Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Investor power in shaping social justice

When enough people work together, they can shift the flow of capital toward justice. Consider how investors significantly shifted the flow of capital away from the private prison and immigrant detention industry in the late 2010s and early 2020s.

When news of family separations at America’s southern border began shedding more light on conditions inside private immigrant detention facilities, financial activists organized investment efforts for everyday investors to pull their money from the private prison and immigrant detention industry, which incarcerates nearly one tenth of the US’s total prison population and over 80% of immigrants in detention.

The two largest private prison companies, CoreCivic and GeoGroup, issue debt and equity securities in the public capital markets to access capital necessary to cover expenses related to daily operations as well as to finance expansions and new initiatives.

Indeed, most private prison companies are financed through the public capital markets. When they need cash to build the next detention facility, they ask investors to purchase a fixed income bond (where a bond is a loan to private prison operators from everyday investors) to be repaid over time. The operators get a loan and the investors are repaid principal plus interest. Shares of CoreCivic and GeoGroup stock are often purchased through their inclusion within conveniently-traded ETFs and mutual funds.

Indeed, most private prison companies are financed through the public capital markets. When they need cash to build the next detention facility, they ask investors to purchase a fixed income bond (where a bond is a loan to private prison operators from everyday investors) to be repaid over time. The operators get a loan and the investors are repaid principal plus interest. Shares of CoreCivic and GeoGroup stock are often purchased through their inclusion within conveniently-traded ETFs and mutual funds.

Private prison and immigrant detention companies repay their debt holders and distribute profit to their shareholders out of the revenue they earn by incarcerating people. The more people incarcerated, the higher the revenue. In fact, both CoreCivic and GeoGroup explicitly identify a reduction in incarceration rates as a ‘material risk’ [to their profitability] in their annual reports.

While increased incarceration rates may be good for profitability, a single-minded focus on profit maximization yields a terrible effect on social justice in America. To be clear, while private prisons are not the only reason behind the disproportionately high incarceration rate of Black and Brown people, they are a significant contributing factor.

Yet, because private prisons view all decisions through a lens of profitability, investments in private prisons offer an attractive financial earnings return.

You can make good money investing in private prisons.

In fact, many investors are shocked to find they already hold stock in private prisons in their 401(k) or retirement accounts. The companies use innocuous-sounding names that easily hide in a laundry list of run-of-the-mill organizations. Companies like Geo Group and CoreCivic lurk in investment portfolios of everyday people who would be devastated to learn their dollars are used to fuel an industry that profits off human incarceration.

“CoreCivic” and “Geo Group” are not exactly exciting or even descriptive names. Their nondescript nature keeps investors from flagging the names as something worth exploring further. Instead, your eyes float from the name to the financial earnings history – boring name, high return, sounds great – before moving on to the next line.

Social justice investors took issue with the fact that investment positions in private prisons pervaded the industry, appearing in countless and blandly-titled investment funds. Investors who are serious about ending police violence against Black Americans should recognize that investing in for-profit prison companies undermines those values. “If your portfolio includes private prisons,” says Rachel Robasciotti, co-founder of Adasina Social Capital, “you are part of the problem. You can’t passively sit there and let that conveyor belt move towards injustice.

Social justice investors took issue with the fact that investment positions in private prisons pervaded the industry, appearing in countless and blandly-titled investment funds. Investors who are serious about ending police violence against Black Americans should recognize that investing in for-profit prison companies undermines those values. “If your portfolio includes private prisons,” says Rachel Robasciotti, co-founder of Adasina Social Capital, “you are part of the problem. You can’t passively sit there and let that conveyor belt move towards injustice.

“Want to work for racial justice? Organize, protest, vote, and spend with intention. And stop giving your investment dollars to companies that exacerbate racial inequities. When publicly traded companies employ these practices, the repercussions extend throughout the financial system.”

Having been exposed to terrible conditions within private prisons and immigrant detention centers, social justice investors divested (sold their existing investments in) for-profit private prisons. Investors searched through their individual stock positions for private prisons and asked their advisors to run a fine-tooth comb through any bundled investments like mutual funds and exchange-traded funds for private prisons hiding within a larger pool of diverse industries.

Everyday investors used their financial decisions to cut off private prisons from the capital needed for business expansion.

And it worked!

Social justice investors forced two of the country’s largest for-profit private prison companies to tighten their financial belts by starving them of capital. An article in the Financial Times by Aziza Kasumov (April 8, 2020) noted that financial experts were shocked to observe how social justice investment strategies “actually work in that bottom-line sense of hurting the target economically.” Their market value, which we know impacts profit for all shareholders, was being negatively affected.

Most private prison companies are financed through the public capital markets.

The same article reported that, in 2019, the two largest for-profit private prisons in the United States are “changing their structure to slash debt, as rising pressure from social activists cuts their ability to reach capital markets.”

The movement scaled, growing from everyday investors to Wall Street banks.

Large investment firms took note of their clients’ values and followed suit. In March 2019, following a years-long public pressure campaign from social justice investors, JPMorgan Chase, Bank of America and Wells Fargo announced that they would stop financing private prison companies.

Because social activists divested (sold) their previous purchases of for-profit private prisons, the companies didn’t have access to the debt needed to run and expand their operations. Since they had been leaning on that debt for continued growth – which in turn was used to repay the initial debt – the private prisons have now had to dip into their cash accounts to repay debt. At the same time, they were unable to pay their investors as rich a dividend, making them less attractive investments to traditional investors who pursue the highest possible financial earnings returns.

With stock prices plunging and access to capital evaporating, the Financial Times article reported that “both companies are exploring asset sales.” In other words, the financial position is so rough that the companies are making the hard decisions needed to stay afloat. It’s the corporate equivalent of selling furniture to pay your mortgage.

Social justice investors hit companies where it hurts. In their profits.

Our money is a powerful tool.

It’s only when social justice activists call out companies’ pursuit of profit at the expense of people that investors take a second look. And then a third. Until social justice investors decide that they’re just not interested in those particular profits.

When enough people direct their money into investments that fulfill their twin objectives of sustainable financial earnings and social justice advances, we collectively finance our vision of the world.

Money talks. What do you want yours to say?

—

This article is adapted from The Social Justice Investor: Advance Your Values while Building Wealth by Andrea Longton. The Social Justice Investor is available for Pre-Order at Barnes & Noble, Amazon, Target, and, even better, your favorite local bookstore through Bookshop.org.

This article is adapted from The Social Justice Investor: Advance Your Values while Building Wealth by Andrea Longton. The Social Justice Investor is available for Pre-Order at Barnes & Noble, Amazon, Target, and, even better, your favorite local bookstore through Bookshop.org.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

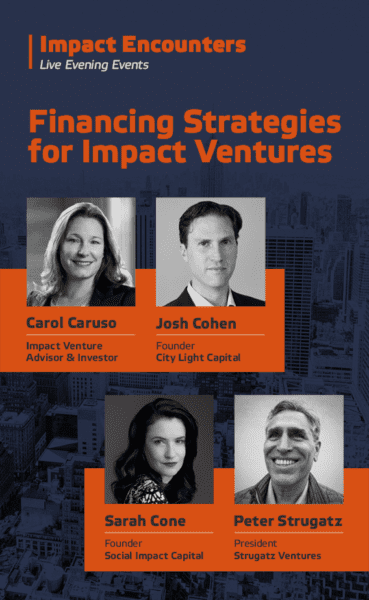

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments