Sovereign Seeds: Reclaiming MENA’s Agricultural Future

Reviving local food systems and unlocking rural prosperity

Contextualizing note: This article is an expanded version of a LinkedIn post that “went viral” overnight, attracting over 100 comments, 200 likes, and 13,000 views in less than 24 hours. As of this writing, about a week later, it has about 150 comments, 300 likes, and 23,000 views, as well as 34 shares. I encourage you to read this version below, as it is better contextualized, but I also encourage you to read the discussions in the comment threads of the original post.)

Dear ESG folks,

I trust you realize we’ve reached an inflection point, in the wake of the Bloomberg Businessweek “ESG Mirage” article that pierced the veil, revealing that the ESG emperor is naked.

(For those who haven’t read it, you really should, but in essence, it documents how “MSCI, the largest ESG rating company, doesn’t even try to measure the impact of a corporation on the world. It’s all about whether the world might mess with the bottom line.” More importantly, it documents how MSCI consciously leverages the implicit expectation that ESG creates a “better world,” while explicitly refusing to integrate measures that would actually deliver such a world, contenting itself instead with better financial returns for MSCI and its users. This characterization accurately portrays the fundamental underpinnings of ESG.)

As an ESG practitioner, you now have two choices:

You can double down on the (delusional) notion that ESG makes the world better (instead of the reality that it’s predatory delay, which Alex Steffen defines as “the blocking or slowing of needed change, in order to make money off unsustainable, unjust systems in the meantime” – I can hear you objecting as I write, but I encourage you to read this definition carefully and challenge yourself to leverage evidence to prove it wrong.)

Or

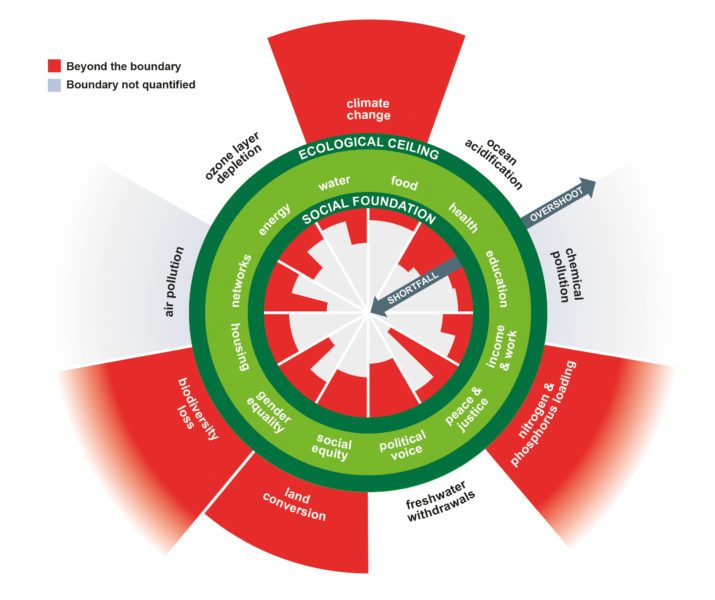

You can embrace bona fide sustainability, which ensures its claims by gauging impacts vis-à-vis ecological ceiling and social foundation thresholds (sometimes visualized as a Doughnut, thanks to Kate Raworth’s 2012 reinterpretation of Barbara Ward’s 1974 conceptualization of social “inner limits” and ecological “outer limits” for the United Nations). See Figure 1.

Figure 1: The Doughnut (Source: Kate Raworth. A Doughnut for the Anthropocene: Humanity’s Compass in the 21st Century. The Lancet Planetary Health. May 2017.)

There are many flavors of ESG, but they all entail these defining features:

In contrast, bona fide sustainability (or Context-Based Sustainability) carries the following, defining attributes:

Now that I’ve shared the defining features of both, I will share a further defining feature of ESG: it almost always seeks to conflate itself with sustainability, claiming that the two terms are interchangeable. I consider Harvard Professor Bob Eccles to be the poster boy for this practice, if for no other reason than that he continued to do so even after I jovially called him out in public for this misleading characterization.

A further defining feature of ESG: it almost always seeks to conflate itself with sustainability, claiming that the two terms are interchangeable.

The point: ESG gains (undeserved) credibility by encouraging the (mis)perception that it contributes to the achievement of sustainability when, in fact, it often does the opposite – it acts as an obstacle to achieving sustainability, because it actively “fogs the windshield,” obscuring and obfuscating attempts to discern sustainability performance. As my good friend Brendan LeBlanc of EY used to say about ESG, “the only thing worse than no progress is the illusion of progress.”

Now that the “ESG Mirage” article has pushed us past a tipping point, the tables have turned when it comes to ESG and sustainability.

Until now, you courted career risk if you embraced bona fide sustainability, which was often (falsely) portrayed as politically unfeasible.

Now, you are courting career risk by embracing ESG, due to the revelations in the “ESG Mirage” article.

So, the foundation of ESG enables you to readily step into an embrace of bona fide sustainability. All you have to do is abandon an exclusive embrace of ESG, which negates and rejects bona fide sustainability.

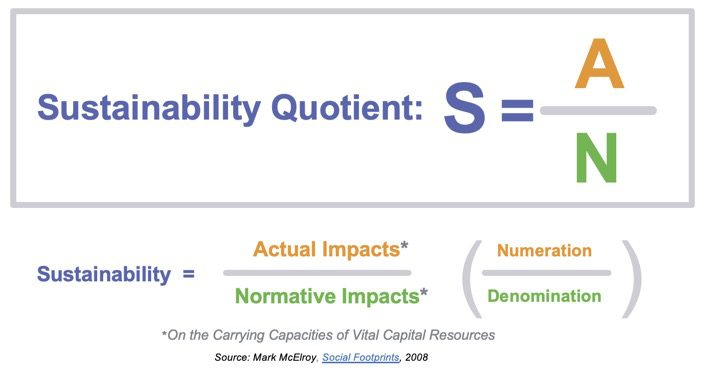

Luckily, you as an ESG practitioner have options, as this isn’t a zero sum game, since the core competencies of ESG are still applicable with bona fide (i.e. context-based) sustainability. Indeed, the “numerator” of the Sustainability Quotient comprises the “actual” impacts that ESG data concerns itself with, while the “denominator” comprises the “normative” impacts, or what the impacts need to be to be sustainable. Think carbon footprint over carbon budget. As Global Reporting Initiative Co-Founder Allen White says, “We need to move beyond incrementalist ‘numeration’ indicators & add ‘denomination’ indicators tied to upper (ecological ceilings) & lower (social foundations) thresholds.” See Figure 2.

Figure 2: The Sustainability Quotient (Source: Mark McElroy, Social Footprints: Measuring The Social Sustainability Performance of Organizations. University of Groningen. 2008.)

So, the foundation of ESG enables you to readily step into an embrace of bona fide sustainability. All you have to do is abandon an exclusive embrace of ESG, which negates and rejects bona fide sustainability. The choice is up to you. Which choice you make helps determine our collective odds of navigating our current predicament, by either increasing the instabilities inherent in systemic collapses (stick with ESG), or increasing the stability of systems to enhance resilience in the face of systemic collapses (embrace bona fide sustainability).

Peace, Bill

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments