Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Focus on emerging funds

Consistent with their stated value of diversity, equity, and inclusion (DEI), impact investors need to rethink their expectations for the funds in which they invest. The traditional approach of many investors has been to invest only in “mature” funds, defined as Fund III and beyond with more than $100M in assets. However, this investment standard stands in sharp contrast to the commitments many impact investors have made to support funds led by BIPOC and women managers. Despite strong performance, funds led by diverse managers have been historically limited in number and under-capitalized. As a result, there are few impact funds led by diverse managers that meet the definition of a mature fund.

Like many practices that don’t entirely serve the goals of impact investors – such as GP capital commitments as a percentage of fund size, which doesn’t necessarily reflect the significance of the GP commitment for the individual GP – the focus on mature funds has been adopted wholesale from conventional investing practice. Avoidance of first-time funds reflects a decision-making context where financial risk and return are the only considerations. Impact investors looking to optimize impact as well as return should consider why a reflexive avoidance of emerging funds may not serve their goals.

Impact investing is still relatively new. The term impact investing was coined in 2008. As of 2020, only about a third of professionally managed assets in the U.S. were invested sustainably. Reaching the milestone of a strategy’s third fund is a matter of time. A fund typically invests capital for 3-5 years, before harvesting investments over years 5-10. Many fund managers won’t raise their second fund until their first fund is fully deployed, which means a second fund won’t be raised until 5 years or more after a first fund is launched. This timeline suggests a Fund III comes to market once a strategy has a track record of 10-12 years.

Impact funds tend to be smaller. Impact funds tend to be smaller in size than their conventional counterparts. According to Pitchbook, in 2020 the average private market fund size was $471M, while the average private market impact fund size was only $168M. Fund size is usually a function of an investment strategy’s proven track record: it takes time for a firm raising sequential funds to reach $100M.

Many BIPOC- and women-led funds are new. Given that only 1.4% of all professionally managed assets in the U.S. are managed by BIPOC and women fund managers, up very slightly from 1.3% in 2019, it’s no surprise that many funds led by diverse managers are first-time funds and funds of less than $100M.

What we have learned at Upstart Co-Lab

What we have learned at Upstart Co-LabUpstart Co-Lab is disrupting how creativity is funded by connecting impact investing capital to the U.S. creative economy. Over the past six years, we have observed that the creative economy is an on-ramp to opportunity in the U.S. for diverse entrepreneurs: up to 35% of all woman-owned businesses are in the creative economy and approximately 38% of minority-owned businesses are in the creative economy. We have consistently found that funds with diverse leadership investing in diverse-led companies often have meaningful exposure to the creative industries. Providing access to capital to BIPOC and women entrepreneurs is now a stated impact goal for the Upstart team.

Upstart maintains an investment pipeline that includes impact investment funds with >20% exposure to creative industries such as fashion, film & TV, video games, health & beauty, and food products. This pipeline includes approximately 100 funds with 20%-90% exposure to creative industries. Of these 100 funds, fewer than 20% meet the definition of a mature fund.

This is in large part because 58% of the funds in the Upstart pipeline are led by BIPOC and women with commitments to back BIPOC and women entrepreneurs. Of these funds, approximately 25% are first time funds that have launched since Summer 2020, and most are funds that have targeted to raise less than $100 million. Examples include Debut Capital, an early-stage venture fund investing in BIPOC entrepreneurs, with 40% of their portfolio invested in creative economy businesses; Collab Capital, an early-stage venture fund focused on Black entrepreneurs, with 60% of their portfolio invested in creative economy businesses; and Supply Change Capital, a BIPOC- and women-led early-stage venture fund investing at the intersection of food, culture, and technology with 65% of their portfolio invested in creative economy businesses.

The creative economy is an on-ramp to opportunity in the U.S. for diverse entrepreneurs.

At Upstart Co-Lab, we have come to believe that supporting first time funds and funds raising less than $100 million with a clear commitment to DEI (that, of course, meet our focus on the creative economy and other investment and impact requirements) is in and of itself a way to generate meaningful impact.

Acknowledging the data and research on the maturity of impact investing funds is limited, we hope there will be better data to answer the following questions as the sector evolves:

In the meantime, we believe it is crucial for investors to consider investing in emerging funds to fix the funding gap for BIPOC and women fund managers and the diverse entrepreneurs they support – and to create meaningful impact.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

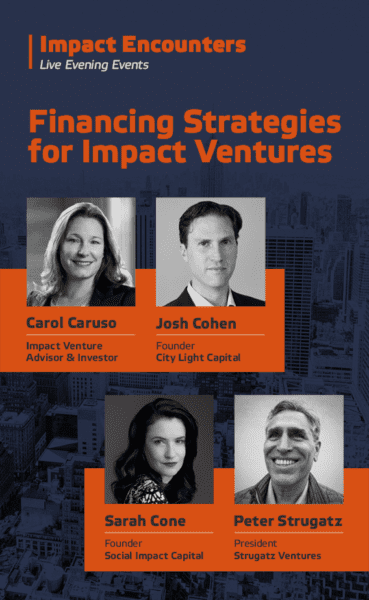

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments