by Sophie Forest | Creative Economy, Editor's Picks, Financial Inclusion, Global, Impact Economy, Impact Investing, North America, Racial Equity & Justice, SDG 10 - Reduced Inequalities, SDG 8 - Decent Work and Economic Growth

Consistent with their stated value of diversity, equity, and inclusion (DEI), impact investors need to rethink their expectations for the funds in which they invest. The traditional approach of many investors has been to invest only in “mature” funds, defined as Fund...

by Stella Tran | Editor's Picks, Global, Impact Economy, Impact Investing, Impact Measurement & Management, Racial Equity & Justice, SDG 10 - Reduced Inequalities, SDG 17 - Partnerships for the Goals, Systems Change

Impact measurement and management (IMM) strategies are increasingly becoming more sophisticated, with many impact investors building robust IMM frameworks across their activities to assess performance, adapt strategies, and share insights. As noted in the Global...

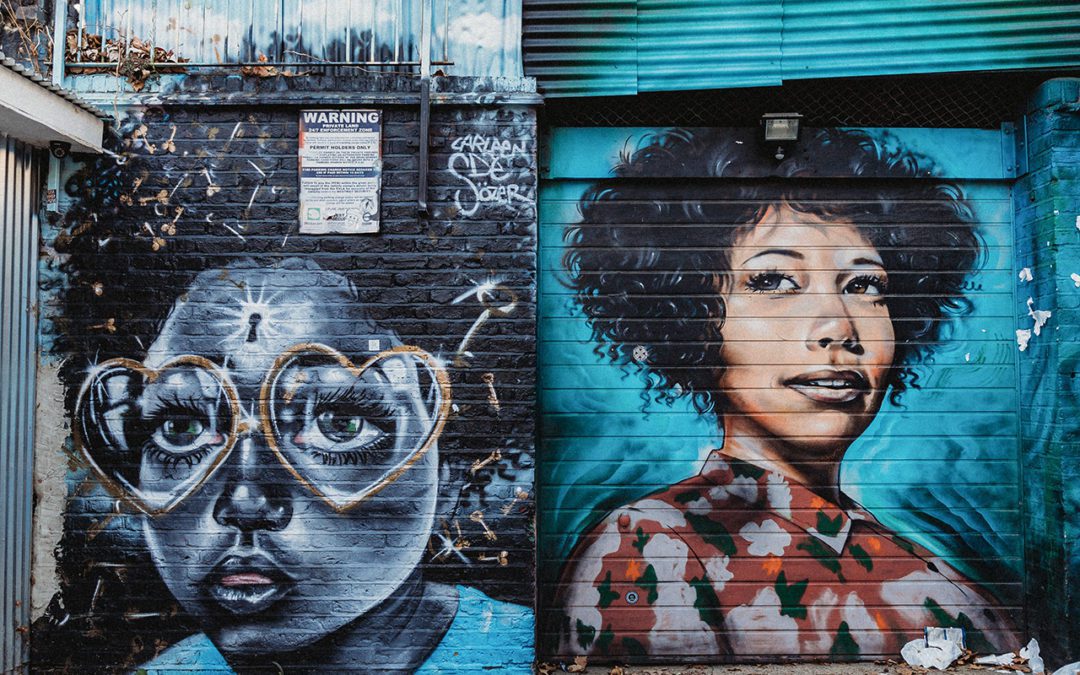

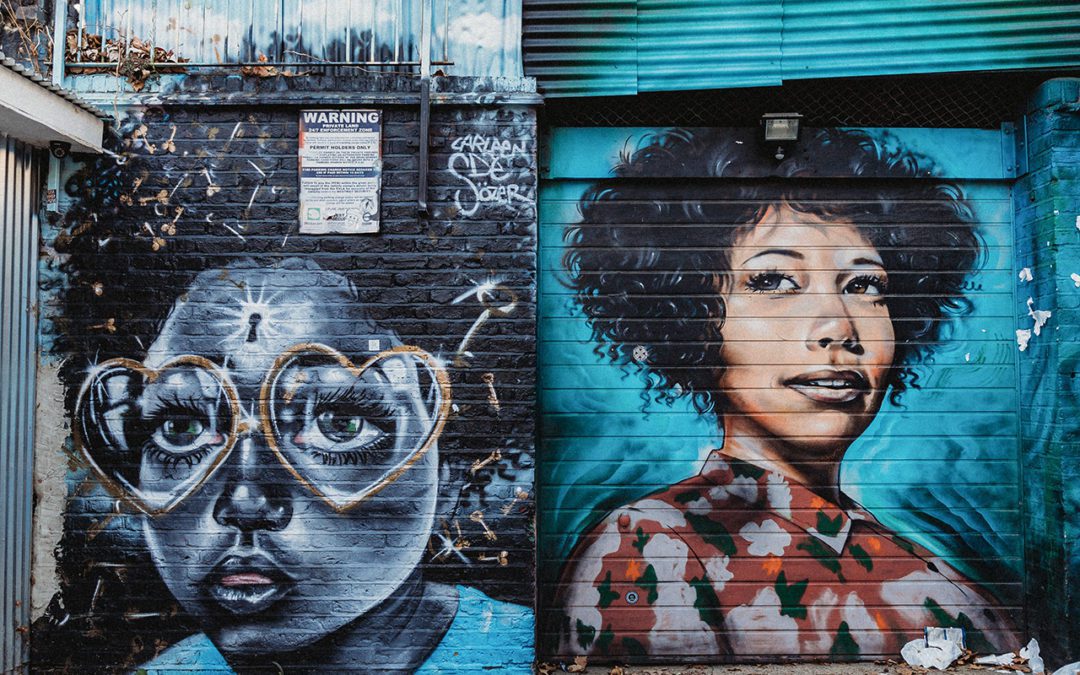

by Meg Massey | Editor's Picks, Impact Economy, Impact Investing, North America, Racial Equity & Justice, SDG 10 - Reduced Inequalities, SDG 8 - Decent Work and Economic Growth

It’s green. It’s easy to grow. It represents a multi-billion-dollar industry. It can treat a range of mental and physical ailments. With the right incentives in place, it could generate the income and economic development needed to build wealth in Black and brown...

by Havell Rodrigues | Blended Finance & Philanthropy, Global, Impact Economy, Impact Investing, North America, Place-based Investing, Racial Equity & Justice, Scaling Solutions, SDG 10 - Reduced Inequalities, Stakeholder Capitalism

The BIPOC wealth gap in the United States is growing, sustained by systemic inequities that have limited access to the cornerstones of wealth creation: real estate and entrepreneurship. While much has been done through CDFIs to improve access to real estate capital...

by Marcela Pinilla | ESG Investing, Impact Economy, Impact Investing, North America, Policy & Regulation, Racial Equity & Justice, SDG 10 - Reduced Inequalities, SDG 13 - Climate Action, SDG 3 - Good Health and Well-Being, SDG 8 - Decent Work and Economic Growth

At last! Environmental, social, and governance (ESG) investing has become mainstream. That’s a good thing, right? According to the Global Sustainable Investment Alliance’s report released in July, global assets under an ESG-related mandate are, as of 2020, about $1 of...