Swedish Disruptor Shakes Up Asia’s Paint Industry

A bold, eco-conscious brand is drawing in a new generation of consumers

The discussion around millets has been gaining momentum in recent years. Millets are being hailed as ‘super crops’ globally. While the production and consumption of millets dates back centuries, it is only recently that the Food and Agriculture Organization (FAO) has announced 2023 to be the ‘Year of the Millets’ under India’s recommendation.

Millet cultivation is emerging as a feasible alternative in the face of global food insecurity, malnutrition, agrarian distress and climate change.

Millet cultivation is emerging as a feasible alternative in the face of global food insecurity, malnutrition, agrarian distress and climate change.

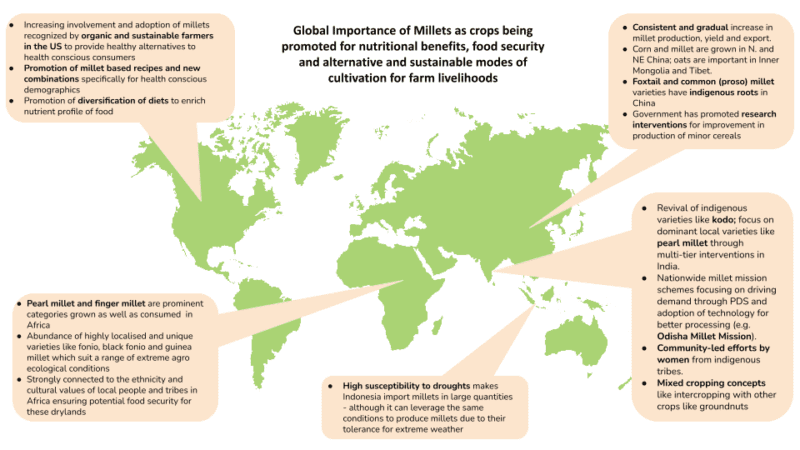

African and Asian countries are most severely affected by undernourishment, with around 700 million people suffering from hunger worldwide. Food security issues have been affecting all continents. With their high nutritional profiles, millets help to address these deficiencies and can evolve as promising solutions towards establishing healthy dietary patterns.

Many regions like Africa and the Middle East have been drawing global attention towards depleting water levels. Water-efficient crops such as millets could be viable for cultivation in these areas, thereby lessening the burden imposed by current staple crops on the water table.

Making a case for millet cultivation is relevant in the present context where innovative patterns of land usage, more income avenues for farmers, and healthier options for consumers are the primary areas of focus.

In 2019, millets were the world’s 3,641st most-traded product, with a total trade of $201M. The past few years have seen a significant rise in the global demand for millets, with global exports growing by 44.8% between 2018 and 2019.

The past few years have seen a significant rise in the global demand for millets, with global exports growing by 44.8% between 2018 and 2019.

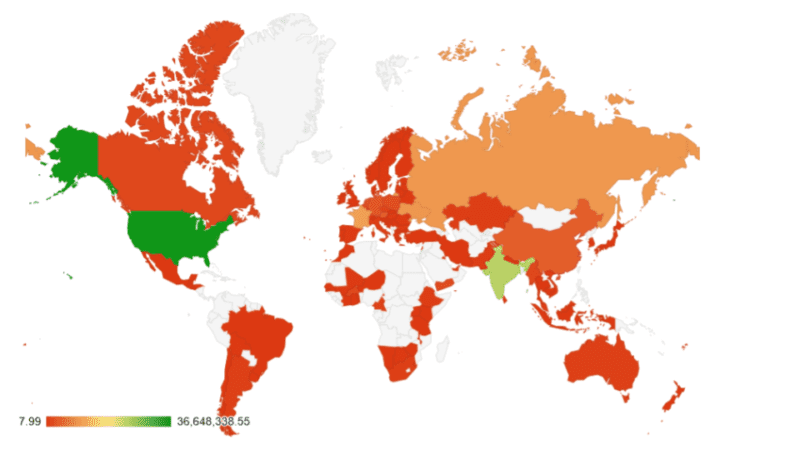

While India is the topmost producer for these grains, the United States leads the global contribution in exports with a share of around 30%. 50% of the millets produced globally are imported to Indonesia, Germany, Iran, Belgium, and South Korea, among others, establishing the Asia Pacific, Middle East and EU as regions of major global demand. While millets are mostly used for consumption, a proportion (7%) is employed for fuel and fodder as well.

The global millet market is projected to grow to over 12 billion USD by 2025. The Asia-Pacific is emerging as a hotspot for activity around millets, with pearl millets being one of the most popular commodities due to its high-volume share in global trade.

India contributes to nearly 20% of the global export value of millets, and thus is a key player in terms of its ability to provide for global demand. China is also showing gradual increase in yields of millets, coupled with the fact that millet cultivation goes back centuries in the country. The top export destinations include the UAE, Nepal, Saudi Arabia, and Germany. There has been more than a 50% growth in the quantity of millets exported to UAE and Nepal, which indicates an emerging market for these cereals. Other countries with relatively lower share in exports from India for millets, like Kenya and Oman, have shown even higher growth in the amount exported during the last few years.

Millets as viable crops in resource-constrained geographies

Millets as viable crops in resource-constrained geographiesRainfed agricultural conditions, requirement of minimal inputs, and indigenous know-how among farming communities make millets more relevant as an agricultural commodity in developing countries with similar geographical conditions. With the dominance of wheat and rice, millets represent less than 2 percent of world cereal utilization. Agricultural practices in the past few decades have strained water resources and affected the carrying capacity constraints on existing land. Hence, millets are regenerating interest as staple cereals in many countries in the semi-arid tropical regions of Africa and India, where low precipitation and degrading soil quality limit the cultivation of other major food crops. India itself is a major consumer and accounts for nearly 38% of the consumption of its domestic produce.

The demand for millets has seen a gradual revival mainly in regions where millets were historically consumed as staple grains. It is driven by renewed interest in their health benefits for an urban population with evolving dietary needs. This upward shift is mirrored by a global trend towards the adoption of organically grown ancient grains, that is, cereals that have undergone minimal genetic modification over the years. Millets that are produced with minimal inorganic inputs are the ideal choice to meet this demand. Millet-based products have also emerged as viable options for people who adopt plant-based or gluten-free diets. Breakfast cereals and plant-based dairy substitutes are two major categories where millets are being seen as feasible alternatives.

Latest Export Share of Millets globally

Learnings from best practices of major players globally

There is potential to tap into geographies that have been showing encouraging trends in millet imports. Major challenges surrounding millet cultivation and distribution can be solved with multi-stakeholder intervention.

Promotional interventions for millets are government-driven in many regions. However, several challenges impede their steady progress. Millets are mainly grown for fodder or domestic consumption, and farmers lack the incentive for commercially viable production, especially with respect to dominance of wheat and rice. The lack of timely inputs, storage, and transport facilities are also limiting factors, especially for small and marginal farmers.

Developed countries emerge as viable locations for processing facilities, which could possibly explain why countries such as the US export more millets than they produce.

Millets require significant processing and value addition. These are cost-intensive activities, owing to the coarse nature and taste of the grains. Developed countries emerge as viable locations for processing facilities, which could possibly explain why countries such as the US export more millets than they produce. The global market trends indicate suitable opportunities for millets but the lags in stable pricing and unrealized potential for profitable market conditions, present areas for stakeholders at all levels to engage and make the markets viable.

The city of Bengaluru, India is emerging as a millets hub with several entrepreneurial chefs reinventing traditional cuisines to reinvent millets as cereals of choice for an urban population.

The city of Bengaluru, India is emerging as a millets hub with several entrepreneurial chefs reinventing traditional cuisines to reinvent millets as cereals of choice for an urban population. Given the variety of millets across the globe, it is pertinent to explore such innovations with regionally available cereals, that also serve to strengthen the farm-to-table connection for local cultivators.

Millet farming continues to be an area that has immense scope for ecosystem-level interventions. There are several challenges that need to be addressed at various points from cultivation to consumption, including but not limited to viable remunerations to farmers, consumer education, streamlining supply and establishing processing, and value-addition capabilities, especially in developing countries. However, focused efforts, collaboration and sharing lessons among stakeholders at an international level could boost the popularity of millets for a sustainable future.

Related Content

Comments

Deep Dives

Featuring

Clarisse Awamengwi

IE Correspondent

July 17 - 12:00 PM EST

Featuring

Russell McLeod

July 24 - 12:00 PM EST

RECENT

Editor's Picks

Webinars

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

At Impact Entrepreneur, we champion fearless, independent journalism and education, spotlighting the inspiring changemakers building the Impact Economy. Diversity, equity, sustainability, and democracy face unprecedented threats from misinformation, powerful interests, and systemic inequities.

We believe a sustainable and equitable future is possible—but we can't achieve it without your help. Our independent voice depends entirely on support from changemakers like you.

Please step up today. Your donation—no matter the size—ensures we continue delivering impactful journalism and education that push boundaries and hold power accountable.

Join us in protecting what truly matters. It only takes a minute to make a real difference.

0 Comments