Sovereign Seeds: Reclaiming MENA’s Agricultural Future

Reviving local food systems and unlocking rural prosperity

In South Africa, the pulse of the economy beats strongly within its small and medium enterprises (SMEs). A McKinsey report from 2020 sheds light on this sector’s vast presence, accounting for an astonishing 98% of all businesses. These enterprises are not just numerous; they are the backbone of the workforce, engaging 50% to 60% of the population across diverse sectors and contributing a substantial 34% to the nation’s Gross Domestic Product (GDP).

Despite their economic heft, a paradox exists: a majority of these SMEs — 85%, to be exact — operate outside the formal economic structures, making do without essential financial services. This disconnect has led to a significant SME funding gap, one that the International Finance Corporation pegs at roughly $20 billion, or 300 million South African Rand.

This gap represents not just a challenge but an opportunity: by bringing these SMEs into the formal fold and improving their access to funding, we can unlock their full potential. Doing so could result in a more substantial contribution to the GDP, given that SMEs are often more rooted in their local communities and can have a more significant impact on employment and ownership distribution compared to larger, more institutional entities.

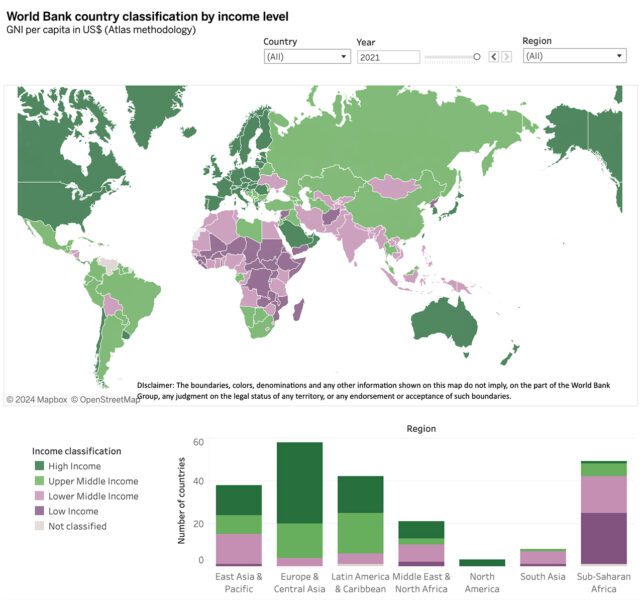

South Africa’s economic narrative is one marked by a steady climb on the global income ladder. In 2021, the nation’s Gross National Income (GNI) per capita stood at $6,540, rising modestly to $6,780 the following year. This consistent growth has earned South Africa a spot in the World Bank’s ‘Upper-middle income’ tier—a classification that speaks to its progressive economic stature when applying the Atlas method, a nuanced approach to measuring economic health.

Source: World Bank

When juxtaposed with its African peers, South Africa’s economic performance shines. The 2022 figures reveal a GNI per capita that far surpasses Egypt’s $4,100 and Nigeria’s $2,160, painting a picture of relative affluence and suggesting a robust economic infrastructure that could support more inclusive growth. Such a comparison underscores South Africa’s potential as a regional leader in economic development, and a formidable player in the broader African market.

Source: World Bank

Dissecting the layers of economic health, we encounter the Gini Coefficient — a barometer for inequality. In 2014, South Africa registered a Gini Coefficient of 63%, indicating a stark contrast between the wealthy and the poor, a gap more pronounced than in Nigeria, which posted coefficients of 35.9% in 2015 and 35.1% in 2018. This data, sourced from the World Bank’s latest records, highlights an asymmetrical income distribution in South Africa, with a ‘fatter left tail’ that signifies a larger proportion of the population holding a smaller share of the nation’s wealth, compared to its African counterparts and the global average.

This inequality poses a critical question for systems-minded changemakers: can bolstering SMEs be the lever to harmonize individual earnings, amplify overall income, and bridge the inequality chasm not only in South Africa but continent-wide? The potential for SMEs to act as equalizers is significant, particularly as the world navigates the headwinds of global economic strain — manifested in inflationary pressures, escalating interest rates, and nonperforming loans.

In this challenging landscape, the imperative for financial institutions, venture capitalists, and private equity firms is to innovate ways to channel funds into SMEs strategically. The goal is to counterbalance the scarcity of resources and catalyze an entrepreneurial ecosystem that can thrive even amidst fiscal contractions and resource competition. The quest is not just for more funding, but for smarter, more inclusive financing strategies that empower SMEs to be agents of equitable growth.

In the face of economic adversity, credit guarantees emerge as a beacon of hope for South Africa’s SMEs. The financial terrain for SMEs in the region is fraught with challenges: fears of losing ownership, significant gaps in information, and a dire shortage of collateral are just a few. Moreover, the liquidity of assets remains elusive, and exit strategies are often not viable, leading to a reliance on short-term debt over more sustainable financial options.

To navigate this landscape, a symposium hosted by Shared Interest, a Johannesburg-based non-profit championing financial inclusion, spotlighted the promise of credit guarantees. They envision these as a tool to cultivate more equitable growth, particularly for Black-owned and women-led SMEs. The discourse at the symposium, which brought together a diverse group of stakeholders, revealed a compelling consensus: there is robust market demand for credit guarantees, with an estimated 60% market uptake potential.

A shining example comes from Nigeria, where the Government’s Impact Credit Guarantee Limited, an offshoot of the Development Bank of Nigeria, has successfully deployed such mechanisms. They’ve rolled out around 55,000 guarantees, enriching 32,000 recipients with a total of $180 million in support, facilitated through Licensed Participating Financial Institutions. Their approach, which includes Individual, Blanket, and Portfolio Guarantees, has been pivotal in securing loans with a coverage of up to 60% for a maximum of five years.

The symposium also cast a spotlight on Italy’s Confidi system, a testament to the effectiveness of private-sector led credit guarantee networks. These schemes collectively fortify the financial scaffolding for SMEs, allowing them to thrive amidst the complexities of market demands and economic pressures.

Can bolstering SMEs be the lever to harmonize individual earnings, amplify overall income, and bridge the inequality chasm not only in South Africa but continent-wide?

The takeaway is clear: collaborative action and credit guarantees are not just a necessity but a proven catalyst for closing the funding gap faced by SMEs. They are instrumental in fostering an environment where entrepreneurs can secure financing on fair terms, propelling the South African economy towards a more inclusive and resilient future.

As we synthesize our insights, it becomes clear that Credit Guarantee Organizations stand as critical pillars in the financial ecosystem. Their strategic role extends beyond mere risk mitigation; they serve as a catalyst for a more inclusive financial landscape. By providing a safety net for lenders, CGOs stimulate a more vigorous flow of capital to SMEs. This, in turn, is a crucial step towards democratizing access to finance, narrowing the chasm of inequality, and fostering a sustainable increase in South Africa’s GDP.

The ripple effects of robust CGOs will touch various facets of the SME sector. The anticipated outcomes are multi-layered: SMEs can expect a reduction in the collateral required for loans, more favorable borrowing costs, and a potential extension in the maturity of financial instruments. Furthermore, there’s an anticipated uptick in both the volume and size of SME funding, broadening the horizons for a greater number of eligible enterprises.

Yet, with great power comes great responsibility. The specter of moral hazard within credit guarantee schemes is addressed through a balanced risk-sharing framework. This involves all parties—the borrower, the lender, and the guarantor—each playing their part to ensure due diligence and exhaust all avenues of recovery before any guarantee activation. Such a comprehensive approach underpins the integrity and sustainability of credit guarantees.

In conclusion, the integration of Credit Guarantee Organizations into South Africa’s financial infrastructure is not merely beneficial but essential. It is a forward-looking recommendation that promises to bolster the economy and uplift the SME sector, securing a more equitable and prosperous future for all.

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments