Sovereign Seeds: Reclaiming MENA’s Agricultural Future

Reviving local food systems and unlocking rural prosperity

The missing billions in impact investing

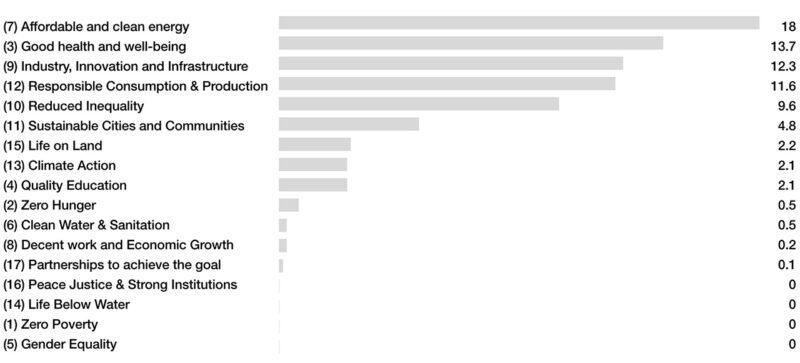

Impact investing is growing, with more capital flowing toward innovative solutions aimed at solving the world’s most pressing challenges. Yet, as revealed by the Norrsken Impact 100 list for 2024 – a list of the most promising impact startups, as chosen by Norrsken and their partners – the funds are not distributed equally. While some Sustainable Development Goals (SDGs) attract billions, others receive nothing. The data shows stark disparities, with SDG 7 (Affordable and Clean Energy) raising a remarkable $18 billion, followed by SDG 3 (Good health and wellbeing) with $13.7 billion, while SDG 16 (Peace, justice & strong institutions), SDG 1 (Zero poverty), SDG 5 (Gender equality), and SDG 14 (Life below water) received… nothing.

So, why are these SDGs being overlooked? And what does it mean for global progress?

Norskken Impact 100 Funding Priorities; Source: https://www.norrsken.org/impact100

SDG 1: No Poverty

Poverty alleviation is a critical issue, but remains underfunded. Although extreme poverty rates have declined in the past few decades, progress has slowed (in some cases, reversed) due to economic instability, climate change, and global conflicts. The COVID-19 pandemic pushed tens of millions back into poverty. A major reason for the lack of investment is the perception that poverty reduction is primarily the responsibility of governments and aid organizations. However, a shift is underway, creating opportunities for impact investors to help fill the growing gap. Unlike sectors such as clean energy or healthcare, poverty alleviation lacks a direct revenue model and is deeply interconnected with other SDGs, making it challenging to address in isolation.

A major reason for the lack of investment is the perception that poverty reduction is primarily the responsibility of governments and aid organizations.

However, companies like Grameen Bank have demonstrated that poverty-focused investments can generate both impact and financial sustainability. Furthermore, affordable housing projects, like Habitat for Humanity or Next Step Network, or EdTech – like Andela and Generation – as well as mobile banking services, like M-Pesa and Rahat, all offer viable investment opportunities that can reduce poverty while ensuring sustainable returns.

Habitat for Humanity Received $436 Million from Mackenzie Scott; Courtesy of Habitat for Humanity

SDG 5: Gender Equality

Gender equality drives economic productivity, innovation, and social resilience, yet SDG 5 remains underfunded. Disparities persist in education, employment, financial inclusion, and leadership, with the Global Gender Gap Report 2024 predicting it will take 134 years to achieve full parity. Advancing women’s employment could add $12 trillion to global GDP and boost some countries’ output by 35%.

Gender equality is often seen as a social issue, yet gender-diverse companies perform better financially. McKinsey found firms with over 30% female representation are more likely to outperform peers. Yet, women-led businesses receive little funding, with U.S. VC deals for female founders hit a six-year low in 2024, down 13% from 2023. Legal barriers persist, with women having only 64% of the legal rights of men. Gender-lens investing (GLI) is growing, with U.S. gender-lens equity funds reaching $4.6 billion in AUM by Q3 2024, but remains a small market share.

Ignoring poverty and gender equality limits opportunities for marginalized populations, while failing to protect ocean health threatens global ecosystems.

Gender equality must be reframed as an economic priority. For instance, gender-lens investment funds, like Elevate Capital and Women’s World Banking, focus on supporting women-led businesses and companies that prioritise gender equality. Moreover, companies like Accenture, are examples of businesses that incorporate gender equality into their ESG strategies.

SDG 14: Life Below Water

Oceans play a vital role in regulating the Earth’s climate, supporting global food systems, and hosting 80% of life on Earth. Despite the ocean economy contributing $2.5 trillion annually, funding for ocean conservation remains insufficient. Fisheries alone support over 600 million livelihoods, while coral reefs generate $375 billion annually from tourism, coastal protection, and biodiversity. The “out of sight, out of mind” problem makes it easier for investors to ignore marine degradation.

Overfishing costs the global economy $80 billion annually, and plastic pollution costs $13 billion each year. Climate change worsens ocean degradation, with warming oceans and acidification threatening coral reefs, fisheries, and marine ecosystems. Half of the world’s coral reefs are already lost, and 90% could disappear by 2050, with projected economic losses of $1 trillion.

Ocean conservation must be seen as both an economic and climate priority, not just an environmental issue. The Nature Conservancy’s Sustainable Fisheries Programme supports long-term fisheries sustainability. Blue carbon projects like the Mangrove Restoration Projects (e.g., Seatrees) restore coastal ecosystems. Organizations like Seacology and Coral Gardeners fund community-led marine conservation, while initiatives like Plastic Bank reduce plastic pollution by creating value from waste and promoting recycling.

The Coral Gardeners, French Polynesia; Courtesy of The Coral Gardeners

SDG 16: Peace, Justice, and Strong Institutions

Strong governance, justice, and peace are essential for sustainable development, yet SDG 16 remains underfunded, seen as too political, complex or lacking clear financial returns. In 2023, violence cost the global economy $19.1 trillion (13.5% of global GDP), while corruption drains over $2.6 trillion annually, deterring investment in fragile states. Though measuring progress is difficult, effective governance attracts foreign investment and boosts economic growth. Every $1 spent on prevention can save between $26 and $75 in crisis response costs and for nations with recent histories of violence, the savings could be as high as $103 per $1 invested.

Investors must view SDG 16 as key to economic security. The World Bank’s Governance Global Practice supports countries in strengthening legal systems and tackling corruption. The Global Infrastructure Facility (GIF) uses blended finance to de-risk investments in fragile contexts and anti-corruption initiatives like Transparency International’s Advocacy Campaigns also play a crucial role in fostering accountability.

How Blended Finance Can Work; Courtesy of OECD

The Consequences of Neglecting These SDGs Neglecting key SDGs perpetuates inequality, weakens governance, and accelerates environmental degradation. Ignoring poverty and gender equality limits opportunities for marginalized populations, while failing to protect ocean health threatens global ecosystems. Underfunding governance and justice undermines stability, deterring investment and hindering economic growth.

Investors must expand impact investing beyond high-return SDGs. Blended finance, social impact bonds, and stronger private-sector engagement can unlock much-needed capital. Governments and philanthropies have a role to play, but private investment is crucial for creating a sustainable, inclusive global economy. The cost of inaction is too high. Bold investments today will help build a more resilient and equitable future for all.

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments