Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

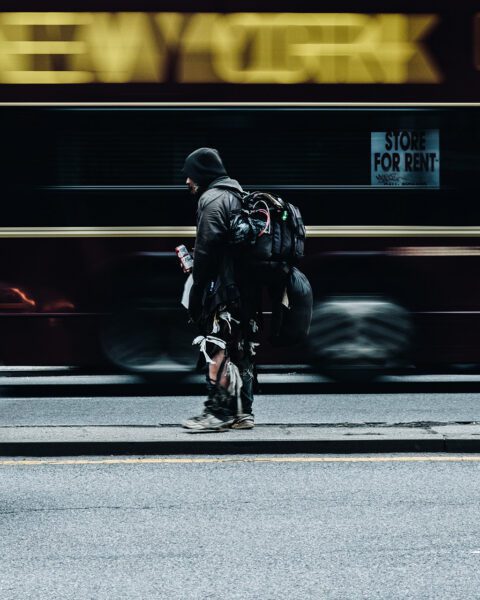

A vicious cycle in wealth inequality

In a nation as affluent as the United States, with a gross domestic product per capita of $76,648 as of 2022, the topic of poverty might seem out of place. Yet, despite the nation’s wealth, the U.S. Census revealed that 12.8 percent of its citizens, amounting to approximately 43 million men, women, and children, lived in poverty that year. This stark reality compels us to ask: What is poverty? According to the government’s formula for calculating income, the threshold in 2021 stood at $27,750 for a family of four. One can hardly fathom supporting a family on such an amount unless living directly off the land.

While the overall wealth generated by U.S. citizens reached a staggering $26 trillion in 2022, averaging roughly $70,000 per citizen, the distribution remains anything but equitable. The Pew Research Center summarizes this troubling trend, stating, “The growth in income in recent decades has tilted to upper-income households. At the same time, the U.S. middle class, which once comprised the clear majority of Americans, is shrinking. Thus, a greater share of the nation’s aggregate income is now going to upper-income households and the share going to middle- and lower-income households is falling.”

Amid these alarming statistics lies a phenomenon aptly termed the “poverty penalty.” This concept underscores the counterintuitive reality that impoverished individuals often pay more for essentials than their wealthier counterparts. The term, popularized in the 2005 book by C. K. Prahalad titled “The Fortune at the Bottom of the Pyramid,” paints a vivid picture of a society where the rich continue to amass wealth, while the poor, burdened with disproportionate costs, descend further into the depths of financial despair. To illustrate, a financially constrained individual might face exorbitant interest rates when borrowing a mere $1,000, while a well-off person could secure a $1 million loan from the same institution at a significantly reduced rate.

Such disparities don’t merely hinge on loan agreements. Societal structures often corner the impoverished, presenting them with challenges at every turn—be it limited access to quality education, healthcare, and housing, or constraints in securing affordable childcare and decent transport options. This systemic imbalance perpetuates a culture where the privileged continually benefit, leaving the marginalized to grapple with insurmountable barriers.

But why does the “poverty penalty” persist? At its core, this unjust system roots itself in denied access to vital resources. Without the ability to secure credit, educational opportunities, optimal healthcare, or even basic necessities like affordable housing, the cycle of poverty continues, unchecked and unrelenting. And the global implications are harrowing. Oxfam’s reports reveal that since 1995, the top 1 percent of the global population has seized nearly 20 times more wealth than the bottom 50 percent.

Societal structures often corner the impoverished, presenting them with challenges at every turn.

Beyond economic disparities, the consequences of such vast inequality reverberate throughout societies. Maslow’s Hierarchy of Needs, a well-regarded psychological theory, proposes a five-tiered pyramid of human necessities. From basic physiological needs like food and shelter to the pinnacle of self-actualization, progression from one level to the next requires the fulfillment of the previous tier. But when individuals are trapped in a cycle where even primary needs remain unmet, aspirations of community esteem or personal growth remain mere dreams.

To understand the far-reaching impact of persistent wealth gaps, one need only look at the statistics. According to Oxfam, such inequality is directly linked to the daily deaths of at least 21,300 people worldwide. Factors range from hunger and lack of healthcare access to climate change repercussions. In the U.S., the Bureau of Labor Statistics notes that college graduates, on average, earn twice the weekly salary of high school dropouts—a discrepancy often stemming from the pervasive effects of wealth inequality.

In grappling with this dire reality, it’s crucial to remember that the solution may lie within the very system under scrutiny. Capitalism, often blamed for perpetuating wealth disparities, can also pave the way for equitable change. Through informed choices and impact investing, there’s hope to redirect wealth and opportunities, ensuring a fairer, more inclusive future for all.

In grappling with this dire reality, it’s crucial to remember that the solution may lie within the very system under scrutiny. Capitalism, often blamed for perpetuating wealth disparities, can also pave the way for equitable change. Through informed choices and impact investing, there’s hope to redirect wealth and opportunities, ensuring a fairer, more inclusive future for all.

Take, for instance, the story of Grameen Bank in Bangladesh. Founded by Muhammad Yunus, the bank provided microloans to impoverished individuals, primarily women, without requiring collateral. Through this approach, Grameen Bank empowered countless individuals to start small businesses, elevating them from the grips of poverty and showcasing the potential of impact investing. Yunus and Grameen Bank were jointly awarded the Nobel Peace Prize in 2006 for their efforts to create economic and social development.

Another noteworthy example is the rise of affordable housing projects funded by impact investors. In regions like sub-Saharan Africa, enterprises such as EchoStone are harnessing impact capital to develop sustainable, low-cost housing solutions for underserved populations. By offering homes at reduced rates and often incorporating green technologies, these ventures not only combat wealth inequality but also address environmental concerns.

These real-world cases exemplify the transformative power of impact investing. By prioritizing both financial returns and measurable societal benefits, impact investors can challenge the established norms of capitalism and play a pivotal role in bridging the wealth divide.

—

This article was adapted from the author’s new book, Higher Purpose Venture Capital.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments