Soundtrack of Resilience

Reviving the musical heart of jazz amidst cultural economy struggles

The investment imperative at The Wall Street Green Summit

The 23rd annual Wall Street Green Summit (WSGS) is not just a milestone for the conference itself but a testament to the growing importance of sustainable finance on a global scale. Launched in 2002 by Peter Fusaro, the WSGS has become a premier platform for thought leaders, investors, and businesses to address the critical challenges and opportunities in building a sustainable future.

Peter Fusaro, Founder of the Wall Street Green Summit

This year’s summit, with its focus on key areas like ESG investing, carbon markets, clean energy solutions, and green transportation, underscores the urgency of climate action. The summit’s packed agenda delves into a range of topics, from SEC mandates and ESG reporting standards to decarbonization solutions and social factor investing.

Founder Peter Fusaro opened the summit with a stark message: time is running out to develop climate solutions. He emphasized the crucial role of young minds in shaping the $100 trillion industry and stressed the importance of a holistic approach, focusing on the “holy trinity” of energy, food, and water. Fusaro also introduced the summit’s new capital introduction portal, a platform designed to connect companies and investment managers.

Phuong Gomard, a leading voice in sustainable finance, argues for mandatory ESG disclosures driven by investor demand for transparency and a shift towards long-term, climate-conscious investing. However, she emphasizes the need for a balanced approach that provides comprehensive information without stifling innovation. Gomard outlined a vision for “Beyond Checklist” disclosures, built on transparency and a balanced approach that considers both the burden on companies and the need for decision-useful information for investors.

Bonnie-Lyn de Bartok, founder of The S-Factor Co., highlights the growing importance of social factors in ESG investing. Social risks like labor practices, supply chain issues, and diversity are increasingly seen as material factors impacting companies’ financial performance. Bartok presented data showing that social issues surpassed carbon emissions as the primary concern for investors in 2021 and again in 2022. However, the lack of standardized data collection and reporting remains a challenge. Bartok called for a “rebranding” of the social narrative to emphasize the positive impact of responsible investment, framing it as an opportunity rather than a burden.

Marina Severinovsky of Schroders explained the financial implications of climate change. From extreme weather events to declining food production, the physical risks of climate change are translating into financial losses. Severinovsky presented data showing a sevenfold increase in losses from physical climate change impacts since the 1970s. The insurance sector is under particular pressure, with rising natural catastrophes leading to ballooning losses and reduced coverage. Investors need to factor these risks into their decisions, while banks are increasingly offering new revenue streams linked to the green transition.

Marco Bernal, Lead Data Engineer at Building Minds, highlighted the importance of retrofitting existing buildings to improve their sustainability. With 80% of buildings in 2050 already built, this approach offers significant potential for reducing our environmental footprint. Bernal presented the example of the Empire State Building, which reduced its energy consumption by 38% through retrofits, saving millions of dollars over the years. He emphasized the need for better data standardization around ESG aspects of buildings, a point echoed by other speakers throughout the day.

Alasdair Were, Abaxx Commodity Futures Exchange’s Head of Environmental Markets

Alasdair Were from Abaxx Futures Exchange and Clearinghouse, presented a compelling argument for the need for “smart commodities.” He emphasized that environmentally sustainable materials need to be priced better, but complex supply chains currently hinder accurate pricing. Alasdair argued that better data is essential for establishing fair green premiums. His mission is to create more reliable price benchmarks, ultimately aiming for a “smart market” for commodities.

Catherine Flax, Founding Member and President at X Machina Capital Strategies, raised a critical but often overlooked issue: orphaned and abandoned oil and gas wells. These wells can leak methane and other harmful pollutants, posing a significant environmental and health hazard. Flax estimates that there are millions of such wells across the US alone, representing a potential source of billions of tons of CO2 equivalent emissions. Addressing this challenge requires better data on well location, ongoing training for maintenance personnel, and collaboration between government, industry, and environmental groups.

The second day of the summit featured insights from leading climate tech investors, showcasing successful companies and startups, and highlighting the challenges and opportunities facing entrepreneurs and investors alike. The overall message was one of optimism: with collaboration, innovation, and a sense of urgency, the financial sector can play a pivotal role in driving a sustainable future.

Jean-Marc O’Brien, Partner at Ardour Capital Investments, offered valuable insights for startups. He emphasized the importance of understanding how a proposed solution integrates with existing supply chains. Building a clear and concise capital raise deck was another key takeaway, focusing on a strong value proposition, target market analysis (who wins/loses if successful), and a well-defined commercialization strategy. Time management was also stressed; crafting a simple, impactful message is crucial to avoid information overload for investors.

Michael Ginsberg, President of Tokamak Energy

Adam Rein from CapShift made a strong case for increased investment in climate solutions. He highlighted the current investment gap and the critical role of private capital in bridging this divide. He identified three key types of climate investors: those focused on mitigation (reducing emissions), resilience (adapting to climate change), and alpha (generating financial returns from sustainable investments).

Robert Politzer’s presentation focused on his company, Green Street Global Inc., transitioning into a climate tech leader. They address two key challenges in the real estate sector: the profitability of building decarbonization and identifying qualified vendors in this niche market. Their solutions offer cost-saving strategies that can achieve net-zero upgrades with increased ROI. Highlighting government incentives and the broader social impact of green buildings (improved indoor air quality and employee productivity), Robert emphasized that profitability and sustainability can go hand-in-hand.

Lorraine Spradley Wilson, Novata’s Chief Sustainability Officer

Nicole Rycroft, Founder and Executive Director of Canopy, addressed the financial risks associated with linear supply chains, particularly in the packaging industry. She highlighted the alarming rate of deforestation driven by paper consumption and the growing demand for sustainable alternatives. Nicole presented a promising solution: next-generation materials derived from waste products instead of virgin forest resources. These solutions offer significant environmental benefits, including lower biodiversity impacts and reduced carbon emissions. She concluded by outlining the substantial investment needed to scale these innovations and meet growing market demand.

The spirit of collaboration was a hallmark of the Wall Street Green Summit (WSGS). While there is no single, easy solution to the complex challenges of climate change and sustainable development, the WSGS brings together diverse voices from across the financial spectrum and beyond.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

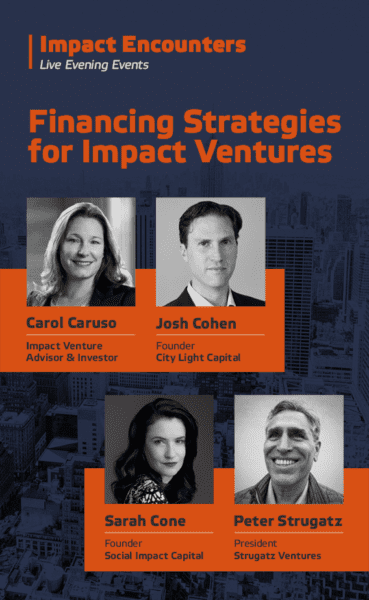

Impact Encounters

May 22 - 6:30 PM EST

Featuring

Courtney Birnbaum

Director of Sustainability, Corbin Capital

May 30 - 12:00 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments