Swedish Disruptor Shakes Up Asia’s Paint Industry

A bold, eco-conscious brand is drawing in a new generation of consumers

Empowering women is imperative to the global community and economy if we want to achieve the United Nations Sustainable Development Goals (UN SDGs) by 2030. Time and time again, it has been proven that investing in women and empowering women-focused enterprises is the key to achieving sustainable development. Although organizations and companies in both the private and public sectors as well as governments are taking active steps to improve the financial inclusion of women, we are very far from the finish line. Women continue to be the majority of unbanked adults (56%), women also continue to earn less on average than men even in developed countries and women-led enterprises receive less funding than those led by their male counterparts. The global COVID-19 pandemic has furthered this gap and affected women, especially those from developing countries in a disproportionate manner.

Women are proclaimed as the “world’s most underutilized resource” and it is estimated that if women are fully empowered to participate in the global economy, they could add to total global output by as much as $28 trillion by 2025. While demand for commercially-sustainable environmental, social, and governance (ESG) investments has continued to grow substantially despite the impact of the COVID-19 pandemic, the current gender financing gap still stands at US $1.7 trillion. Gender financing is defined as funding which is disbursed or committed to improving gender equality.

Empowering women-focused enterprises is critical to achieving gender equality and achieving the UNSDGs. However, huge glaring gaps in gender financing continue to exist. Credit: Impact Investment Exchange.

While historically, the charge to close the gender funding gap has been undertaken by non-governmental organizations (NGOs), donor agencies, and development finance institutions (DFIs), since the implementation of the UN SDGs, the role of the private sector in helping close this gap has become particularly important. While global interest in sustainable finance is increasing and women-focused lending programs have proven successful, gender-specific financial instruments are still not considered mainstream investments. In 2022, less than 1% of all sustainable bond issuances listed gender as a priority. Despite the obvious benefits of investing in women and the role women could play in accelerating economic development, gender equality and women’s economic empowerment (WEE) initiatives led by donor organizations and development finance institutions (DFIs) as well as gender-labelled bonds continue to be grossly under-funded.

In order to understand the current global landscape of gender financing, it is important to note that resource flows into the Global South for development — whether in the form of grants, loans, export credits, or private investment — continue to be controlled by the Global North. Additionally, “experts” and consultants from the Global North continue to decide how aid is disbursed and how initiatives and funding programs are designed in the Global South. As a result of the same, programs designed to help those in the Global South are not as effective and are often out-of-touch with the reality of the recipient, leading to ineffective utilization of funds.

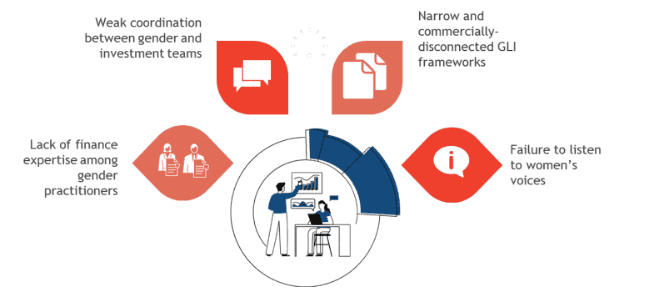

The major challenges facing the gender financing space globally include a lack of financial expertise amongst gender practitioners, failure to listen to women’s voices on the ground coupled with narrow gender lens investing (GLI) frameworks and overall weak coordination between the gender and finance teams. While there is an increasing awareness about the importance of allowing beneficiaries such as underserved women and girls to have a voice in designing and implementing programs and initiatives designed to benefit them, this is not being implemented across the spectrum. The narrative of women from the Global South as passive “beneficiaries of aid” needs to end. Instead, their voices from the ground need to be heard and translated into improving programs designed for them.

Challenges confronting the gender-financing space globally. Credits: IIX

When the voices of women and the underserved are heard and considered in decision-making, this has a ripple effect on the functioning of institutions, policy generation, and overall improvements in the standard of living. Women have immense potential as catalysts of change at the individual, household, and community levels and not listening to their voices in the overall conversation about development is a huge missed opportunity for any society.

Listening to women can help strengthen links between gender financing and impact on the ground. Credit: IIX

So, what can be done to bring the world closer to achieving gender parity? As a society, we are continuing to make strides in the right direction, but we are still far from our goal, as women and girls in the Global South continue to be denied equal rights, opportunities, and outcomes as men. The overall top-down approach to development, with the Global South in the passenger seat, needs to change to accelerate the process of achieving gender parity. Listening to women is the key to strengthening the direct link between gender financing and the impact it generates for women and communities. There is also a need to ensure gender-lens investing (GLI) is more inclusive and that strategies employed inculcate a deeper tie between DFIs and the private sector. This bottom-up and inclusive approach will help harness the ability of finance and capital markets to do good and empower women to help reach our ultimate goal of gender parity. We must remember that when women and girls lose, everyone loses.

—

The findings published in this article are part of a three-part thought leadership series on ‘Making Finance Work for the 99%’ by the Research and Advisory Team at the Impact Investment Exchange Pte. Ltd. (IIX). The series introduces a bottom-up gender lens approach to emphasize the strong business case for investing in women entrepreneurs and women-focused micro-, small- and medium-sized enterprises (WMSMEs). This draws upon IIX’s extensive experience in unlocking capital for impact enterprises and generating transformative change in the Global South. You can read the complete primer and other publications by the IIX R&A team here.

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments