Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

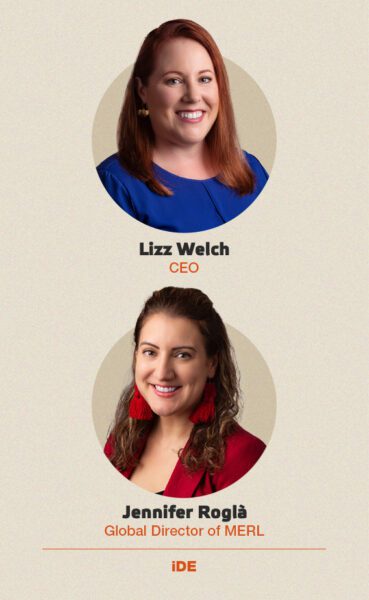

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

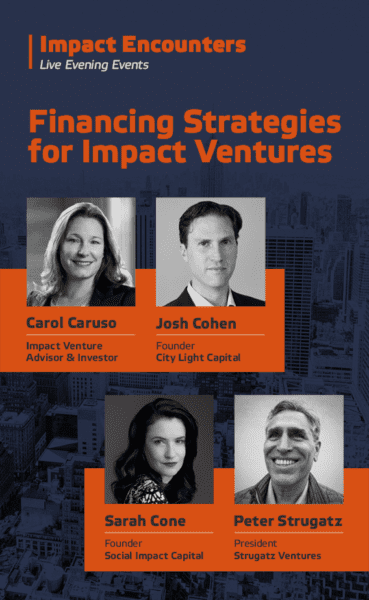

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments