financial products and services exclusively to Native CDFIs and Native communities. Working closely with the U.S. Treasury’s CDFI Fund, Oweesta has consistently delivered returns to its investors. With $70 million in direct investment to date, Oweesta channels capital into private-sector businesses, fosters homeownership, and supports asset-building across Native communities. The result is a transformation of tribal economies nationwide.

According to Nikki Pieratos (Bois Forte Band of Chippewa), Managing Director at NDN Fund, and Chrystel Cornelius (Turtle Mountain Band of Chippewa and Oneida Nation), Executive Director at Oweesta, “Among the many advantages sovereign nations, tribal enterprises, and enterprises located on Indigenous lands offer for investors are exemptions from federal and state tax, special consideration for government and diversity contract awards, preferential access to some federal grant and loan programs, special tax credits, incentivized leasing, and specialized investment or trade zones.” Intermediaries like NDN and Oweesta help impact investors navigate and leverage these benefits.

A growing network of Indigenous-led organizations acts as intermediaries to eliminate funding asymmetries between impact investors and Native American communities.

Impact investors and funds bridging the gap Among venture capital and private equity funds providing pathways for Indigenous economic empowerment is the Native American Venture Fund, which aims to deliver robust investor returns by leveraging “unique economic and legal advantages” offered by federal and state government relationships with recognized tribes. The fund provides capital, leadership, and vision for building scalable and sustainable tribal economies, prioritizing both job creation for tribal members and the long-term goal of tribal economic self-sufficiency.

North America’s first Indigenous-led and owned venture capital intermediary is Raven Indigenous Capital Partners. Based in Victoria, British Columbia, and Albuquerque, New Mexico, Raven is an impact-driven venture capital firm with a culturally centered approach, investing in Indigenous and Native American businesses. Its first fund closed at $25 million — far surpassing the initial $5 million goal — and supported 20 investments in 11 companies. Raven’s Fund II, anchored by investors such as Bank of America, BDC Capital, Farm Credit Canada, and Vancity, provides late-seed and early-stage investments for innovative, scalable, and purpose-driven Indigenous enterprises. Currently investing from a $110 million pool, Raven offers pre-seed through Series B equity, working to build trust with founders by honoring relational values often critical to Indigenous communities.

The Northwest Area Foundation supports Native Americans, communities of color, immigrants, refugees, and rural communities in eight northwestern U.S. states and 76 Native nations. Its newly announced 2030 impact investing strategy aims to “fuel long-term change” with loans, market-rate investments, and other forms of funding that prioritize Native American communities.

In a recent press release, Foundation President and CEO Kevin Walker said, “This strategy represents a turning point in how we think about community impact. By doubling down on investments that prioritize Native, rural, and historically underserved communities, we’re providing capital and changing systems to create pathways to self-determined economies.”

Scaling its $43 million impact investing portfolio in priority communities — with hopes of deploying “an ambitious $60–80 million” by 2030 — further amplifies the Foundation’s community-centered investing approach. Impact investing dollars supporting Native-led organizations and projects align with its longstanding commitment to direct at least 40 percent of grantmaking to Native-led organizations. In addition, low-interest Program-Related Investments (PRIs) for community-led organizations provide affordable funding for Native-owned enterprises, renewable energy projects, and nonprofit community centers.

Walker added, “By investing directly in Native-led organizations and diverse businesses, we’re doing more than funding projects—we’re fostering long-term resilience, wealth creation, and self-determination.”

In December 2024, philanthropist MacKenzie Scott awarded over $103 million in unrestricted funding to Native CDFIs—one of the largest single philanthropic investments in Native financial institutions. In total, Scott has committed $132.5 million since 2020 to 37 Native-serving nonprofits, approximately 0.8 percent of her overall $17.3 billion in giving.

Co-founder and CEO Danielle Forward (left) of Natives Rising, Founding Partner Betsy Fore (center) of Velveteen Ventures, and Chief of Staff Madison S. (right) of Natives Rising.

Crucial to Indigenous entrepreneurial journeys are community-centric organizations providing mentorship, capacity-building workshops, and cultural revitalization. These efforts equip Native entrepreneurs with the knowledge and tools to navigate capital raising and manage business growth.

Natives Rising, launched in 2016 by entrepreneur and Forbes 30 Under 30 honoree Betsy Fore (Cheyenne River Sioux descent) and former Meta tech designer Danielle Forward (a tribal member of the Cloverdale Rancheria Pomo Indians), focuses on “economic empowerment for the most impoverished group in the U.S.: Indigenous people.” Natives Rising runs three accelerators — the Native Women’s Tech Fellowship, Indigenous STEM Camp, and Founders Circle — that provide $50,000 grants to Native-owned businesses, plus coaching for startups with $1 million or more in annual revenue.

Another catalyst is Roanhorse Consulting, LLC, founded by Vanessa Roanhorse (Diné). This Indigenous-led social enterprise invests directly in Indigenous leaders, prioritizing data collection informed by Indigenous research approaches and implementing community-driven projects that emphasize people over profit.

Likewise, Native Women Lead, based in New Mexico, addresses the intersections of economic justice, racial equity, and Indigenous women’s empowerment. Its Matriarch Funds supply Indigenous women–led businesses in the Four Corners region with patient capital and wraparound support. Since its inception, Native Women Lead has distributed $550,000 to 65 Native women entrepreneurs across more than 200 tributes, pueblos, and nations.

Partnering with Oweesta, the Impact Finance Center convenes impact investors and Native communities, identifying over 200 potential backers looking to align with Native-led opportunities. This model aims to catalyze significant investments and create sustainable programs in Indigenous communities.

Between 1997 and 2017, the number of Native American and Alaskan Native women–owned businesses grew by 201 percent.

Founded by Stephanie Gripne, the Impact Finance Center and Impact Investing Institute are working toward a $1 trillion National Impact Investing Marketplace, expanding infrastructure initially piloted in Colorado. The center’s programs — Impact Days, the Impact Investing Institute, Who’s Who in Financial Innovation & Impact Investing, Impact Investing Giving Circles, and Impact Investor Collectives — have helped create over 70 new impact investors and source more than 550 social ventures, generating $260 million in direct impact investments over three years. Since 2012, the organization has mobilized $400 million in capital with over 150 investors involved.

Federal efforts continue to produce tangible benefits for Indigenous communities. Among these is the $720 million allocated to Tribes and Native communities through the Inflation Reduction Act (IRA) of 2022, as well as the strengthened Buy Indian Act that has spurred a 65 percent increase in government contract opportunities for Indigenous entrepreneurs.

When the Trump administration rescinded its spending freeze on federal loans and grants following the Office of Management and Budget’s January 27 memorandum, the pause affected tribal nations receiving billions in federal funding for such initiatives as economic development, housing, and infrastructure. This is in stark difference from Biden Administration’s strengthening “the self-determination and economic vitality of Tribal Nations and Native people,” influenced perhaps by Dr. Jill Biden’s nine visits to tribal lands, breaking with “centuries of limited interactions between first ladies and Native communities.” An Executive Order urged federal agencies to provide funding streams and programs accessible to Tribal communities.

Marshall Franklin of Commercial Furniture Refinishers; Photo by Rosemary Stephens; Courtesy of Mission Driven Finance

A recent roundtable hosted by Native Americans in Philanthropy, Hyphen, and Mission Driven Finance convened philanthropic, financial, and nonprofit representatives to expand economic development and investment in Tribal communities. Former U.S. Interior Secretary Deb Haaland (Pueblo of Laguna) encouraged the philanthropic sector to commit 10 percent of its total giving to Indian Country, stressing the need for public-private partnerships and interagency collaboration. Two major announcements followed:

Other consultancies, such as Washington, DC–based Native American Capital, help tribes and tribally owned businesses access public and mixed market capital, including specialized federal investment programs and the New Markets Tax Credits (NMTC) program. The firm has also raised capital for the Small Tribes Consortium through the Federal State Small Business Credit Initiative (SSBCI), channeling millions in grants to Native businesses.

Moving forward, funders within the impact investing ecosystem must recognize that Indigenous entrepreneurs represent an untapped opportunity for meaningful investment returns, economic sustainability, and societal well-being. Building respectful, culturally informed relationships with Indigenous communities is crucial — particularly given the deep-seated mistrust in conventional financing.

Moreover, flexible investment structures that prioritize community-centric goals rather than pure profit can better align with the Indigenous mindset, where self-wealth is often secondary to uplifting families and communities. Accompanying capital with appropriate mentorship, financial literacy resources, and technical assistance can further ensure business success. Finally, commercial banks must actively engage Indigenous customers, building long-term relationships and aligning their services with Native entrepreneurs’ commitment to collective prosperity.

By bridging these longstanding gaps and emphasizing mutual respect, the impact investing community can help create thriving entrepreneurial ecosystems that benefit both Indigenous communities and broader society — fostering economic empowerment while honoring cultural values and traditions.

—

This article was supported by a generous gift to the Impact Entrepreneur Journalism Fund. Support the Fund here. Donations are tax deductible.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments