Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Revelations from the 2023 GIIN Forum

This article brings attention to a variety of impact insights and innovations presented at the 2023 GIIN Conference in Copenhagen (GIIN Impact Forum). I delve into areas that, despite their critical importance to the planet and society, may not be widely recognized. These include innovative efforts to protect and restore our oceans, a focus on children’s wellbeing through active “child-lens” investing, and employing tech and AI to measure not just the scope and extent of impact, but also its “strength through depth”.

Danielle Boyd from the Institutional Investors Group on Climate Change (IIGCC) and others shared the encouraging news that the costs of green energy have decreased, including solar batteries and wind power, renewables, and battery capacity, to meet the needs of 2030.

Now is the moment to scale emerging green tech for the period beyond 2030 and to invest in solutions, not just in decarbonizing. Essentially, there’s a call for transitional finance to scale these solutions and establish the right infrastructure around them. This acceleration requires collaborative efforts and more private market investment, a focus that’s growing within the IIGCC.

Robert Sturgeon from the Ontario Teachers’ Pension Plan (OTPP) elucidated a unique asset owner standpoint towards impact investing. Unlike a conventional asset-centric approach, his pension organization embarked on their impact journey by nurturing a comprehensive understanding of impact among all 450 employees and enabling them to pinpoint opportunities independently. The impetus for this change emerged from the grassroots, predominantly fueled by the younger cohort who perceived a positive impact as a vital component to their professional endeavors and future prospects.

Robert advocated for a paradigm shift, urging not merely a change in investment strategies but a cultural metamorphosis. He emphasized the potency of external expertise in advancing progress. Aligning with impact principles, he championed an intentional, thematic, and evidence-based methodology to seamlessly integrate impact throughout the organizational fabric.

The Global Impact Investing Network (GIIN) in collaboration with the Centre for Impact Investing & Practices, Singapore (CIIP), unveiled a foundational impact investing program aimed at a broad spectrum of investment professionals, with a particular emphasis on the Asian demographic. This initiative also encompasses an educational framework for corporations, designed to enhance their allure for impact capital. Parallelly, the CFA Society in the UK is on the verge of launching a pilot impact investing accreditation program, marking a progressive stride in the global impact education arena.

The call for a sustainable blue economy is both urgent and ripe with opportunity. Karen Sack from the Ocean Risk & Resilience Action Alliance (ORRAA), alongside other experts in the domain, fervently articulated the necessity for escalated action, showcasing a plethora of new products tailored for this mission.

ORRAA’s objective is to foster multi-sector collaboration with an ambitious target of channeling $500 million into pioneering products by 2030 to preserve our coastlines. Given that 71% of the Earth’s surface is enveloped in blue and harbors 85% of the biodiversity, the oceans are an indispensable cornerstone of our economy and daily lives, playing a critical role in heat absorption. Our climate predicament cannot be tackled without addressing ocean sustainability, yet ocean-related causes are the least funded Sustainable Development Goal (SDG), with a mere 0.01% of climate finance allocated.

The narrative transcends conservation, advocating for regeneration to curb the ongoing temperature surge, and mitigate risks to communities and cities situated in low-lying regions. The silver lining emerges with the advent of over 60 financial, insurance, and blue bond incubator products. Karen elaborated on several of these, such as the Outrigger Fund, emphasizing the imperative for extensive collaboration and scalable strategies to render these products attractive to institutional investors, while steering clear of detrimental ventures like deep seabed mining.

Amit Bouri, co-Founder and CEO of the GIIN

Reflecting the sentiment that “Nature is the most incredible entrepreneur out there,” the discourse urges alignment with nature rather than opposition. This ethos of transcending mere sustainability reverberated through various sessions. M. Sanjayan from Conservation International (CI) pointed out that a mere 14% of the Earth’s surface encapsulates about 70% of the world’s carbon and roughly 91% of its biodiversity. This presents a focal point for initiatives like the Timberland Investment Fund that targets degraded, almost valueless land, restoring a portion and converting the rest into forestry, thus securing a robust Return on Investment (RoI). Similarly, a marine initiative where fisheries pay a premium for fishing rights, with the proceeds reinvested in conservation, underscores the philosophy of intertwining production with protection. The overarching message advocates recognizing the escalating value of nature, heralding it as a lucrative business prospect for the morrow.

A panel dedicated to exploring the potential in the global south conveyed a blend of optimism and frustration. The discontent stems from a prevailing lack of understanding and an unwarranted risk premium assigned to a broad spectrum of investments across nations in Africa, India, and Asia. There persists a misplaced focus on governance issues, overshadowing the immense opportunities that lie in serving the hundreds of millions of individuals and enterprises that remain unbanked, unconnected, and unsupported. Africa, with its rich reservoir of natural resources (accounting for 40% of key global minerals) and a burgeoning young entrepreneurial populace, epitomizes a region where market gaps present a vast canvas for impact investing. Kenny Nwosu of Norsad Capital encapsulated the sentiment succinctly: “If you want to have impact, you need to commit to impact.”

A compelling session by UNICEF and Calvert Impact Capital urged the integration of children’s interests in investment strategies and decisions. Given the disproportionate repercussions of global adversities on children, there’s a pressing need to prioritize their wellbeing, especially in critical domains like climate, water, and sanitation. Several partners are already collaborating with UNICEF’s Innovation Centre on this initiative, including notable entities like Triodos, Tideline, Calvert, and Save the Children. However, child-lens investing is in its nascent stages, necessitating rigorous research, advocacy, field testing, and co-development to propel it forward.

The discourse delineated three investment stages: child screened, child inclusive, and child centered, with the latter two geared towards devising solutions explicitly tailored for children. For a more comprehensive insight into this framework, UNICEF’s paper on Child-Lens Investing is recommended: Read more.

In the milieu of impactful innovation, the discourse around Artificial Intelligence (AI) is indispensable. The conversation on responsible AI was enriched by insights from Toju Duke, the founder of Diverse AI (Diverse AI). The narrative underscored the imperative to grasp and mitigate the risks and data biases to ensure equitable and safe utilization of the myriad opportunities heralded by AI. Toju elucidated the necessity for “guardrails” in domains such as facial recognition, given its intrinsic racial bias, and the realms of fake news and image manipulation, which pose threats to privacy, human rights, and child health.

Addressing bias through “fairness” assessments of sample data concerning race, ethics, religion, etc., is vital. Additionally, the ethos of data ethics should extend to datasets, promoting transparency. To fortify human rights, the robustness of AI systems to thwart infiltration by malevolent actors is crucial. An investor checklist proffered a sequence of queries to elucidate the ramifications of the investment in question.

The collaborative endeavor between Omidyar Network India (Omidyar Network India) and Decodis (Decodis) showcased the transformative potential of AI in India, catering to the emergent “half billion” of potential customers making their online debut. The investments predominantly target online ventures, enhancing accessibility to health, education, communications, entertainment, and finance.

A cost-effective, scalable impact measurement tool has been devised, leveraging tech and AI for swift, regular garnering of substantial customer feedback. The feedback undergoes analysis, and the impact is evaluated against predetermined goals. Darryl Collins, CEO and Founder of Decodis, detailed the use of Interactive Voice Recording (IVR) in eliciting high-quality feedback from customers across various dialects. For instance, AI facilitated the compilation of 500+ pages of interview transcripts within two days, a task that traditionally spanned two months. Employing AI with Natural Language Processing (NLP) and speech signal analysis not only captures the content of responses but also the nuances in how responses are articulated, enriching the data’s meaning. Impact assessment encompasses scale (reach), breadth (outcomes and beneficiaries), and strength of impact, facilitated by the depth of data, showcasing the positive transformations in lives. Impact scores, computed at both company and portfolio levels, facilitate comparative analysis across businesses and sectors, enabling adjustments. For instance, a company excelling in breadth and depth might lag in impact scale.

For a deeper dive into the topic, the paper on the “next billion” is accessible here.

As I ruminate on the diverse deliberations at the GIIN forum, several salient takeaways emerge:

The discourse at the GIIN forum has undeniably shed light on the multifaceted dimensions of impact investing and the innovation landscape. The blend of traditional and contemporary, from focusing on the intrinsic societal fabric to leveraging cutting-edge technology, delineates the progressive trajectory of impact management. The collective endeavor, as evidenced by the diverse stakeholders at the forum, is a testimony to the burgeoning global commitment towards a sustainable and equitable future.

Impact Entrepreneur’s Laurie Lane-Zucker speaks with the GIIN’s co-Founder and CEO, Amit Bouri, at the 2023 GIIN Impact Forum in Copenhagen, Denmark.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

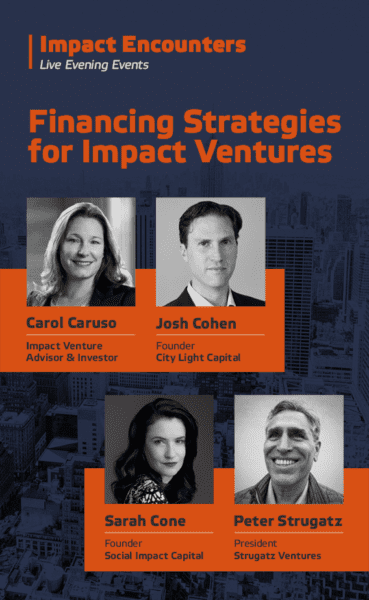

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments