Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Rethinking the reporting of waste

(Environmental, Social, and Governance) factors have transitioned from a supporting role to a starring one in the investment arena, though they have received mixed reactions. Critics, quite understandably, point to inconsistencies in standards, metrics, and the overall quality of sustainability plans – many of which identify waste as a significant concern.

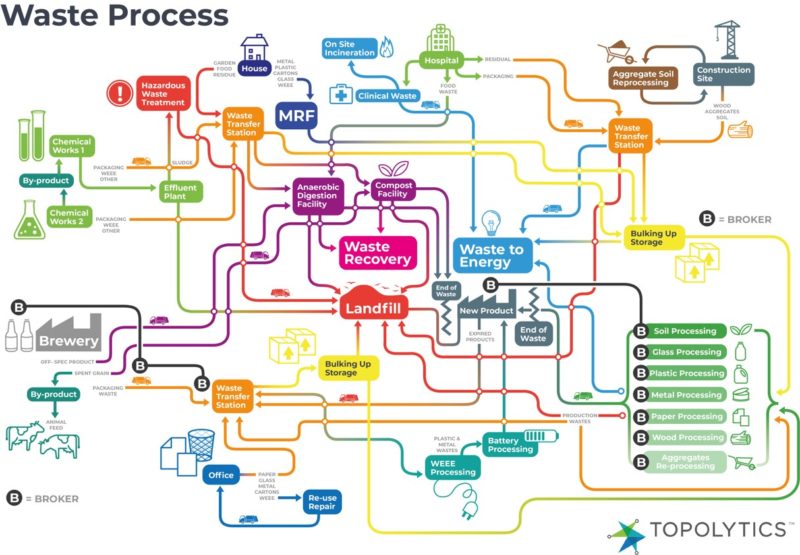

Historically, waste has been accepted as a routine cost of doing business. This process involves buying raw materials (some of which are wasted), transforming them into products (generating operational waste), selling those products (creating waste during transportation), and finally disposing of products and packaging after use. This ‘linear’ economic model is now being questioned, with a growing movement towards materials circularity. However, to unlock the potential economic benefits of this shift, there is a pressing need to enhance our visibility and comprehension of waste throughout the value chain.

On a global scale, waste generation has nearly doubled from 1970 to 2000 and continues to expand at an alarming rate. The World Bank projects that urban areas will generate a staggering 3.4 billion tons of waste annually by 2040. At present, it’s estimated that over 60% of this material ends up in landfills, and more than 61% of the world’s population lacks access to sufficient recycling infrastructure. The 2023 Circularity Gap report emphasizes that a mere 7.2% of materials are reclaimed and reintegrated into production systems.

For waste and recycling to be credible ESG metrics, reporters must gain a deeper understanding of the processes and commercial models associated with the production, movement, and processing of materials.

Publicly available waste management data is typically sourced from national regulators and agencies, who in turn require commercial waste companies and municipal authorities to disclose information. The quality of this data is inherently varied, reflecting the diverse nature of organizations involved in moving and processing materials, ranging from multinational corporations to informal community enterprises. Monitoring the billions of annual material movements—including hazardous sludges, construction waste, inert recyclables, metals, organics, and ‘special’ industrial by-products—is a complex task. This inconsistency creates an opaque picture, an acknowledged issue that hinders trust in the data. Without this trust, the significant value hidden in waste materials or by-products remains unrealized.

The variability, isolation, or even absence of waste data calls into question the integrity of information fed into ESG reports, even when adhering to key voluntary reporting standards. These standards have evolved in their approach to waste; for example, the Global Reporting Initiative (GRI) refined its definitions in 2020. In 2023, the European Union’s newly adopted Environmental Sustainability Reporting Standards (ESRS) include a focus on ‘Resource use and circular economy’ (ESRS E5).

When waste and recycling are considered material sustainability issues, corporate reporters face several challenges. Waste management companies often define and measure waste differently, despite existing classification schemes. The collection, storage, and processing of this data vary widely, leading to a tremendous diversity in reports and an inherent level of opacity. Consequently, corporate reporters have limited visibility over the downstream supply chain and lack knowledge about the fate of their waste. Additionally, the regulation of waste varies not only between countries but also within them.

The end-to-end movement of waste through the system remains obscured to all players in the value chain, from the waste producer to the hauliers and processors. While the chain of custody for certain materials may be straightforward and robust, most often, the material undergoes a series of transitions through various sites, ownerships, and transformations before reaching its final destination. Here, it may be landfilled, incinerated, recycled, recovered, or even leak from the system, either within its country of origin or abroad. This intricate journey complicates the ability of reporters to measure, monitor, and disclose information with confidence.

Waste is not merely a by-product; it is also an input to economic activity, whether through recycling or as refuse-derived fuel. Its management carries real economic implications, yet waste is neither homogenous nor easily categorized. It is a tangible asset created in one location and then moved for various purposes such as storage, transfer, sale, processing, disposal, or reuse.

For waste and recycling to be credible ESG metrics, reporters must gain a deeper understanding of the processes and commercial models associated with the production, movement, and processing of materials. This understanding necessitates the ability to access, process, standardize, and analyze data from numerous sources in varying formats. Only then can the information be distilled and visualized to create meaningful, comparable metrics for reporting. Importantly, the insights derived from this process will not only inform cost efficiencies and enhance supply chain effectiveness but may also lay the foundation for closed loops and resource recovery.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments