Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

Expectations for companies are rising. Today’s state of the world tests both the breadth and durability of climate change and sustainability commitments, shifting the dynamics for thousands of companies as they confront mounting investor, employee, and customer expectations. The current circumstances make for an unprecedented test of capitalism and corporate purpose, creating a critical need for investors to gain an acute understanding of the emerging issues and metrics that are both financially material and stakeholder salient.

Impact investors need new tools and better scorecards to assess whether their portfolio companies are future-proofed. Below are tips and suggestions to help investors navigate this uncharted rugged terrain.

In July, three megatrends converged in a perfect storm, redefining what it means to invest responsibly over the long term and compelling investment managers to decide whether to be on the sustainable impact investing menu and lose out on new growth opportunities or at the table shaping its future. The three catalysts are:

In February, House Republicans introduced a working group aimed at dismantling the trillions in investor assets under management incorporating a company’s material ESG factors, seeking to build on the spurious narrative promulgated by the ‘war on woke’ campaign that has resulted in 167 pieces of anti-ESG legislation introduced in 37 States this year. Their work culminated in July in what the GOP dubbed ‘ESG Month,’ a campaign denouncing investment managers for considering the financial repercussions of everything ESG, from extreme weather events to severe water scarcity and human rights violations.

The result of this political theater is, on one level, all bark and no bite, as its passage in the Senate faces insurmountable hurdles. However, these antics could curb the number and type of ESG shareholder proposals permitted by the SEC to go to Board vote. More significant is how these efforts could soften the SEC’s long-delayed climate change reporting rule calling for companies to report on their direct and indirect (Scope 3) carbon emissions.

Meanwhile, in the real world, July was one of the hottest months on record, with extreme heat blanketing most of the country, from Phoenix with its unprecedented streak of 30 days of over 110-degree weather necessitating the opening of over 90 cooling centers to a wide swath of Florida, whose coastal waters reached for the first time over 100 degrees, putting coral reefs and its dependent marine life in peril.

Impact investors need new tools and better scorecards to assess whether their portfolio companies are future-proofed.

But in a split-screen moment, ESG investors celebrated a breakthrough 25 years in the making when the alphabet soup of ESG reporting standards coalesced around its newly anointed kingmaker, the ISSB, housed under the auspices of the IFRS. As a result, the ISSB now has the final say in setting the rules for how thousands of companies report on hundreds of industry-specific metrics that investors use to make investment decisions.

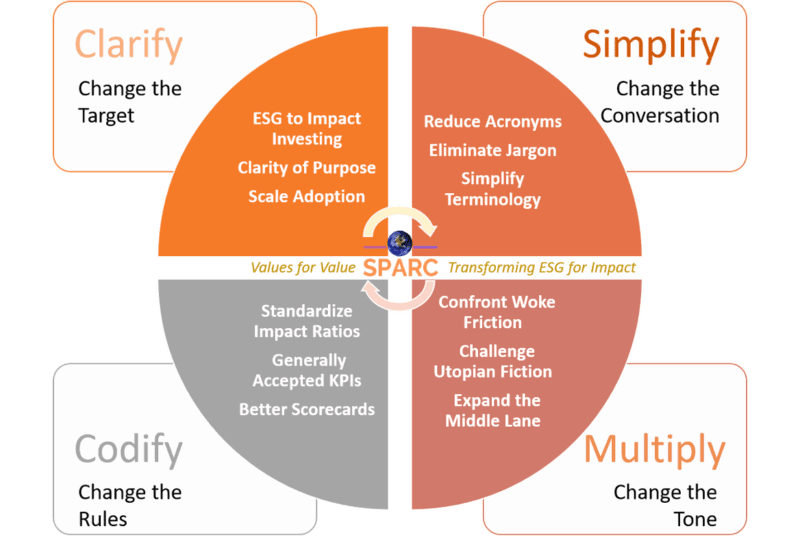

Astute investors need a new playbook to determine whether the companies they own are future-fit. The playbook should include new impact metrics and ratios for assessing a company’s impacts on people and the planet over the long term, using the financial materiality threshold set by the ISSB standards as the starting line and the aspirations of the Sustainable Development Goals (SDGs) as the aspirational finish line. Achieving this desired positive impact at the needed scale and velocity requires four transformational shifts.

1. Clarify: Change the Target

Climate change is a symptom of a more significant issue that rarely makes the headlines: unsustainable extraction and consumption of natural resources. A recent study by the Natural Capitals Coalition finds that the world’s biggest industries ‘burn through $7.3 trillion worth of free natural capital a year. And it’s the only reason they turn a profit,’ illustrating what environmental crusader Paul Hawken characterizes as: ‘We are stealing the future, selling it in the present, and calling it GDP.’ By shifting our targets to confront the root causes, impact investing can help drive the transformation changes needed to tackle these wickedly complex social and environmental challenges.

2. Simplify: Change the Conversation

As David Ogilvy, known as the “Father of Advertising,” said: ‘Our business is infested with idiots who try to impress by using pretentious jargon.’. The same can be said about ESG jargon today. It acts like a cancer thwarting mainstream investor adoption and should be irradicated.

ESG is now viewed as either woke on one side of the ideological spectrum because it is deemed to go too far, or a joke derided for not going far enough by those believing capitalism (and, by extension, capital markets) are no longer fit for purpose. ESG has been called a ‘scam’ and ‘devil’s incarnate’ by the indelible Elon Musk and also discredited by sustainable investing pioneers who now refer to ESG as ‘fairy dust…a whirligig, a frenzy, a marketing mania’ to a ‘dangerous placebo.’ A former champion of ESG investing, BlackRock’s CEO Larry Fink, no longer uses the term ESG because ‘it’s been misused by the far left and the far right.’

Steering the conversation from ESG to impact investing promises to raise investor sites and accelerate progress. Impact investing opinion leaders should embrace a less is more approach avoiding the tendency to be overly prescriptive. As Einstein said famously, ‘Make things as simple as possible, but not simpler.’

3. Codify: Change the Rules

“In God we trust; all others must bring data,” said Edwards Deming famously. But in today’s be careful what you wish for moment, investors are awash in a tsunami of environmental, climate change, and social issues, indicators, and data. Important questions need answers before investors can optimize their use of this treasure trove of new information, such as:

Answering these questions requires standardized impact investing ratios to complement ratios used in financial analysis, such as earnings per share (EPS), price-earning (PE), and return on equity (ROE). To this end, SPARC is piloting the suitability of new impact investing ratios that include return on impact investment (ROII), net positive impact value (NPII), and internal rate of impact return (IRIR). SPARC is testing the efficacy of these ratios through the prism of how a company manages its stakeholders, purpose, authenticity, reputation, culture, longtermism, and the environment (its SPARCLE).

4. Multiply: Change the Tone

Over a thousand years ago, the revered poet Rumi illuminated the path to achieving critical mass adoption for impact investing when he said, ‘Raise your word, not voice. It is rain that grows flowers, not thunder.’ Impact investors should continue building a giant tent for investors by adopting a welcoming, non-confrontational narrative that protects against what Freud called the ‘narcissism of small differences.’

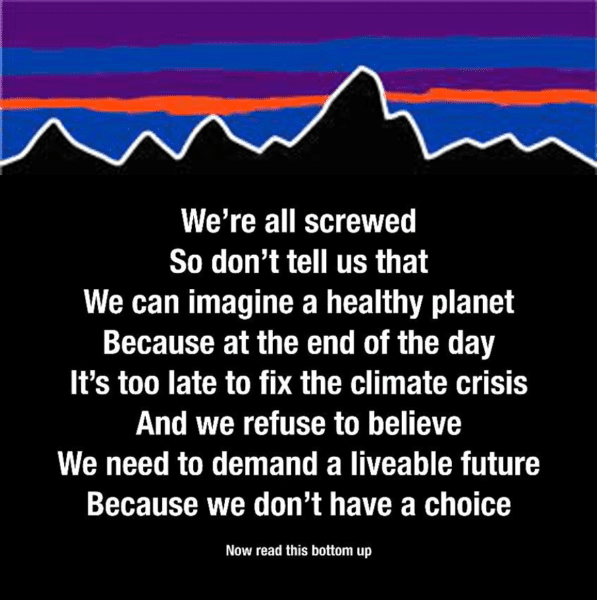

Tackling the root cause of climate change and other sustainability imperatives the usual way, from the top down, can feel overwhelming. However, examining the same issue from the bottom up, as depicted below in the Patagonia ad, can flip the narrative to one of hope for what’s possible when investors act together with commensurate urgency. Let’s work together to deliver on impact investing’s full potential as an unstoppable force for good; because achieving more sustainable and equitable outcomes for people and the planet (earth, not Mars) is a challenge too big to fail.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

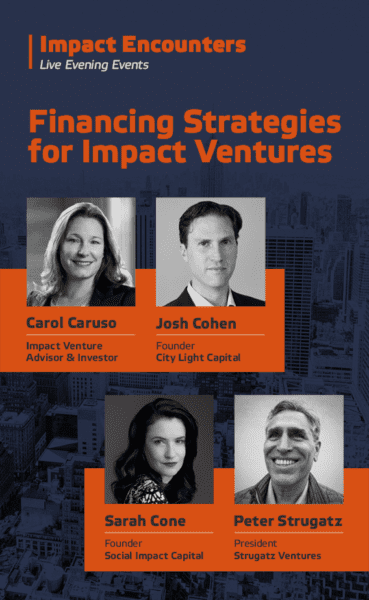

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments