Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Says new Business of Handmade report

Courtesy of Cooploom

Massive financing gap stunts the growth and scale of India’s craft-led MSMEs. Catalytic Capital is a possible solution to jumpstarting a handmade revolution in India

Key Findings:

Mumbai, 17 July, 2023 | 200 Million Artisans, an impact-first, ecosystem enabler championing India’s artisan economy, released the much awaited Business of Handmade, 2nd Edition – Financing a Handmade Revolution – How Catalytic Capital Can Jumpstart India’s Cultural Economy, a pioneering research study that maps the financing needs and challenges of craft-led MSMEs in India.

This research positions India’s handmade and craft-led MSMEs as offering new and alternative models to industrialisation and green growth. It argues that India’s handmade economy, positioned as the ‘Creative Manufacturing and Handmade’ sector in this study, offers a massive opportunity to drive dignified jobs, gender inclusion and climate action at scale while bridging the $140 billion low-skill manufacturing gap which is about 5% of India’s GDP. This study also reveals a massive financing gap that stunts the growth and scale of India’s craft-led MSMEs and explores the role of catalytic capital and other new / emerging approaches to financing as the possible solution to jumpstarting a handmade revolution in India.

Key Insights and Findings

The study carried out over 12 months involved in-depth interviews with 70+ investors, ecosystem actors, intermediaries and enterprises. 516 craft-led MSMEs – retail brands and social/ creative enterprises – participated in a pan-India survey, insights from which are now documented as part of the Business of Handmade report.

The research offers a first of its kind segmentation of craft-led enterprises; 6 clear enterprise segments operating across the farm to consumer value chain. It also offers a roadmap on the ideal financing fit for each enterprise segment.

“During the course of this research, our team witnessed the emergence of Handmade 2.0. This resurgence is being led by a young and passionate cohort of entrepreneurs, especially women, who want to build purpose-driven craft-led businesses that also take India’s creative producers and artisans along. The time is truly now to finance India’s creative and cultural economy and its many MSMEs”, said Priya Krishnamoorthy, Founder and CEO, 200 Million Artisans while launching the report.

Maintaining that 92% of Handmade and Craft-led MSMEs (HCMs) see catalytic capital – an investment approach that is patient, risk-tolerant and impact-focused – as a great fit for their financing needs, the report confirms that India’s CMH sector and its many MSMEs are more than ready to benefit from friendly and flexible capital that has, so far, been out of bounds. By presenting tangible data and need gaps that demonstrate where investors and policy-makers can intervene, Business of Handmade – 2nd Edition offers a roadmap to help the sector achieve dynamic growth, profitability and impact.

“Catalytic capital is an engine for opportunity and growth in places that the mainstream financial system isn’t able to serve—at least not on its own,” said Stacy Xiao, program officer for the Catalytic Capital Consortium (C3). “As 200 Million Artisans has made clear—both in its research and its transformative work—when we expand access to capital in the craft sector, we expand economic opportunity and gender equity for tens of millions of entrepreneurs, with a ripple effect throughout the communities where they live and work.”

Business of Handmade – 2nd Edition was supported by the Catalytic Capital Consortium and was one of the 14 research projects across the world selected to build the evidence base around the uses of catalytic capital and and equip investors with the data, knowledge and insights needed to drive deep and sustainable impact. In India, it was supported by the Global Alliance for Mass Entrepreneurship (GAME) and was carried out in partnership with The Social Investment Consultancy and Berylitics. Leading community and impact organisations like Creative Dignity, AIACA, Co-Live, Good Market Global, World Fair Trade Organisation and Catalyst 2030 also aided this pan-India study.

About Business of Handmade

Business of Handmade (BoH) is a flagship research property developed by 200 Million Artisans with the goal of uncovering issues impacting India’s artisan economy. Every report produced as a result, is published as a public good. View the first edition of Business of Handmade here.

About 200 Million Artisans

200 Million Artisans is an impact-first, ecosystem enabler supporting India’s craft-led enterprises to become global powerhouses of inclusive and green production. We bridge gaps in knowledge, business support, and innovative financing via collaborative projects and platforms with the goal to catalyse sustainable solutions that are good for the planet and its diverse communities.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

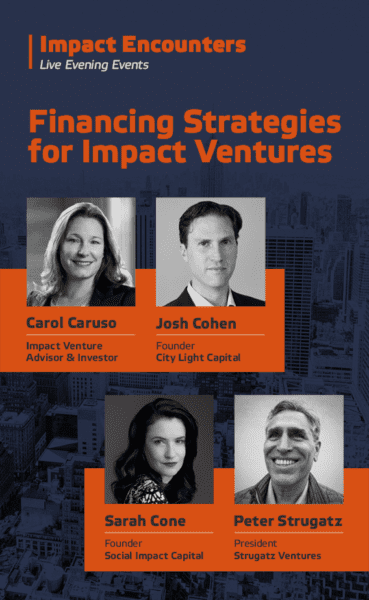

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments