The Algorithmic Classroom

South Korea’s ambitious experiment with AI in classrooms holds lessons for the world

The recent inauguration of President Trump marked yet another turning point in the politicization of humanitarian and development funding. On Friday 24th January, the US Secretary of State, Marco Rubio, announced that the US is halting spending on existing foreign assistance programs (except for Israel and Egypt). Overnight, “stop-work orders” were issued on active grants, throwing countless programs into chaos. As of Tuesday 28th January, Rubio issued a waiver to allow “core life saving programs” to continue during the 90-day freeze on foreign aid as the US reviews its aid policies.

But state funding has never been neutral. It comes with strings attached, bureaucratic nightmares, and ethical dilemmas that force organizations to balance financial sustainability with their core principles. The problem isn’t just about Trump’s funding cuts or policy shifts; it’s about a long history of governments using aid as a political tool, changing priorities unpredictably, and leaving programs vulnerable to collapse.

Protesters gather outside of USAID headquarters in Washington, D.C.

State funding isn’t just about supporting people in need, it’s about leverage. Governments have long used aid to push geopolitical agendas, secure alliances, and shape global narratives. When a government decides a region or issue is no longer a priority, funding dries up, and organizations scramble to fill the gaps. This dependency is dangerous.

Trump’s administration has made this painfully clear. His 2017 “Global Gag Rule” slashed $8.8 billion in reproductive health funding, cutting access to critical services. Refugee resettlement funding was gutted, with the annual cap dropping from 110,000 to just 45,000. Climate? A proposed 31% budget cut to the EPA meant a $2.6 billion loss for environmental programs.

Now, with Trump 2025, we’re looking at an even more extreme “America First” agenda — freezing all foreign aid, sidelining USAID, and reinstating the Gag Rule. The impact? Entire regions and communities left destabilized as funding for health, poverty alleviation, and education disappears while resources shift to border security (again).

But Trump isn’t an outlier (although he could be the most bold/extreme so far). Obama’s administration used aid as a tool, too – just with different priorities. He expanded democracy and governance funding, tying it to political conditions. After Uganda passed anti-LGBTQ+ laws, the US (and other donors) redirected $140 million in aid, crippling HIV/AIDS programmes. Clinics lost funding. Drug shortages followed. The very people the policy aimed to protect were ironically left worse off.

Counterterrorism was another focus, with billions poured into security in North and West Africa while development aid declined. In Yemen, the US backed Saudi-led military operations despite human rights concerns. Humanitarian aid trickled in inconsistently, dictated more by diplomatic interests than actual needs. The result? One of the worst humanitarian crises in the world, with millions facing famine and disease while US support for the Saudi-led coalition prolonged the conflict.

Defense Secretary Ash Carter meets with Deputy Crown Prince and Minister of Defense Mohammed bin Salman of Saudi Arabia at the Pentagon June 16, 2016.

State funding comes wrapped in red tape – layers of bureaucracy, compliance checks, reporting obligations and political conditions that slow down aid instead of enhancing its accountability. Governments tighten restrictions, setting impossible funding requirements that force organizations to spend more time justifying their existence than delivering support. These organizations end up drowning in paperwork, diverting resources away from actual service delivery just to meet donor demands.

USAID has been long criticized for its excessive bureaucracy. NGOs seeking grants must navigate complex applications, comply with rigid performance metrics, and submit endless financial and operational reports. These demands are not just tedious; they actively delay aid, forcing organizations to prioritise paperwork over people. The UK’s FCDO is no different. A recent analysis of UK aid cuts highlighted how the focus on accountability led to additional layers of paperwork that detracted from actual humanitarian efforts.

Boris Johnson merged the UK’s FCO and DFID, in a controversial decision which was criticised widely. After the merger, the UK reduced aid spending from 0.7% to 0.5% of GNI.

Government funding overwhelmingly favours large charities, which increasingly resemble corporate outsourcing firms like Serco and G4S. High-value contracts go to the same few organizations, many of which operate at a distance from the communities they claim to serve. Impact takes a backseat to administrative efficiency, with smaller, locally embedded charities losing out. In the last decade, 97% of UK charity closures were among those with annual incomes under £1 million, evidencing that the system is unfavourable towards grassroots actors.

When private companies partner with social organizations, they can provide consistent, sustainable funding that isn’t swayed by shifting political tides.

Even when money is available, it rarely reaches those best placed to make a difference. Governments channel the bulk of aid through UN agencies and INGOs, which then pass down only a fraction to national and grassroots organizations. These local actors (often the most effective at responding to crises) lack the resources to navigate donor bureaucracy. In a 2022 global survey, two-thirds of NGOs reported that their funders failed to cover even basic administrative costs. Half had financial reserves for 21 days or less, leaving them on the brink of collapse.

Figure from Humentum’s 2022 Report on How international funders can stop trapping their grantees in the starvation cycle and start building their resilience.

If state funding is unreliable and politically charged, what’s the alternative?

Private and public partnerships can offer innovative solutions that keep the focus on impact rather than bureaucracy. When private companies partner with social organizations, they can provide consistent, sustainable funding that isn’t swayed by shifting political tides. The IKEA Foundation has provided $198 million in funding and in-kind support to UNHCR since 2010, contributing to refugee housing solutions, like solar-powered camps in Jordan. Also, DHL Speedballs are tough, cushioned, and brightly coloured shipping bags that are filled with aid and dropped into remote or inaccessible areas. DHL has partnered with countless organizations to deploy urgent relief.

DHL Speedballs distributed in Myanmar in 2008.

Community-driven funding puts power directly in the hands of those affected and tied to community priorities. Mutual Aid Networks (emerging strongly during COVID-19) mobilized resources globally, from Brazil to India to the US, using crowdfunding and direct donations to address urgent needs like food insecurity and medical care.

These actors are often unburdened by political agendas, allowing them to fund pioneering solutions that could revolutionise industries or address systemic issues.

Impact investment removes reliance on grants or donations, directing capital into projects that generate both financial returns and measurable social good. There are many great investment groups, including LeapFrog Investments, who fund businesses expanding financial and healthcare access across Africa and Asia, while Accion partners with institutions to increase access to capital for entrepreneurs. Village Capital focuses on impact-driven startups tackling social, environmental, and economic challenges. The GIIN estimates that 3,907 organizations manage $1.57 trillion in impact investing AUM, with a 21% annual growth rate since 2019. This trend is expected to continue at double-digit growth until at least 2030.

Cartier Women’s Initiative Cohort for 2024. This program highlights female entrepreneurs, supporting them with financial, social and human capital support to grow their impact businesses.

Blended capital enables large-scale projects that traditional investors find too risky and NGOs might find too ambitious. The Education Outcomes Fund pools government, private foundations, and impact investment resources to finance education programmes in low-income countries, with returns tied to measurable improvements in student outcomes. Development Impact Bonds (DIBs) align governments, investors, and implementing organizations to fund initiatives where returns are based on actual real-world outcomes, whether increasing education access or reducing poverty.

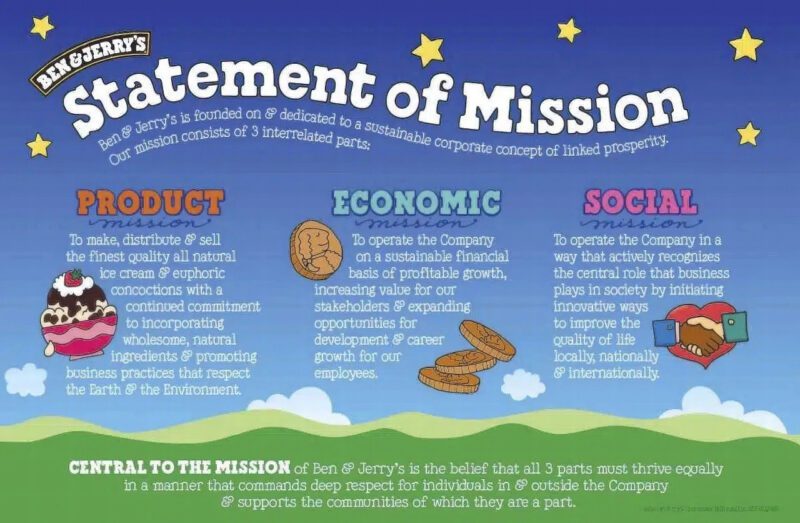

Companies and philanthropists have the unique ability to take risks and fund long-term solutions in ways that state funding often cannot. The Ben and Jerry’s Foundation, for example, supports grassroots organizations working in their communities to achieve social and environmental justice, prioritizing communities that have been denied power. Patagonia and Cotopaxi direct profits toward environmental and anti-poverty initiatives. These actors are often unburdened by political agendas, allowing them to fund pioneering solutions that could revolutionise industries or address systemic issues.

These alternatives aren’t perfect. While ensuring accountability in corporate partnerships is a promising strategy, it can inadvertently reinforce elite power dynamics in traditional philanthropy. Impact investments must strike a balance between financial viability and true social benefit. Grassroots funding can be unstable, and blended capital models require complex coordination. It’s also the responsibility of donors to make themselves more accessible. But relying solely on state funding has already proven unsustainable. The reality is: there is no perfect model. What matters is the willingness to innovate, adapt, and build funding structures that prioritize independence, sustainability, and real impact.

Ben & Jerry’s Statement of Mission

The challenges of state-funded aid highlight the urgent need for more sustainable and independent funding models. True resilience lies in diversification. Embracing alternatives can reduce reliance on politically volatile state funds and ensure missions remain intact, even amid policy shifts. The future of aid must be built on adaptability, financial independence, and an unwavering commitment to impact, because the communities we serve deserve stability, not uncertainty. It’s time we rethink how we fund the work that truly matters.

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments