Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

What investors need to know to capture the opportunity

Interested in space? Now is a great time to be an investor. From Space Capital to Space VC, space specialty funds have proliferated in recent years. Or maybe alternative proteins are more your jam? I’ve met with over 40 food VC and PE funds in the past year. Reed Jobs, Steve Jobs’ son, has got your number with his newly launched VC firm. These are just some of the newest additions to the ever-growing stream of specialized funds.

The trend towards specialization isn’t new – it’s been gaining traction for more than a decade in alternative investments, from hedge funds to private equity. The investment rationale is that specialization brings advantages as managers with expertise in a particular sector or industry have a leg up on generalists.

But in my experience, it’s not always so straightforward. Generalist funds offer the ability to withstand better macroeconomic and sector shifts thanks to greater diversification and perspective. Generalists also offer the benefits of scale; they can manage more money; they can also have a deeper back office investor relations team; and they can just offer a better investor experience than the specialists.

Understanding the advantages of each type of fund – specialist or generalist – is essential for LPs investing in the private markets, as is building portfolios that manage risk in order to optimize returns. This is even more important when it comes to impact investing.

In fact, impact investing is perfecting the art of how to be a specialist investor, taking specialization to an entirely different level. Impact has become hyper specialized. This is because the impact dimension demands greater levels of specialization. An impact fund is solving for a theory of change, so you need to actually understand the impact that you’re having in addition to the financial returns you are seeking, which makes them even more knowledgeable and networked in their field. However, it also makes impact funds even more vulnerable to some of the drawbacks of being a specialist.

And from an impact allocator’s perspective, specialization also offers the potential to invest to make money and contribute positively to a global need. Your priority is electric vehicle battery productions? Solar? Wind? The global south? Access to water? Creating better DEI outcomes? And on and on. You’ve got an issue that you want to drive capital towards to advance your sustainability or social agenda? Well, there’s (probably) a fund for that!

Indeed, one of the knocks on impact is that it’s too specialized. And for asset owners with only a small allocation to impact investments, it exposes more of the risks than benefits for specialized funds. The good news is that as the impact ecosystem has scaled over the past 10 years, there are an increasing number of funds for sophisticated asset owners to have their cake and eat it too. Our proprietary database of PE and VC impact funds has grown to over 600 managers, providing enough offerings to enable the benefits of specialization while building a diversified portfolio. However, the investment acumen and expertise within impact investing are essential to manage risk beyond the surface level.

What’s really interesting is that the specialization that’s taken place in impact is creating opportunities for all investors.

What’s really interesting is that the specialization that’s taken place in impact is creating opportunities for all investors, regardless of whether an asset owner has an impact mandate. Since I’ve been investing for over a decade in both impact funds and companies, here are some of the key takeaways on how to strike the right balance.

There is a great deal of research that shows that specialist funds outperform compared to generalist funds. Cambridge Associates found that specialists return nearly 5% more than their generalist peers. That’s a whopper of a difference. This is borne out by my own experience. When I was working in the hedge fund industry at Aurora Investment Management, we regularly noticed that our sector specialist funds were top performers. This is no secret. In fact, sell-side advisers often qualify potential buyers based on evidence of their sector knowledge.

There are a bunch of reasons for this. For one, the number of general partners (GPs) in the market looking to deploy capital has never been higher, so you have to differentiate in order to win deals. Specialization helps you do this. But there are other advantages. Having specialist knowledge can help you better understand sector trends, consumer behavior, demographic changes and more, generally the real business needs of a portfolio company. GPs with industry expertise are often better able to build strong relationships with management teams and to add value operationally post-deal.

Specialization also helps GPs add value to LPs. As a manager, there’s always the expectation from your LPs that you’re adding value, and this holds true even more for private funds than public strategies. That’s how you build a reputation. And this is where sector expertise comes in handy. If you have people who have successfully built businesses and operated in that sector, they’re much more able to add value. This holds true for a management team or board member, too. Specialization makes them a better sounding board. It makes a board member more insightful about what is going on. Or, perhaps they can make customer introductions because they literally operated in that sector.

In addition to being talent driven, specialization is also demand driven. And this is important to understand. Take climate investing, for example. We’ve had a climate crisis for a long time, but investors are starting to see that businesses in need of solutions to their climate neutrality goals are creating a multi-trillion-dollar opportunity, and LPs are now seeking out funds that bring this expertise. So, there’s a market out there, especially in impact, for increased specialization.

The thing is, as important as specialization may be to driving returns, the macro matters, too. You can easily be blindsided about broader macro shifts if you are too focused on your sector. Whether it’s hedge funds or venture capital funds, I’ve always found that specialists take longer to adapt to a changing environment. Moreover, these funds also lack diversification. You can have 20 companies in a portfolio, but in specialist funds they are all highly correlated, and when markets shift out of favor for your sector, you can be left holding the bag. So, you can pick all the great specialists you want, but then you have to take care of diversification on your own. And this is where generalists can outperform.

Another way of saying this is that portfolio construction really matters, and specialization can leave you particularly vulnerable to policy changes and market shifts. For example, if you were clean tech 1.0 investors and that’s all you had in your portfolio, once that sector blew up you were done. Same thing with edtech during the Obama era. Even though a lot of his policies were supportive of the education sector, in general, he took a pretty hard line against for-profit education. And when China banned for-profit education companies in 2021 it wiped out many funds. I’m not saying that sector specialization is bad, on the contrary. But sectors and themes go through periods of out/underperformance. So you can’t just chase the winners. There’s a tangible benefit to building a portfolio where individual investments zig and zag at different times.

I’ve been an institutional allocator for 17 years and have met with thousands of managers across asset classes and strategies. Every manager claims they have a competitive advantage, and they try to demonstrate this when sharing investment examples. While there are many forms of expertise that can drive alpha, one of the most overlooked is when an impact investor explains why a market failure exists. For example, many healthcare funds possess a strong understanding of our healthcare system, from providers to payers and life sciences. However, it’s only a firm with an impact lens that can articulate why health outcomes vary by race and gender and use that insight to find commercial solutions to the problem. Martis Capital’s investment in Alcanza, a clinical research platform explicitly aiming to build a more diverse patient population in their trials than the standard in the market, hits on a problem and solution that is less crowded than the dozens of healthcare roll-up pitches I hear about every year.

There’s a tangible benefit to building a portfolio where individual investments zig and zag at different times.

There is fundamentally more substance and unique sourcing angles when you invest with an impact lens. I would argue that any healthcare investor not thinking through the social determinants of health, for example, is overlooking opportunities right in front of them.

You need the deeper understanding of impact regardless of the sector you’re investing in, and not just to find the best opportunities but to help your portfolio companies succeed. Within the education sector, for example, selling to districts is a difficult thing to do and a reason many businesses fail. With the massive growth in the edtech sector, it’s not surprising that more generalist investors are dabbling in the field. Yet few have operated or invested in education, let alone been a teacher or staff in a K-12 or higher education setting. It takes them years before they can realize which companies will succeed, in part because it takes impact expertise to distinguish a business model that will tangibly improve education outcomes and thus gain traction.

For example, Reach Capital invests in US ventures providing education solutions with the ability to scale to millions of children and adults across the education spectrum, from early childhood, K-12, higher education and lifelong learning. To do this well and to achieve their impact outcomes, there’s a whole host of specialty knowledge they need to understand that is specific to education – from AI and edtech tools to the social determinants of health to career drivers to culturally relevant curricula. Every partner on their team brings prior experience as an educator, operator, policy maker, or investor in education who is not just excited about the massive opportunity to make money but also understands the critical barriers to students improving, whether it’s reading or math or getting jobs. They’re also able to use their impact expertise to help these companies sell to districts in need of solutions.

And this goes for all stages of the capital stack. For example, Carbon Direct is a growth equity fund in our portfolio working in the budding decarbonization ecosystem. They provide both scientific advisory services and investment capital to companies in this space. Doing this successfully requires them to have highly technical knowledge about carbon capture, carbon removal, and carbon. The fact that the Carbon Direct team brings the expertise to evaluate which technologies actually have merit and will reduce greenhouse gasses (GHG) was a must have for us to invest. They stand out amongst the growing proliferation of climate tech investors with a limited understanding of the contributors to GHG.

Ultimately, when you are doing due diligence for a fund manager who claims a particular sector expertise, the sophisticated allocator will appreciate the need to ask the right questions and push the manager to articulate exactly what their expertise is and how that specialty knowledge can lead to better returns and better outcomes from the companies they invest in. And it is more common for impact funds to have expertise that draws not just from investment experience, but also from operating, policy, and even personal lived experiences.

While most asset owners without an impact lens aren’t thinking about impact investing, they should be. Our experience of investing for more than 10 years has shown that impact funds have even deeper domain expertise than non-impact sector specialists, and this expertise can lead to better investment decisions and value creation for portfolio companies.

Non-impact allocators can think about it this way: impact is a really effective way to uncover mispricings and new opportunities. If you already buy into the idea that a broad-based portfolio of sector specialists is the winning formula, you should be adding impact funds into the mix as they bring the same benefits as a sector specialist but to an even greater degree.

It’s also essential for allocators to build portfolios of specialized funds.

All this being said, impact can’t work in a vacuum. Impact investors need to be as well-networked to access the best companies, disciplined about evaluating businesses, and determined to add value as any investor. They should also be more aware of the specific macro and policy exposures they’re taking with these themes. It’s true that most impact themes are betting on big secular trends that are likely to play out in their favor over the long term. Yet the volatility and potential loss of capital that can occur in the medium term must be addressed as well.

It’s also essential for allocators to build portfolios of specialized funds and avoid the common mistake I see when institutional investors decide to explore impact investing – they allocate only a small amount of capital that leaves room for 1-3 impact funds. Because of the specialization in this field, it creates significant risk. When returns don’t hit their targets, investors then blame impact or the manager’s decisions instead of their own poorly constructed portfolios or shifts in the macro environment.

But creating an optimal portfolio of specialist impact funds isn’t easy to do. It took us 10 years to perfect. Early on there simply weren’t enough good funds to invest in that had strong sector and impact knowledge. But now there are many specialty impact funds, spanning early-stage venture to control buyout strategies.

Our approach at Impact Engine to portfolio construction has always been to prioritize diversification and risk management. We’re betting on the funds and businesses in a variety of important thematic areas, all of which fall under our three core themes of environmental sustainability, health equity, and economic opportunity. These three domains are not perfectly correlated to each other, so bringing them together in one portfolio helps to optimize risk and return. We’re essentially able to build a portfolio of specialists, with all the benefits that they bring without the risks. This also gives us the unique vantage point of observing trends and being able to make opportunistic co-investments and direct investments to double down on our highest conviction investments.

My bottom line is this: the big secret about impact investing in the private markets is that it doesn’t matter whether you have a mission for your portfolio, including the right specialist impact funds will give you an advantage. Impact specialization, when combined with portfolio management expertise, can add value to your portfolio and give you an edge as an investor.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

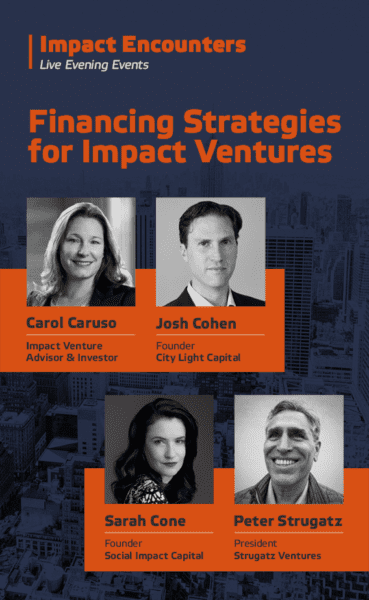

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments