Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

A win-win for investors and society

In a world where investment opportunities seem to be increasingly well-explored and competitive, private equity (PE) in emerging markets stands out as a compelling frontier. It is not just an opportunity for significant financial returns and more diversified portfolios, but also an opportunity to make a transformative societal impact in communities that need it the most. With this rare win-win potential, why is it so untapped? For a discerning investor, emerging markets provide a lucrative and meaningful opportunity.

Capital is pivotal to catalyzing growth. Emerging and frontier markets, which include countries such as Indonesia, Vietnam, Peru, and Kenya, are notably deprived of this critical need. These markets are home to 90% of the world’s under-30 population but only receive 25% of global PE investments. Teeming with young, ambitious minds and innovation, they are hamstrung by a lack of investment. Additionally, investments in emerging markets are particularly essential to address poverty, inequality, and environmental challenges.

Capital is pivotal to catalyzing growth. Emerging and frontier markets, which include countries such as Indonesia, Vietnam, Peru, and Kenya, are notably deprived of this critical need. These markets are home to 90% of the world’s under-30 population but only receive 25% of global PE investments. Teeming with young, ambitious minds and innovation, they are hamstrung by a lack of investment. Additionally, investments in emerging markets are particularly essential to address poverty, inequality, and environmental challenges.

Historically, PE investments in emerging markets have not showcased impressive returns. Returns data from Cambridge Associates points to approximately 10-12% net annual returns, lagging the 13-15% seen in developed markets, which causes many investors to steer clear of emerging markets. However, this doesn’t tell the full story. First, companies in emerging markets have, on average, negligible financial leverage – a tool that meaningfully inflates the returns of their developed-market counterparts. Also, many emerging markets funds are nascent (i.e. early on the ‘J-Curve’), or suffer from a limited track record, managerial inexperience, and other structural issues like poor currency risk management. These factors create a self-perpetuating cycle of underperformance and deter further investment. But these problems can be mitigated by experienced investors with a thoughtful approach.

Investments in emerging markets are particularly essential to address poverty, inequality, and environmental challenges.

While the venture / tech space is relatively competitive in many emerging markets, with noticeable liquidity in sub-$10 million check size funding, there is a glaring lack of traditional growth equity investments to catapult successful businesses into their next growth phase. Growth equity is traditionally defined as investing primary capital to fund the expansion of companies that exhibit substantial organic growth, have proven business models, are profitable (or at least on the verge of profitability), and have no, or limited, leverage. These investments also require larger check sizes and a different investment approach than early-stage deals. This phenomenon, also described as “Series C Gap”, is especially pronounced outside of tech sectors, in industries such as healthcare and industrials. While in emerging markets, venture capital has been attracting almost twice as much capital as later-stage private equity investments, in developed markets it is the opposite. In 2022, in emerging markets in the Asia-Pacific region, there was over 5 times as much capital deployed in Venture Capital than in Growth Equity.

The investment sweet spot – how to seize the opportunity

The investment sweet spot – how to seize the opportunitySavvy investors who bring proper financial scrutiny to these markets have an enormous opportunity to tap into. Here is how they can take advantage of it:

Investment strategies that pursue positive impact often suggest a trade-off between ‘doing good’ and ‘making money,’ but this has been revealed as a false dichotomy. Recent research and data suggest that a thoughtful focus on ESG or impact parameters can actually enhance long-term performance by mitigating risks and fostering sustainable growth. In emerging markets, there exists an inherent alignment between growth equity investments and measurable societal impact, negating the need for a compromise between returns and purpose.

To complement the data with a few tangible examples:

Growth equity investments in emerging and frontier markets are enormously underappreciated. They have the potential to offer strong, less correlated returns, which offers a compelling proposition for discerning investors. By recognizing the inherent opportunities and adopting informed strategies, investors can unlock robust returns while also driving meaningful societal change. Creating positive impact is not the enemy of returns – on the contrary, in the fertile ground of emerging markets, these two can go hand in hand, fueling a cycle of prosperity that could uplift billions.

It is time to turn our investment compass towards emerging markets. The rewards, both financial and ethical, could be unlike anything we’ve seen in a long time.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

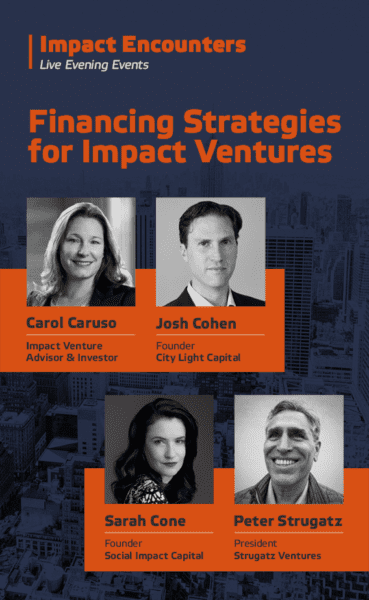

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments