Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Insights from Stephane Boujnah at the Bloomberg ESG Summit

Photo courtesy of Eloise Rouse

As the luminaries of the financial world convened under the bright lights of the Bloomberg 2024 ESG Investing Summit, a pivotal conversation took shape, one that would navigate the currents of ESG Investing amidst contrasting global perspectives. In the heart of Europe, where ESG principles advance with relative consensus, Stephane Boujnah, CEO of Euronext, and Francine Lacqua, Bloomberg TV Presenter, engaged in a profound dialogue that pierced through the fabric of traditional finance. This panel discussion, set against a backdrop where political expedience has yet to stifle the momentum of ESG initiatives, contrasted sharply with the contentious debate swirling around these issues in the United States.

In this forum, Boujnah laid out a vision of investment that wove together the immediate with the eternal, challenging the audience to look beyond the horizon of short-term gains and consider the long-term implications of sustainability in market dynamics. As he spoke, it became clear that ESG Investing was not just a trend, but a transformative force reshaping the very contours of economic growth and corporate governance.

—

Finance, traditionally a field narrowed by sharp focus on immediate returns, is now embracing a broader vision that includes sustainability. Boujnah eloquently discussed the limitations of existing finance theory, highlighting how long-dismissed externalities are gaining prominence. The reflection of sustainability in equity, bond, and commodity markets, Boujnah posited, is not just a trend but a determinant of future returns. It’s an acknowledgment that the financial industry’s paradigm is shifting towards a model that values long-term resilience and growth.

Francine Lacqua (left) and Stephane Boujnah at the Bloomberg 2024 ESG Investing Summit

The dialogue then transitioned to the importance of foresight. ESG compels analysts to extend their gaze beyond the present, Boujnah remarked. He underscored demography as the silent force behind market movements, with population dynamics and productivity, increasingly influenced by AI, as key drivers. In a world where economic growth is intertwined with climate change, ESG becomes the lens through which we scrutinize long-term investment viability.

Boujnah shared insights on Euronext’s leadership in ESG ETF issuances, where once a tool for diversification, ESG is now a beacon for investors seeking issuers with robust sustainability narratives. Yet, ESG’s appeal is not without complexity. Environmental issues, though clearer in delineation, face transatlantic challenges. Social factors bring a regional flavor, entangled in Europe’s history, social welfare focus, and regulatory beam, contrasting with the U.S.’s approach to philanthropy and individualism. Governance, inherently subjective, remains a canvas for debate and perspective.

The conversation turned to the stark contrasts in ESG focus between the United States and Europe. Boujnah illustrated how market forces and community activism shape the U.S. approach, while Europe leans on regulatory frameworks and collective will to mold its ESG landscape. Corporates navigating this dynamic environment must preemptively weave sustainability into their strategies, he urged, cautioning against the risks of inaction.

Photo Courtesy of Adeline Diab

Quoting President J.F. Kennedy, Boujnah emphasized the urgency of ESG considerations: “If you don’t take care of politics, politics will take care of you.” He advocated for proactive leadership over market-following, suggesting that early adopters of ESG principles may avoid the pitfalls of stringent regulation.

In a poignant moment, Boujnah addressed a pressing concern for ESG advocates: the integration of security and defense within ESG frameworks. Reflecting on historical precedents like Victory Bonds during WW2, he challenged the audience to consider the role of military financing within ESG, in light of geopolitical realities. “You don’t choose your neighbors — in Europe, we have Russia and Turkey; in the United States, they have Canada and Mexico”.

As the fireside chat neared its conclusion, Boujnah left the audience with a parting thought: “It is better to be roughly correct than precisely wrong.” It was a call to embrace the imperfections of foresight and to commit to the ESG journey with courage and conviction.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

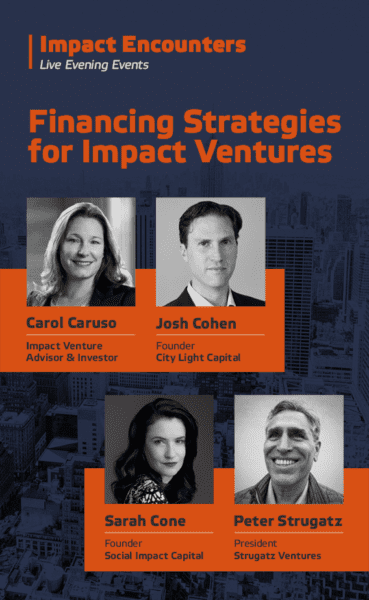

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments