Redefining the Fundraising Journey for Impact Startups

Twenty Twenty-Two opens with the clear recognition that the economic landscape has been forever disrupted. The past two years — which laid bare the market’s structural inequalities, climate emergency, and systemic barriers to inclusive prosperity – clearly posed the question of whether, what, and how to rebuild what’s next.

Sustainable solutions for the corporate sector – whether that means net zero targets, carbon neutrality, inclusive business practices, or the adoption of circular economy principles, has, fortunately, become the new normal. Customers, employees, investors, and community stakeholders now demand sustainability integrated into corporate business models, and as our colleagues at Omidyar Network’s Capitalism Reimagined project have noted, the battleship has finally turned: markets are beginning to serve society rather than the other way around. Sustainability and inclusion have become the new “growth strategy.” More and more data points to the new reality that profits and purpose not only intersect but are indeed mutually supporting.

The trend that sustainability and profitability are inextricably linked is now unmistakable, certainly at the fund level. A recent report by McKinsey found that more than two-thirds of over 2000 ESG-related investments had equity returns better than traditional market yields. At a macro level, according to US SIF Foundation, since 2020, Environmental, Social, and Governance (ESG) investment funds have experienced record inflows, now totaling more than $50 trillion, a number larger than the US economy, with $1 of every $3 invested – or $17 trillion, in sustainably invested assets.

At the corporate level, there is clearly still some distance to go, with less than half of corporates successfully integrating sustainability into their core business.

But at the corporate level, there is clearly still some distance to go, with less than half of corporates successfully integrating sustainability into their core business. This is an unmet opportunity for corporates, particularly given the increasingly obvious strategic imperative for the corporate sector to achieve lasting value and meet strategic demands to reduce downside risk, achieve higher equity returns and attract the best talent.

Of course, there is an important debate about the “how” of truly integrating sustainability, or Environmental, Social, and Governance (ESG) standards, into corporate business models. Regardless, the market is clearly signaling its strong preference: a “sustainability” premium, both in broad-based indexes and within industries, is manifesting across the board.

The market is clearly signaling its strong preference: a “sustainability” premium, both in broad-based indexes and within industries, is manifesting across the board.

For individual corporations, it’s not just about corporate social responsibility and the moral imperative to accelerate our social and environmental progress, but capturing, as Paul Polman, former CEO of Unilever notes, “the biggest business opportunity of all time.” As he argues, it’s obvious that more sustainable business models yield lasting value and attract the best people, unlock innovation, and create resilience. Economically, the evidence is stacking up to show the strategic and financial benefits to companies that actively work to solve societal problems.

What Polman did not note, however, is that this truth holds as well for small businesses (defined here to be commercially viable businesses with between 5 and 250 employees with the intention to grow, seeking between $20,000 and $2 million in capital). If, that is, they have the tools they need to integrate resilience and sustainability into their business models from the outset. Connecting the dots between the potential for small businesses around the world to solve for sustainability and the opportunity for corporations to leverage that potential is where the magic lies when it comes to creating a more sustainable, post-pandemic society.

What Polman did not note, however, is that this truth holds as well for small businesses (defined here to be commercially viable businesses with between 5 and 250 employees with the intention to grow, seeking between $20,000 and $2 million in capital). If, that is, they have the tools they need to integrate resilience and sustainability into their business models from the outset. Connecting the dots between the potential for small businesses around the world to solve for sustainability and the opportunity for corporations to leverage that potential is where the magic lies when it comes to creating a more sustainable, post-pandemic society.

A sustainability premium wasn’t the only premium that emerged over the last two years. Resilience – or the capacity of a business to adapt well to unexpected disruptions, as well as innovate to overcome impending challenges – was the real unsung hero.

Resilience is at the nexus of sustainability and, indeed, fundamental to long-term sustainability. It’s baked into sustainability’s DNA. Enhancing resilience not only enables a business to adapt and withstand inevitable shocks – whether they be related to climate, social inequity, the unending pandemic, or all the above – but to anticipate and embrace the future with the innovative solutions, grounded in local communities, our next reality demands.

Resilience is at the nexus of sustainability and, indeed, fundamental to long-term sustainability. It’s baked into sustainability’s DNA.

Undeniably, the pandemic cast a bright light on the ability of small enterprises in particular – which are, by the way, the vast majority of businesses in the world, according to the World Bank — to be the engine that drives the solutions we need to achieve a more sustainable and inclusive post-pandemic society. If the world’s small businesses — at 90% of all businesses and 50% of all jobs — were able to meet their potential for resilience and sustainability, they would be the drivers of the systemic changes needed for more inclusive and sustainable economies.

The “sustainability potential” of small business remains unmet largely because most SMEs don’t have the expertise or resources available to fully integrate measurable positive environmental and social impact into their business models. While SMEs often hold the keys to the kingdom when it comes to resilience and innovation to embrace expected and unexpected disruption, their capacity is often limited when it comes to maximizing and measuring their sustainable impact. This is true even though investing in the tools that enable them to achieve and demonstrate sustainability over time ultimately lowers their costs, strengthens their financial viability, and significantly increases their capacity to scale, along with their appeal to corporations interested in more inclusive and sustainable supply chains.

The “sustainability potential” of small business remains unmet largely because most SMEs don’t have the expertise or resources available to fully integrate measurable positive environmental and social impact into their business models.

Meanwhile, enterprises in the most challenging markets — often the most resilient and with the most innovative solutions to challenges like climate change, food security, and inclusion — are still largely untouched by investors and struggle to access the capital and support they need to scale. The places where resilience matters most – often the hardest markets to reach and with the enterprises perceived as riskiest – are still largely unbroached. For instance, developed countries received $60 billion more in clean energy investment than developing economies. Equipping these enterprises with the tools they need to grow and scale sustainably can change this equation. For example, Elen, which began 30 years ago as a small Kosovar company, with the benefit of support, has grown to become a leader in decarbonizing energy systems and digitizing the energy industry, completing thousands of projects across Europe for corporate clients to increase solar capacity to generate electricity.

When SMEs have the investment and tools they need to integrate resilience and sustainability into their business models from the outset

When SMEs have the investment and tools they need to integrate resilience and sustainability into their business models from the outset — through an ongoing process that empowers them to make the operational improvements to anticipate changing consumer demand, build competitive advantage, and anticipate and prepare for inevitable environmental and social change — they lower risk, gain ground with investors and potential corporate partners, and become agents of resilience and sustainability themselves. If the last two years have shown us anything, it’s that resilience is the differentiator of the thriving small businesses of the future.

What’s next for the more than half of corporations that have yet to find a path to integrate sustainability and inclusion into their core business?

As corporations look for innovative strategies toward truly sustainable business models that advance their achievement of the SDGs, meet ESG criteria, and take advantage of Paul Polman’s “biggest business opportunity of all time,” they should leverage the strategic benefits of partnerships with organizations focused on giving small businesses the tools and knowledge they need to increase their resilience and sustainability as they grow.

Partnerships with organizations that grow and scale impact-oriented companies with solutions that address the challenges of people and planet meet a valuable list of corporate strategic imperatives. Corporations can leverage the power of small businesses by:

Partnerships with organizations that grow and scale impact-oriented companies with solutions that address the challenges of people and planet meet a valuable list of corporate strategic imperatives. Corporations can leverage the power of small businesses by:

Corporate partnerships with organizations whose mission it is to grow and invest in the most resilient enterprises in markets unreachable by traditional investors, like CEED Global, will get us closer, faster to surmounting the monumental social and environmental challenges we now face. Doubling down on resilience is the best avenue to achieve the trifecta of higher returns, sustainable solutions, and greater impact and inclusion. As 2022 poses the question of whether, what, and how to rebuild our economy post-pandemic, it’s clear that partnerships that accelerate the growth of the small business sector in emerging markets are an essential underpinning of what’s next.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

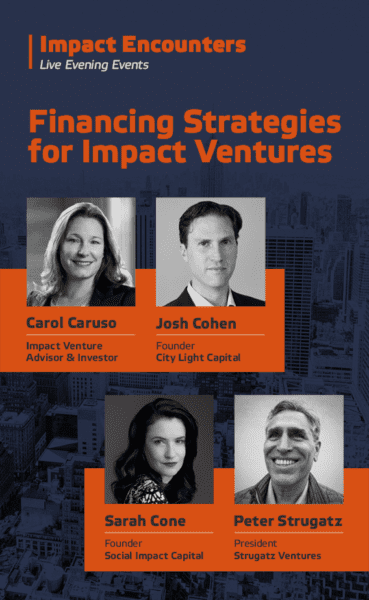

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments