Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

The unveiling of the $1.1 billion SDG Loan Fund heralds a transformative development in the landscape of impact investing. This pioneering collaboration between Allianz Global Investors, the Dutch development bank FMO, and the MacArthur Foundation is engineered to facilitate high-impact loans to entities aligning with the United Nations Sustainable Development Goals (SDGs), particularly in emerging and frontier markets. Its innovative blended finance structure and impressive size carve out a distinctive niche for the fund within the ambit of impact investment.

Distinct in its scale, the SDG Loan Fund brings a novel financing strategy to the forefront. The blending of public and private funds enables the fund to adopt a risk profile that might otherwise deter private investors. With a $25 million credit guarantee from the MacArthur Foundation and a first-loss position taken by FMO, the fund mitigates investor risk, catalyzing the flow of capital into high-impact areas.

Courtesy of FMO Entrepreneurial Development Bank

The fund commits to a portfolio of approximately 100 loans targeting the energy, financial, and agribusiness sectors. By focusing on these strategic areas, the fund aims to propel developing countries toward achieving pivotal SDGs, including promoting sustainable economic growth, advancing equality, and combatting climate change.

The SDG Loan Fund signifies a beacon of hope for impact enterprises in emergent and frontier markets. Often constrained by capital scarcity, these entrepreneurs and businesses can find solace in the fund’s commitment to high-impact loans. By earmarking sectors critical to sustainable development, the fund promises to be a wellspring of support for enterprises striving to meet salient SDG-related challenges.

The fund’s ethos of providing long-term, patient capital is a boon for entrepreneurs traditionally curtailed by the short-term horizons of conventional financing. This patient capital ethos resonates with the protracted journey towards sustainable development, offering enterprises the temporal space to expand and manifest a substantive impact.

The SDG Loan Fund epitomizes the maturation of catalytic capital within impact investing. Characterized by a readiness to confront higher risks and moderate returns in exchange for social and environmental returns, catalytic capital is indispensable for enticing private sector investment into domains often branded as high-risk or low-yield.

The fund’s leverage effect is a testament to the potency of catalytic capital, with a $9 mobilization of private capital for every public dollar, far outstripping the average for blended finance constructs. This leverage is not just crucial for closing the significant financing gaps to achieve the SDGs but also for escalating the resource allocation required to meet these ambitious targets.

Catalytic capital has long been a component of the impact investing ecosystem, but it has recently gained prominence and strategic importance. The SDG Loan Fund aligns with this trend, showcasing the impact that blended finance can have on global challenges. Through initiatives like the Catalytic Capital Consortium (C3) and dialogues at venues such as COP28, the fund exemplifies the increasing focus on mobilizing public and private capital for enhanced impact.

A core aspect of the fund’s strategy is a robust impact measurement framework that will quantify the social and environmental outcomes of its investments. The fund’s specific impact goals are oriented towards measurable progress on selected SDGs, and it will employ rigorous metrics to assess and report on the impact achieved.

Investment Selection and Due Diligence

Investment Selection and Due DiligenceThe fund’s due diligence process for selecting investments is meticulous, focusing on the potential for sustainable impact as well as financial returns. It involves comprehensive analysis of the borrowers’ business models, their alignment with the SDGs, and their capacity to deliver on impact objectives.

To augment the impact of its investments, the fund plans to engage proactively with borrowers, providing support beyond capital. This engagement will be geared towards bolstering the borrowers’ ability to meet their impact goals, ensuring that the fund’s investments yield tangible benefits aligned with the broader objectives of the SDGs.

The SDG Loan Fund’s inception marks a critical stride towards actualizing a sustainable and equitable global economy. It not only galvanizes financial support for entrepreneurs in challenging markets but also embodies the future trajectory of impact investing. By leveraging catalytic capital, the fund stands as an influential archetype for channeling resources towards the SDGs, setting a benchmark for future endeavors in blended finance and impact investing.

Explaining the SDG Loan Fund — Courtesy of the MacArthur Foundation

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

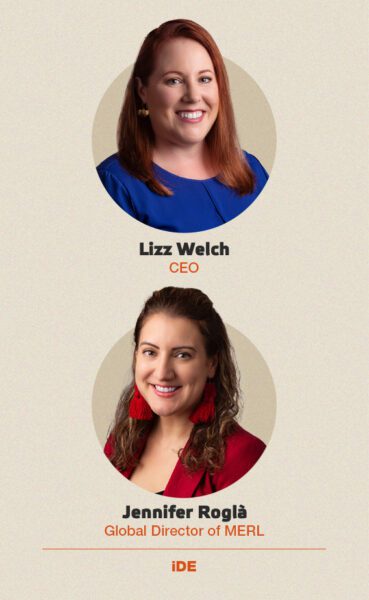

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

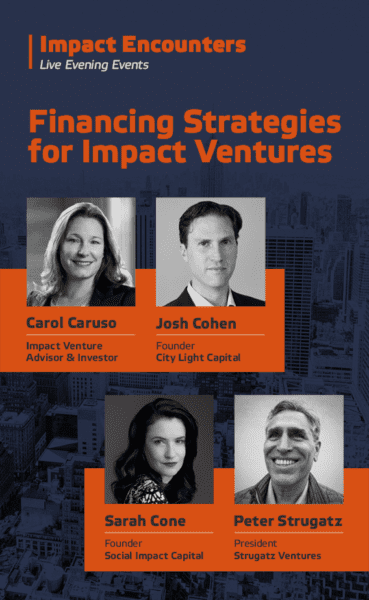

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments