Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

A conversation with Toniic’s Adam Bendell

In the world of finance and investment, there’s a quiet revolution happening — one that’s not driven solely by profit, but by a profound desire to make the world a better place. Impact investing, as it’s known, is gaining momentum as individuals and organizations seek to align their financial resources with their values and a vision for a more sustainable future. To gain insight into this evolving landscape, we sat down with an expert in the field, a key player in a movement that’s reshaping the way we think about capital and its potential to drive positive change. This interview with CEO Adam Bendell, sheds light on Toniic, a non-profit organization dedicated to catalyzing impact investing and fostering a new approach to wealth and investment.

Adam Bendell of Toniic

Toniic is on a mission to move both money and mindsets. It operates primarily as a membership organization, attracting a diverse group of individuals, family offices, and foundations — all driven by a shared commitment to impact investing. At the core of Toniic’s philosophy is the concept of servant leadership, a framework championed by Robert Greenleaf. This framework urges executives to attune themselves to the needs of those lower down the organizational hierarchy. In the context of Toniic, this means being in tune with the broader societal needs and values that drive their impact-driven members.

This commitment to a deeper understanding of purpose extends to their approach to wealth. Toniic encourages its members to ask whether their wealth aligns with their highest values and purposes. It’s not just about returns on investment; it’s about ensuring that every financial decision contributes to a more sustainable and equitable world.

“Impact investors don’t start from a place of what’s in it for me,” says Bendell, “but rather, what is the world I envision and how can we get there to create systems better than those we inherited. They come from a profound care for the world, a radical beginning point.”

Toniic creates a safe space for asset owners to explore the fundamental question, Is my wealth managed in alignment with my highest purpose and values? “It requires a combination of both inner and outer transformation,” Bendell says. “To get people to reconsider their relationship to resources, it works best with a gentle conversation, an invitation into a beautiful journey. We attract rather than blame, shame, or scare, and share the example of our broader membership.”

The impact investing landscape has evolved significantly in recent years. Today, approximately one-third of global investable assets — equivalent to $35 trillion — adhere to some form of sustainable lens. However, this lens varies depending on geographic location. In the United States, for example, the focus is often on single materiality, where Environmental, Social, and Governance (ESG) factors are used to enhance financial performance. In contrast, Europe has embraced a double materiality approach, acknowledging the broader impact on the world that may or may not directly affect the bottom line.

Impact investing, while growing, still represents only a tiny fraction of the global economy. To truly make a difference and achieve Sustainable Development Goals (SDGs) or tackle the world’s most significant challenges, Bendell says more significant capital allocation is necessary.

According to Bendell, one of the big challenges lies in the structure of traditional financial instruments, such as venture capital and private equity, which may not be inherently suited to social and environmental enterprises. Terms and structures need revision to better align with the goals of impact investing. Tax codes, especially in the United States, present complications that make it harder to have a deep impact in public markets compared to private ones. “Wealth managers have no idea where to put impact deals,” Bendell says, “they push you to either maximize returns or make donations, and relationships between clients and wealth managers make it difficult to switch to one perhaps better suited for a values-based approach.” Bendell points to initiatives like ImpactTerms.org that aim to make frameworks more accessible, and the sharing of investment structures and their outcomes can help newcomers navigate this evolving landscape.

To get people to reconsider their relationship to resources, it works best with a gentle conversation, an invitation into a beautiful journey.

As we look ahead to the next five years, the future of impact investing remains uncertain. Much depends on whether the experiments in the field can catch fire and spread to more traditional, risk-averse capital. There’s also the looming uncertainty of potential backlash against ESG (Environmental, Social, and Governance) practices, with some political figures viewing them as threats to the status quo.

Moreover, Bendell points to the impact investing community’s lack of clarity in metrics and reporting. “Bespoke metrics or vanity metrics will get us nowhere as a field,” he says, “The fact that you have always done it this way is a lousy excuse for continuing to do it this way.” We need “interoperability,” he says, to compare whether a dollar invested in enterprise X is going to be more impactful than a dollar invested in Y. We need to let go of how we’ve always done it and embrace emergent industry standards.”

However, these challenges are not insurmountable. Toniic, along with other organizations and individuals dedicated to this cause, is working diligently to overcome these hurdles and unlock capital for impact. In the end, impact investing is about more than just financial returns; it’s about shaping a world where every investment takes into account its broader effects on society and the environment. As the movement continues to grow and evolve, it has the potential to reshape the very foundations of finance and inspire others to join in the journey towards a more sustainable, equitable, and compassionate world. We should continue to cultivate safe spaces for the raw, honest conversations that Bendell says most effectively move us forward collectively.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

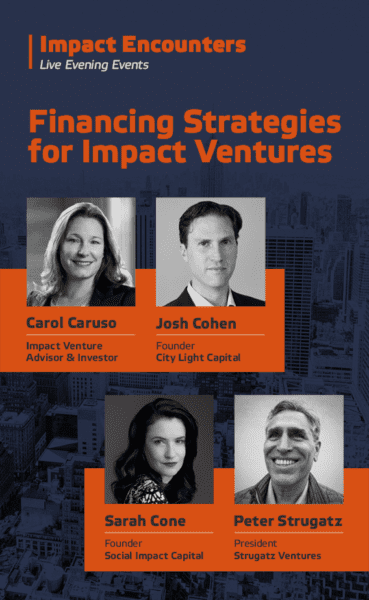

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments