Sovereign Seeds: Reclaiming MENA’s Agricultural Future

Reviving local food systems and unlocking rural prosperity

Supporting small business financing and fund innovation

In recent years, many initiatives have, with great fanfare (if variable follow-through), been launched to improve access to capital for businesses arising from historically disadvantaged groups within the US. These efforts include increasing credit available from financial institutions and programs to back investment funds led by historically under-represented groups. Surprisingly, the program with perhaps the single greatest potential to expand capital access has largely flown under the radar within the impact investment community.

Meet the State Small Business Credit Initiative (SSBCI), a federal program re-launched in 2021 with up to $10 billion in funding aimed at enhancing capital access for small businesses, particularly those owned by historically underserved populations. This initiative, overseen by the U.S. Treasury Department and implemented through various state, territorial, and tribal entities, is poised to catalyze a wide spectrum of more equitable business financing across the United States and its territories.

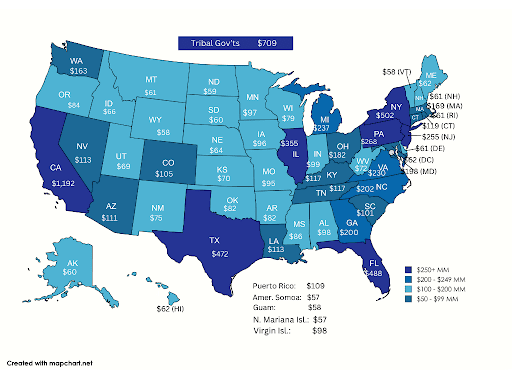

SSBCI Allocations by State and Territory ($ MM)

Originally launched under the 2010 Jobs Act, the SSBCI program disbursed $1 billion before its initial run ended in 2016. This funding had a significant impact, with 80% going to very small businesses and over 40% reaching low-income areas. The re-authorized SSBCI 2.0 program under the American Rescue Plan Act of 2021 was launched with enhanced features and a tenfold increase in funding to $10 billion.

Surprisingly, the program with perhaps the single greatest potential to expand capital access has largely flown under the radar within the impact investment community.

Relative to the initial program, SSBCI 2.0 is further focused on supporting businesses owned by Socially and Economically Disadvantaged Individuals (SEDI), which includes a broad range of groups such as those facing racial or ethnic prejudice, women, individuals from rural areas, veterans, and people with disabilities. The program’s allocation methodology will provide incremental funding to those programs that achieve specific milestones in funding businesses meeting the defined SEDI criteria.

The SSBCI stands out from other programs because of both the scale of its target impact across the United States and its ability to catalyze innovative strategies expanding economic opportunity.

The program’s ambitious scale is reflected in its stated goal to generate $10 in private capital investment for every $1 deployed in SSBCI funding. As a result, its $10 billion in federally committed capital could potentially mobilize over $100 billion in total. This massive influx of capital could significantly improve access to business funding, driving growth and innovation across the country. Importantly, the SSBCI is not just about injecting funds into the market through existing channels. By providing for a diverse array of funding mechanisms under local control, the programs enable a rich environment for innovation and learning around effective models for expanding economic opportunity in a variety of environments. Whether it’s providing credit enhancement for small business loans from CDFI’s, providing strategic support and capital to incubate early-stage companies, or seeding new investment funds, SSBCI’s flexible approach allows for tailored solutions that meet local needs.

SSBCI 2.0 presents a tremendous opportunity for investment fund managers, entrepreneurs, and impact investors to advance local and regional initiatives to expand economic opportunity. However, given the program’s size, scope, and complexity, it has taken some time for individual state level programs to be established and begin deploying allocated capital. Fortunately, many of the local programs received US Treasury approval in 2023 and are now being implemented at accelerated rates. Other programs continue to be developed and are expected to be implemented over the remainder of 2024. Profiles of SSBCI 2.0 programs approved to-date can be found on the US Treasury’s Capital Program Summaries.

Fortunately, many of the local programs received US Treasury approval in 2023 and are now being implemented at accelerated rates.

Impact entrepreneurs, investors, and others seeking to access funding enabled through the SSBCI 2.0 program can identify specific program and contacts through the Treasury’s List of SSBCI Capital Programs and Contacts.

—

Future articles in this Series for Impact Entrepreneur will explore how SSBCI 2.0 funds are being used innovatively and impactfully in different regions and by various stakeholder partners. If you have examples or ideas for leveraging SSBCI 2.0 to drive meaningful change in small business financing and support a more inclusive economy, please share them with us for reference.

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments