Rethinking Copyright in the Age of Generative AI

Striking a balance between incentives and innovation

A blueprint to move from climate activism to global environmental norms

The climate negotiations in Glasgow, Scotland provided a powerful reminder of the importance of understanding and appreciating the different influencers that are shaping the global sustainability movement.

While activists protested on the streets of Glasgow, inside the building negotiators from scores of nations were working overtime to forge agreements to stem climate change. One point of view is that the “street” activists were disrupting those working on solutions to climate change. On the other hand, would these discussions even be happening but for the awareness raised by activists?

This scenario illustrates a lesson we authors have learned time and time again from working in the sustainability movement for more than 50 years: that all major societal change stems from the awareness raised by activism. Always has. Always will.

Consider how the sustainability world was changed when 15-year-old Greta Thunberg skipped class to sit in front of Swedish Parliament holding up a sign reading “skolstrejk för klimatet” (school strike for climate). Her message, that young people will bear the brunt of climate change impacts caused by prior generations, caught on with youth around the world. Within a year, her impassioned cry, “how dare you,” at the 2019 UN Climate Action Summit inspired legions of climate activists.

At its core, the sustainability movement is about changing notions of responsibility for people and the planet.

At its core, the sustainability movement is about changing notions of responsibility for people and the planet. That’s where the “Impacting Together” collaboration hosted by Salesforce comes in. The network brings together experts and agitators from global influencing organizations representing impact investing and social enterprise, philanthropy and nonprofits, and corporations to explore their common interests in advancing a better world. We can see the through-line from the awareness raised by passionate activists to the less sexy, but no less important, work of policy makers, standards setters, and other influencers who enact change at scale. After a few conversations, however, it was evident that the groups had very different approaches to achieving similar sustainability-related objectives. We agreed to explore the commonalities amongst the groups working across the range of sustainability issues. This observation uncovered connections that, while obvious to some, can also be new, powerful drivers of progress for others.

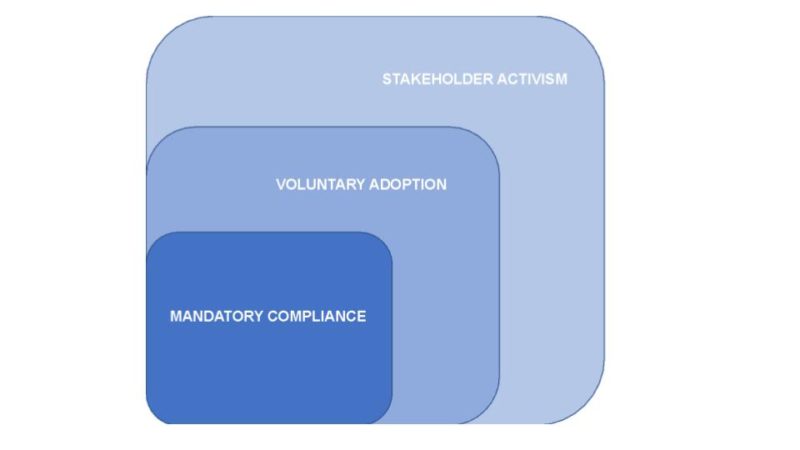

For instance, a maturity curve (fig. 1) drives sustainability adoption for many corporations. It begins with awareness of a new issue, such as fisheries collapse. Agitated stakeholders then raise awareness of the issue, which can stimulate responsible companies to voluntarily change their behaviors. As more companies follow suit, pressure from multiple stakeholders builds for late adopters to follow, and eventually, regulators act to ensure a consistent and reliable approach.

Figure 1. Maturity model – from awareness raising to global norms.

By developing and using common metrics, we can not only reduce the barriers to collaboration but perhaps we can build an ‘early-warning system’ that clarifies how addressing social and environmental issues adds value across the spectrum. And like putting your ear to the tracks to know when a train is coming, hopefully these connections and common metrics will help us all get off the tracks in time.

Impacting Together coalition members are developing frameworks to help understand the actors and roles in the broader impact management ecosystem, which includes sustainability work.

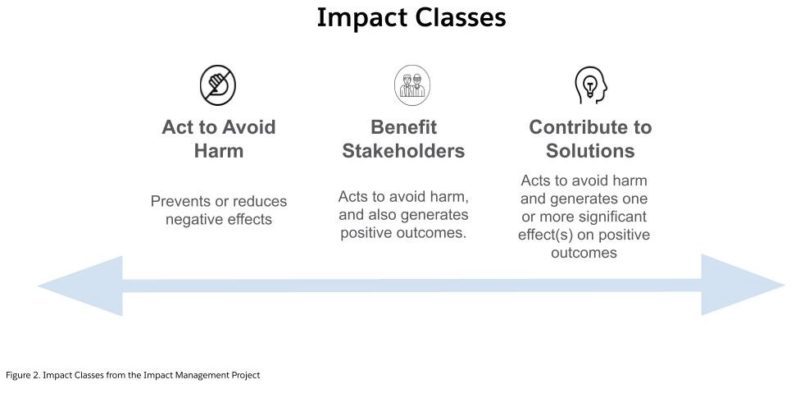

Impacting Together coalition members are developing frameworks to help understand the actors and roles in the broader impact management ecosystem, which includes sustainability work. Our jumping off point is the Impact Classes (fig.2) pioneered by the Impact Management Project (IMP). Impact Classes group investments based on their impact characteristics and reflect different motivations and constraints underlying investor and donor efforts to manage the effects of their portfolios on people and the planet.

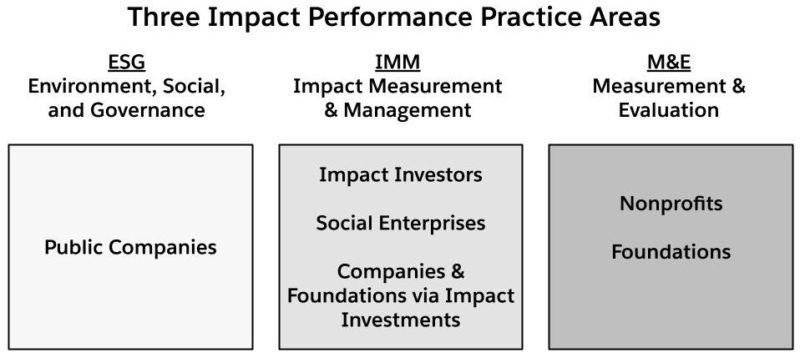

We then identified three current impact performance practice areas 1) ESG (environment, social, and governance), 2) IMM (impact management and measurement), and 3) M&E (measurement & evaluation), aware there are more nuances and actors than are represented.

ESG ratings are increasing in popularity today: 92% of the companies in the S&P 500 issue some form of sustainability disclosure.

Investor interest stems from the value of this information for identifying risks and opportunities for companies in their portfolios. While sustainability reporting is primarily issued from publicly traded companies, private equity investors are also increasingly demanding this information from their portfolio companies.

IMM is a function of “impact investing.” In contrast to ESG, IMM could be described as the “tip of the spear.” Whether the climate crisis, alleviating poverty, advancing equity, or other causes, impact investors want to advance social and environmental efforts, even if it means accepting lower rates of return. Embedded in IMM is the expressed purpose of using data and evidence to improve social and environmental efforts.

M&E tools are longstanding metrics in civil society. It’s how nonprofits and their funders measure the success of their investments. Like IMM, the expressed purpose of using data and evidence to improve social and environmental efforts is embedded, and there’s a natural connection to both the accounting and reporting processes used in ESG and impact investing.

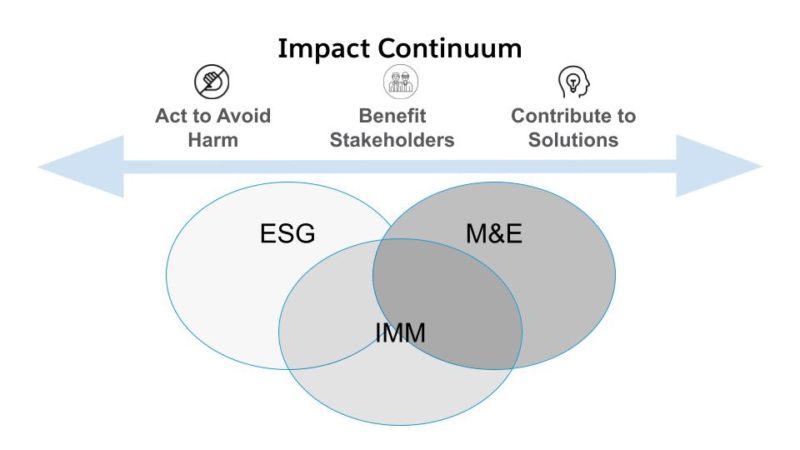

Despite bringing different norms and methodologies, the practitioners share a common intent to measure progress with consistent, comparable, and verified metrics whenever possible. The issues are the same and measurement of progress is similar, wherever practitioners fall along the impact continuum. (fig. 4)

Impacting Together is exploring the synergies in connecting these practices that could accelerate progress toward common goals. There are no definitive conclusions yet, but the Impact Management Continuum model is the first to connect these related fields through the data that drives them all.

The connectivity thesis underlying the Impacting Together coalition has been on full display as ESG issues have moved from activism to the mainstream. Not too many years ago, petitioning for more transparency on ESG issues was the sole province of activist NGOs and socially responsible investors.

Now, the world’s largest institutional investor BlackRock, with $10 Trillion in assets under management, warned companies to provide better climate accounting or suffer the consequences. BlackRock made good on this threat in May of 2021 when, with other institutional investors, they sided with a tiny activist impact investor (Engine One) in support of their shareholder resolution to add new climate-aware members to the board of ExxonMobil. In a tale of intrigue and drama, the unlikely and hitherto unheard-of coalition of impact and institutional investors emerged victorious over the objections of ExxonMobil’s management. In the end, the strange bedfellows had enough votes to elect three activist directors to ExxonMobil’s board.

In a tale of intrigue and drama, the unlikely and hitherto unheard-of coalition of impact and institutional investors emerged victorious over the objections of ExxonMobil’s management.

While this dramatic proxy battle played out, regulators and standards setters moved ahead to ensure that all companies monitor and report on their climate risks. In 2021, new laws were enacted in Japan, Great Britain, Singapore, and New Zealand requiring public companies to disclose their carbon emissions and management systems. Unlike voluntary sustainability reports, these new laws require climate information to be integrated into the company’s financial statements. The coalition believes that this trend will expand beyond climate change.

The U.S. Securities and Exchange Commission is poised to issue new regulations requiring ESG disclosure (starting with climate reporting) for listed companies. Such disclosures are regulated and must be audited, assured, and integrated into financial statements. The new International Sustainability Standards Board (ISSB) is developing new global reporting standards. Since IFRS standards are used by 60 percent of the nations in the world to guide financial statements, the new ESG standards will immediately harmonize accounting and reporting in these critical issues.

As the new regulations and standards take shape, it is noteworthy that sustainability issues beyond climate change, such as climate justice and equity issues, are on this same path, shifting from activist driven to global norms.

After the ISSB was announced, the Impact Management Platform was launched by four U.N. agencies, the Organization for Economic Co-operation and Development (OECD) and the World Bank. The purpose of this group is to consider the “non-financially material” issues that will not be covered by the ISSB. As demonstrated by the maturity model and the examples above, some of these issues are likely to become financially material in the long-run and should be in focus now.

The Impact Management Platform is the embodiment of the Impacting Together coalition’s thesis: Impacts that initially appear to be fringe issues mature into global norms. As the maturation process plays out, it will accelerate the process if the issues are measured consistently. Consistency drives comparability, and comparability drives improvement.

Impacts that initially appear to be fringe issues mature into global norms.

Sadly, the current momentum for better impact reporting is being driven because climate risks have become financial risks. It’s sad because, ideally, society would have acted to mitigate these impacts long before they wreaked so much havoc. Hopefully, by connecting the through-line from activism to global norms we can shorten the response time.

But, as the velocity of sustainability issues entering the mainstream increases so does the friction among different actors. Distrust among impact-minded and financially motivated entities slows progress.

Full alignment in motives and actions is not realistic nor even helpful. However, establishing a continuum of related efforts joined together by common measurement will reduce friction, increase understanding, fuel collaboration, and, ultimately, accelerate progress. By understanding this paradigm, we can better define the roles and relationships, and create a common language, norms, and practices that will speed progress toward a more sustainable and just world.

—

This essay is part of the “Why IM” thought leadership series — a set of perspectives and calls to action to mainstream the adoption of Impact Management. The series is motivated by an initiative of Impacting Together, a cross-sector network of practitioners aiming to break down silos across sectors and practice areas to share tools, solutions, and frameworks that can advance deep, durable impact.

Read a related piece in the IMM series: Why Impact Measurement Matters.

Related Content

Comments

Deep Dives

RECENT

Editor's Picks

Webinars

Featuring

Lizz Welch & Jennifer Roglà

iDE

May 16 - 12:00 PM EST

Impact Encounters

May 22 - 6:30 PM EST

News & Events

Subscribe to our newsletter to receive updates about new Magazine content and upcoming webinars, deep dives, and events.

Become a Premium Member to access the full library of webinars and deep dives, exclusive membership portal, member directory, message board, and curated live chats.

0 Comments