Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

In an era marked by rapid economic and technological advancements, we face a paradox: unprecedented progress alongside escalating economic disparity and diminishing human dignity. This contradiction prompts a critical examination of capital control, a linchpin in driving innovation and addressing societal challenges. The concentration of capital control shapes our priorities, determining which challenges receive attention and resources. Hence, there’s a pressing need for diversifying asset management and revolutionizing capital distribution — not just in terms of equity, but as a means to implement urgently needed practical solutions.

The influence of capital is pervasive, shaping societal contours and individual lives, yet its impact varies based on one’s vantage point. My personal encounter with capital’s complexities became apparent when I invested in my sister’s entrepreneurial endeavor. Despite meeting all initial loan criteria from a credit union, we faced a thicket of additional demands and disproportionate collateral requirements. This ordeal illuminated the systemic hurdles faced by minority and women-led businesses in accessing capital. Experiencing these barriers firsthand revealed the intricate layers and disparities embedded within capital structures and their varied manifestations across different societal contexts.

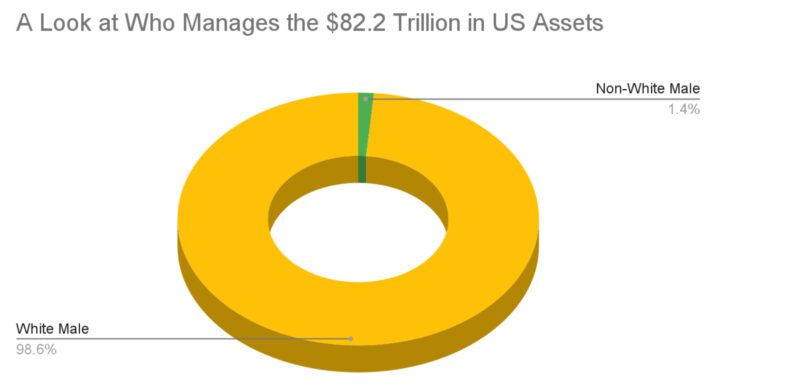

The challenges I encountered are indicative of broader systemic issues within our financial ecosystem. The control of capital, predominantly held by a white male demographic, leads to a significant imbalance in addressing humanity’s diverse challenges. This lack of diversity stifles a wide range of innovative ideas and solutions, thereby failing to meet varied societal needs.

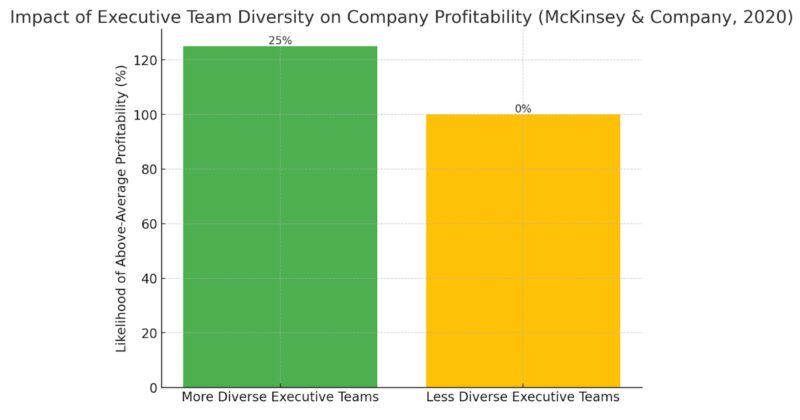

The necessity for diversity extends beyond ethical considerations; it’s a strategic imperative. McKinsey & Company’s research indicates that companies with diverse leadership are more likely to outperform financially. Diverse teams foster enhanced decision-making and investment outcomes, yet the financial sector has been notably slow in adopting such diversity.

The stark disparities are evident in venture capital statistics. In 2021, only 2% of $330 billion in venture capital went to women-led initiatives. The figures are even more disheartening for women of color: Black women secured less than 0.50%, Latina founders 0.51%, and Indigenous women merely 0.004%. These numbers are more than statistics; they represent a narrative of persistent exclusion and overlooked potential.

Diversity in financial management mirrors the importance of biodiversity in natural ecosystems. Just as diverse species ensure ecological balance and resilience, a variety of perspectives and experiences in capital allocation are crucial for a robust financial ecosystem. Currently, the concentration of capital control within a predominantly white male demographic creates an imbalance akin to an ecologically homogenous area, prone to stagnation and decline. This homogeneity narrows the scope of innovation and fails to address multifaceted societal needs.

By infusing diverse viewpoints into capital management, much like nurturing a range of species in an ecosystem, we enhance the system’s overall resilience, creativity, and adaptability. A financial landscape with diverse leadership and equitable capital distribution fosters inclusive growth, tapping into the full potential of all communities. Such a diversified financial ecosystem allows each participant to contribute unique strengths and insights, cultivating a healthier, more sustainable, and dynamic economic environment. Though this narrative primarily focuses on the U.S. market, it’s important to note that the challenge of gender imbalance is a global issue.

Capital control is synonymous with the power to shape outcomes. With just 1.4% of the $82.2 trillion in U.S. assets managed by firms owned by women or people of color, a critical imbalance persists. Such concentration not only stifles the infusion of diverse ideas into the market but also overlooks myriad societal needs.

The impact of this narrow capital allocation is profound. A homogeneous funding approach curtails the breadth of innovation and problem-solving strategies necessary for a resilient economy. Conversely, diversity in investment can unlock a spectrum of solutions, enriching both the economy and society.

Venture capital trends illustrate this issue starkly. In 2021, a paltry 2% of the $330 billion in venture capital went to women-led efforts, with even smaller fractions reaching women of color. This is not just a matter of numbers but a story of systemic exclusion and unrealized potential. While white males constitute nearly 60% of venture capitalists, the problem is less about their majority and more about what society loses due to this imbalance. We forego the unique contributions and insights of a vast swath of our community, resulting in a significant deficit in collective progress and creativity.

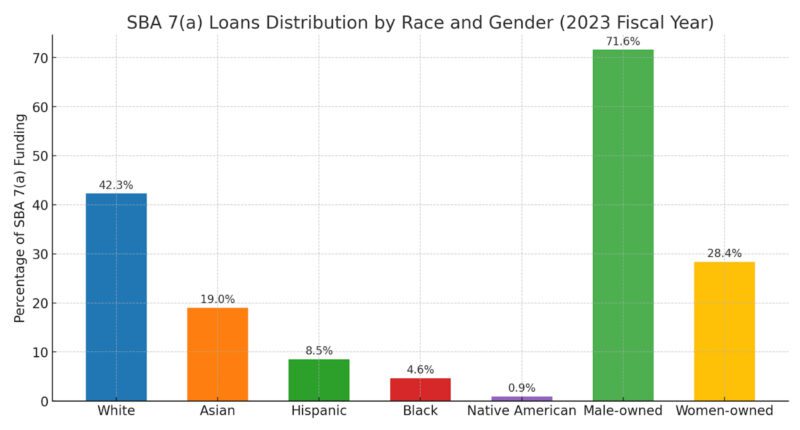

The disparities in capital control and allocation stretch across all asset classes, from bank loans to public markets. Beyond venture capital, sectors like private equity show even less diversity. Discriminatory lending practices, such as those once employed by Wells Fargo, highlight systemic biases in banking. Moreover, minority-led firms face undue barriers in public markets, where they struggle with visibility and investor confidence. Debt financing, although vital for small business growth, often imposes disproportionate hurdles on those in need of capital the most.

To cultivate an equitable distribution of capital, a concerted effort is necessary within the financial ecosystem.

My investment in my sister’s venture offered a firsthand look at these challenges. At a credit union, despite meeting initial loan criteria, we faced excessive demands and an inflated collateral requirement. This incident is symptomatic of broader structural issues, where financial institutions’ practices, marked by discrimination, create unnecessary burdens and risks for minority entrepreneurs, even when dealing with supposedly supportive financial products like SBA loans.

However, the disparities evident in the SBA 7(a) loan distribution present not just a challenge but an opportunity for systemic change. By rethinking and reshaping these financial structures and services, we can forge a more equitable and inclusive system, one that supports businesses regardless of the owner’s race or gender.

Diversity in asset management isn’t just a moral imperative — it’s a strategic business advantage. McKinsey & Company’s 2020 study underscores this, showing that companies with more diverse executive teams are 25% more likely to have above-average profitability. Diverse teams enhance decision-making and, consequently, investment outcomes. Asset managers from varied backgrounds bring unique perspectives that enrich the assessment of opportunities and risks, crucial for recognizing the potential of non-traditional businesses often led by underrepresented entrepreneurs.

Despite clear data supporting the value of diversity, the financial industry has been slow to transform. The persistent lack of representation in executive teams and among asset managers suggests a significant gap between understanding diversity’s benefits and actualizing them in business practice.

To cultivate an equitable distribution of capital, a concerted effort is necessary within the financial ecosystem. This includes enhancing diversity within investment firms, creating clear access to funding for underrepresented entrepreneurs, and nurturing a new generation of diverse entrepreneurs and investors through educational and sponsorship programs. We must also advocate for regulations that acknowledge biases and foster diverse representation across asset classes, truly reflecting societal goals.

The need for action is urgent. Recognizing disparities is not enough; we must reshape investment and capital management practices. Collective action from investors, policymakers, and business leaders is essential to dismantle the barriers to fair capital access. This involves establishing clear funding data, accountability, support programs, and a redefined vision of entrepreneurial success.

In this mission, we all have roles to play — as advocates, governments, policymakers, investors, and entrepreneurs — united in our goal to transform the structure of capital control and management into a bridge that addresses humanity’s greatest challenges, rather than a barrier. By doing so, we acknowledge the multipolar world we operate in, where a diverse array of voices and perspectives is not only present but essential for driving forward a dynamic, innovative, and inclusive global economy.

Influencing policy is as critical as sponsorship, networking, and advocacy efforts to elevate historically marginalized voices. As stewards of capital, we have a duty to foster an inclusive environment that nurtures diverse, innovative minds, vital for unlocking entrepreneurial potential reflective of our diverse global society.

Controlling capital is both a recognition of influence and a mandate for action. A capital distribution that echoes the diversity of our global society is not just about equity — it’s a strategic necessity for a vibrant, innovative, and inclusive economy.

In this endeavor, each of us has a role to play — whether as advocates, government officials, policymakers, investors, or entrepreneurs. Our united aim is to transform capital control and management from a barrier that perpetuates historical inequalities into a bridge that addresses our most pressing global challenges.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments