Swedish Disruptor Shakes Up Asia’s Paint Industry

A bold, eco-conscious brand is drawing in a new generation of consumers

$15.00

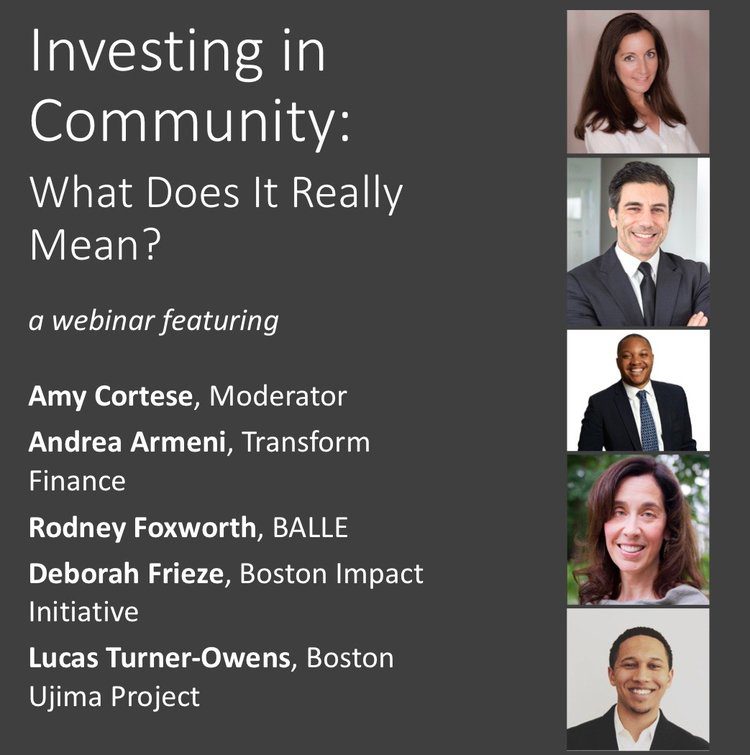

Content: Video Webinar Presentation with Q&A

Length: 1:12:20

Premium Members get free access to the entire catalog of past webinars as well as invitations to upcoming, live programs.

$15.00Add to cart

Place-based investing has been a hot topic in impact investing in recent years. It’s an acknowledgement that not all communities have benefited equally from the past decade’s economic gains, and that targeted investment can help revitalize areas that have been left behind. With recent federal Opportunity Fund legislation, even more money is pouring into marginalized communities.

But what does it mean to invest in community? And how effective are current approaches, particularly those that seek to help distressed communities? For all the recent talk in impact circles of community engagement and sharing of power, most community investment is still top-down, decided by well-meaning individuals and organizations that channel financial returns to the same wealthy class. At best, these local investments create jobs and improve quality of life in the communities they target. But they do little to create wealth in communities that lack it or address a fundamentally inequitable system.

There is a different approach emerging, however, that draws from a long history of bottom-up, grassroots local investing, where community members not only have a say in where investments are made, but can invest small sums themselves and benefit financially from the revitalization of their communities. This live webinar and Q&A features several cutting-edge thinkers and practitioners in place-based investing, and explores the different definitions and approaches to community investments, identifying the shortcomings to traditional models and laying out some new alternatives.

Amy Cortese is a Brooklyn-based journalist who writes about topics spanning business, finance and social issues. She is a longtime contributor to the New York Times and a former editor at BusinessWeek. Her work has also appeared in ImpactAlpa, Crain’s New York, B Magazine, Conscious Company and other publications. Her book, Locavesting, was one of the pioneering works on the emerging local investing and community capital movement. She is editor of Locavesting.com, a media & educational site that followed from the book. Most recently, she cofounded investibule.co, an aggregation platform for community-based offerings ranging from Kiva loans to JOBS Act crowdfunding, and helped to found the National Coalition for Community Capital (NC3), a nonprofit focused on education and advocacy around the emerging models for community-based investment. She has been named a “Top 30 Crowdfunding Thought Leader” and was present at the historic April 2012 Rose Garden signing of the JOBS Act.

Andrea Armeni is the Co-Founder and Executive Director of Transform Finance, a field-building non-profit organization based in New York and operating internationally. Transform Finance seeks to highlight key issues at the intersection of capital and social justice — from labor issues to racial equity to the wealth gap — and develop strategies for investors and movement builders to act on them.

Andrea is also the lead convener of the complementary Transform Finance Investor Network, a community of practice of family offices, foundations, pension funds and other asset owners. He is recognized as an innovator in the field of impact investing, particularly at the intersection of capital and systemic change. He is a lawyer by training and has taught at the Yale Law School and at Université Paris Dauphine in France. He is a BMW Foundation Responsible Leader, serves as Advisor to the United Nations’ Joint SDG Fund, and sits on the board of directors of the investment fund CARE Enterprises, Inc. and of the NGO Finance for Good Brazil. He is an adjunct faculty member at the NYU Graduate School, where he lectures in the masters’ program. Most recently he is the author of “Innovative Financing Structures for Social Enterprises” and co author of the briefing “Renewable Energy: Managing Investors’ Risks and Responsibilities.”

A nonprofit leader and social entrepreneur, RODNEY FOXWORTH is Executive Director of BALLE (Business Alliance for Local Living Economies), a network of entrepreneurial leaders working to advance equitable economic opportunities through entrepreneurship and local business ownership in marginalized communities throughout the U.S. and Canada.

Previously, he was CEO and Founder of Invested Impact, a consulting firm focused on economic development, philanthropy, and social innovation, and co-founder and Strategy Advisor of Impact Hub Baltimore. Prior to founding Invested Impact, Rodney was community manager at BMe, a national network of black male leaders and entrepreneurs. Rodney has also served as program manager at Job Opportunities Task Force, a policy advocacy and workforce development organization. Additionally, he has been a consultant to the Annie E. Casey Foundation, Calvert Impact Capital, and the John S. and James L. Knight Foundation, among others. Rodney is a BALLE Fellow, Next City Vanguard, and Baltimore Business Journal “40 under 40” honoree. He is featured in the Washington Post bestseller, “Reach: 40 Black Men Speak on Living, Leading, and Succeeding.” Rodney serves on the board of Justice Funders and SOCAP.

Deborah Frieze is founder and president of the Boston Impact Initiative, an impact investing fund focused on economic justice, which means investing in opportunity for all people—especially those most oppressed or abandoned by our current economic system—to lead a dignified and productive life. The fund takes an integrated capital approach, combining investing, lending and giving to build a resilient and inclusive local economy. Deborah is co-author (with Margaret Wheatley) of Walk Out Walk On, an award-winning book that profiles pioneering leaders who walked out of organizations failing to contribute to the common good—and walked on to build resilient communities. She is also founder of the Old Oak Dojo, an urban learning center in Boston, MA.

Lucas Turner-Owens serves as the Fund Manager for the Ujima Project. As the Fund Manager, he is responsible for loan packaging, underwriting, and managing Ujima’s portfolio of investments. In addition, Lucas also provides technical Assistance to entrepreneurs, connecting them with business support organizations and new customers.

Prior to joining the Project, Lucas worked as an economic policy analyst for Operation HOPE, a nonprofit focused on consumer financial education. In this role, Lucas acted as an advisor to the CEO on government affairs and public policy with a focus on strategies designed to benefit underserved communities. After this time spent working in the economic policy space, Lucas worked as a loan officer for Cooperation DC, providing technical assistance and expansion loans from a network of impact investors to grow social enterprises and worker-owned co-operatives in Washington D.C. Following this Lucasjoined Next Street Financial as a senior analyst in their Boston office. In this role, he applied his background in small business development and public policy to support clients making impact investments and strategic growth decisions. Lucas was a founding member of Youth Against Mass Incarceration and has been active in local grassroots movements in Boston in partnership with groups such as Alternatives for Community and Environment and Reclaim Roxbury. Lucas holds a BA from Wesleyan University.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.